Franchise Tax Return K 150Rev 7 06 Ksrevenue Form

What is the Franchise Tax Return K-150

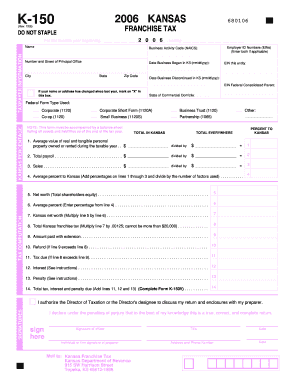

The Franchise Tax Return K-150 is a tax form used by businesses operating in Kansas to report their franchise tax obligations. This form is essential for corporations, partnerships, and limited liability companies (LLCs) that are subject to franchise tax in the state. The K-150 provides a structured way for businesses to disclose their income, deductions, and other relevant financial information to the Kansas Department of Revenue. Understanding this form is crucial for compliance and to avoid potential penalties.

How to use the Franchise Tax Return K-150

Using the Franchise Tax Return K-150 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and balance sheets. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your business's financial status. After completing the form, review it for any errors or omissions. Finally, submit the K-150 to the Kansas Department of Revenue by the designated deadline, either electronically or via mail.

Steps to complete the Franchise Tax Return K-150

Completing the Franchise Tax Return K-150 requires attention to detail. Begin by entering your business information, including the name, address, and federal employer identification number (FEIN). Next, report your total income and allowable deductions. Calculate the franchise tax based on the applicable rates for your business type. Ensure that all calculations are accurate and that you have included any necessary supporting documentation. Once completed, sign and date the form before submission.

Filing Deadlines / Important Dates

Filing deadlines for the Franchise Tax Return K-150 are crucial for compliance. Typically, the form is due on the 15th day of the fourth month following the end of your business's fiscal year. For businesses operating on a calendar year, this means the form is generally due by April 15. It is important to stay informed about any changes to these deadlines, as late submissions may result in penalties or interest charges.

Required Documents

When preparing to file the Franchise Tax Return K-150, certain documents are essential. These include your business's financial statements, such as profit and loss statements, balance sheets, and any relevant tax documents from the previous year. Additionally, you may need records of any deductions you plan to claim, such as business expenses or credits. Having these documents organized will streamline the process and ensure accurate reporting.

Penalties for Non-Compliance

Failure to file the Franchise Tax Return K-150 on time can result in significant penalties. The Kansas Department of Revenue may impose late fees, which can accumulate over time, increasing the total amount owed. Additionally, non-compliance can lead to interest charges on unpaid taxes. It is important for businesses to understand these penalties and prioritize timely filing to avoid unnecessary financial burdens.

Quick guide on how to complete franchise tax return k 150rev 7 06 ksrevenue

Prepare [SKS] seamlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to find the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Modify and eSign [SKS] to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Franchise Tax Return K 150Rev 7 06 Ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the franchise tax return k 150rev 7 06 ksrevenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Franchise Tax Return K 150Rev 7 06 Ksrevenue?

The Franchise Tax Return K 150Rev 7 06 Ksrevenue is a tax form specifically designed for businesses operating in Kansas. This return helps companies report their franchise tax obligations accurately. By using this form, businesses can ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with the Franchise Tax Return K 150Rev 7 06 Ksrevenue?

airSlate SignNow provides a seamless solution for signing and sending the Franchise Tax Return K 150Rev 7 06 Ksrevenue electronically. With its user-friendly interface, businesses can easily manage their tax documents and ensure timely submissions, reducing the risk of compliance issues.

-

What are the costs associated with using airSlate SignNow for Franchise Tax Return K 150Rev 7 06 Ksrevenue?

airSlate SignNow offers flexible pricing plans that cater to different business needs, starting at an affordable monthly rate. With these plans, you get unlimited eSigning capabilities, allowing you to handle documents like the Franchise Tax Return K 150Rev 7 06 Ksrevenue without additional fees.

-

Can I integrate airSlate SignNow with other software for handling the Franchise Tax Return K 150Rev 7 06 Ksrevenue?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing the Franchise Tax Return K 150Rev 7 06 Ksrevenue. Popular integrations include CRMs, cloud storage services, and accounting software, facilitating efficient document handling.

-

What benefits does airSlate SignNow provide for the Franchise Tax Return K 150Rev 7 06 Ksrevenue?

Using airSlate SignNow simplifies the process of completing and submitting the Franchise Tax Return K 150Rev 7 06 Ksrevenue. The platform ensures documents are securely signed and stored, streamlining compliance and making it easier to access historical forms when needed.

-

Is airSlate SignNow user-friendly for filing the Franchise Tax Return K 150Rev 7 06 Ksrevenue?

Absolutely! airSlate SignNow is designed with user experience in mind, making it straightforward for anyone to prepare and sign their Franchise Tax Return K 150Rev 7 06 Ksrevenue. The intuitive interface ensures that users can navigate through the eSigning process with ease.

-

Does airSlate SignNow provide support for filing the Franchise Tax Return K 150Rev 7 06 Ksrevenue?

Yes, airSlate SignNow offers excellent customer support for users with questions about filing their Franchise Tax Return K 150Rev 7 06 Ksrevenue. Whether you need assistance with the software or have questions about the form itself, the support team is readily available to help.

Get more for Franchise Tax Return K 150Rev 7 06 Ksrevenue

Find out other Franchise Tax Return K 150Rev 7 06 Ksrevenue

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast