Electric Vehicle Power Excise Tax Department of Revenue Form

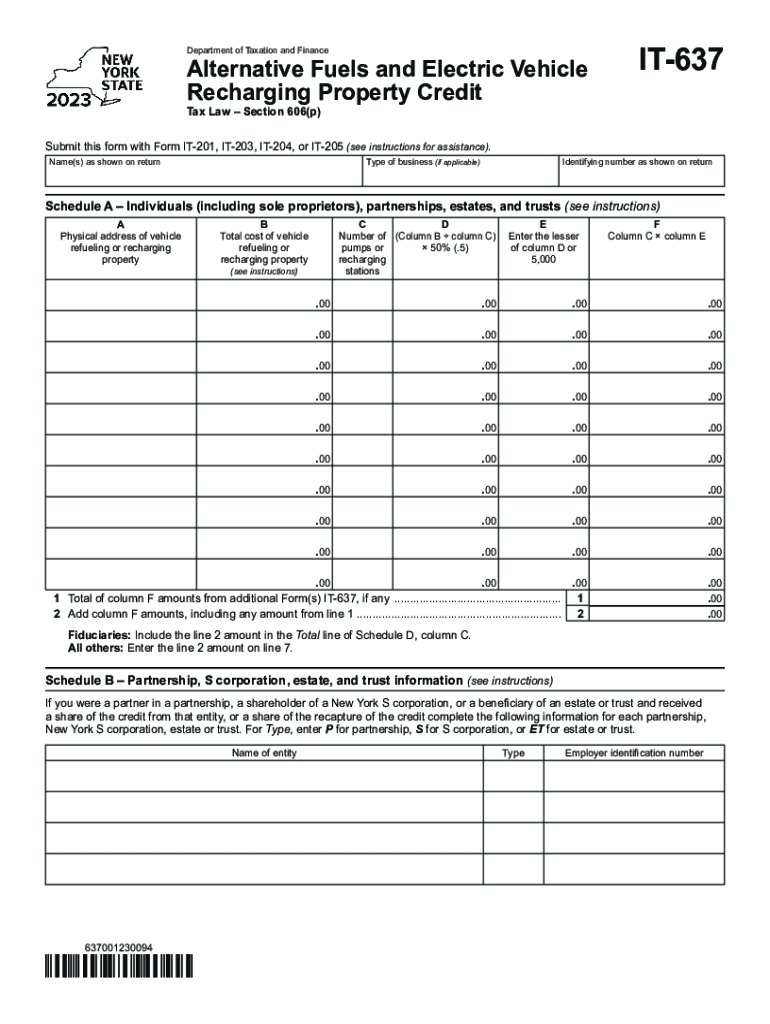

Understanding the 2023 IT 637 Form

The 2023 IT 637 form, also known as the New York State Electric Vehicle Power Excise Tax form, is designed for individuals and businesses to claim credits related to electric vehicle usage. This form is essential for taxpayers seeking to benefit from incentives aimed at promoting electric vehicle adoption in New York. It allows taxpayers to report their eligible electric vehicle purchases and calculate the corresponding tax credits they may receive.

Steps to Complete the 2023 IT 637 Form

Completing the 2023 IT 637 form involves several important steps:

- Gather necessary documentation, including proof of electric vehicle purchase and any applicable receipts.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Provide details about the electric vehicle, including make, model, and purchase date.

- Calculate the credit amount based on the guidelines provided by the New York State Department of Revenue.

- Review the form for accuracy before submission.

Eligibility Criteria for the 2023 IT 637 Form

To qualify for the credits available through the 2023 IT 637 form, taxpayers must meet specific eligibility criteria. These typically include:

- Purchasing an electric vehicle that meets the state’s definition of an eligible vehicle.

- Being a resident of New York State or having a business operating within the state.

- Filing the form within the designated time frame as outlined by the Department of Revenue.

Filing Deadlines for the 2023 IT 637 Form

Timely submission of the 2023 IT 637 form is crucial for taxpayers to receive their credits. The filing deadlines are generally aligned with the annual tax filing dates. It is important to check for any specific deadlines set by the New York State Department of Revenue to ensure compliance.

Form Submission Methods for the 2023 IT 637 Form

The 2023 IT 637 form can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission via the New York State Department of Revenue’s official website.

- Mailing the completed form to the designated address provided by the Department.

- In-person submission at local tax offices, if applicable.

Penalties for Non-Compliance with the 2023 IT 637 Form

Failing to comply with the requirements of the 2023 IT 637 form can result in penalties. Taxpayers may face fines or the denial of credits if the form is not filed accurately or on time. It is essential to understand these potential consequences to ensure proper adherence to tax regulations.

Quick guide on how to complete electric vehicle power excise tax department of revenue

Effortlessly Prepare Electric Vehicle Power Excise Tax Department Of Revenue on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without hiccups. Handle Electric Vehicle Power Excise Tax Department Of Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Electric Vehicle Power Excise Tax Department Of Revenue with Ease

- Locate Electric Vehicle Power Excise Tax Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form—by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Electric Vehicle Power Excise Tax Department Of Revenue and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the electric vehicle power excise tax department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2023 it 637?

airSlate SignNow is an advanced eSignature platform that enables businesses to send and sign documents seamlessly. It incorporates the '2023 it 637' standards for security and compliance, ensuring your documents are safe and legally binding. This makes it an ideal choice for organizations looking to streamline their document management processes.

-

How much does airSlate SignNow cost in 2023?

In 2023, airSlate SignNow offers flexible pricing plans that cater to various business needs. You can select from monthly or annual subscriptions, which provide access to a variety of features related to '2023 it 637' compliance and efficiency. Pricing is competitive, ensuring that you get the best value for a premium eSignature solution.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features such as customizable templates, real-time tracking, and user-friendly eSigning options. In line with '2023 it 637' guidelines, these features enhance both user experience and operational efficiency. This makes it easier to manage documents and streamlined workflows effectively.

-

How can airSlate SignNow benefit my business in 2023?

By adopting airSlate SignNow, your business can save time and reduce costs associated with paper-based processes. The platform is designed to improve productivity while ensuring compliance with '2023 it 637' standards for data security and privacy. This translates to faster contract turnarounds and improved customer satisfaction.

-

Does airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow offers seamless integrations with a variety of business applications, such as CRM and project management tools. This enhances functionality and aligns with '2023 it 637' protocols, allowing you to streamline your workflows across different platforms. It ensures that all your tools work together efficiently.

-

Is airSlate SignNow suitable for small businesses in 2023?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. With its cost-effectiveness and compliance with '2023 it 637' standards, small businesses can utilize the platform to enhance their operations without overstretching their budgets.

-

What kind of customer support does airSlate SignNow provide?

airSlate SignNow offers robust customer support to ensure users can navigate the platform effectively. Support teams are available through various channels, and the service is designed to align with '2023 it 637' standards for responsiveness and efficiency. This means that you can rely on timely assistance whenever needed.

Get more for Electric Vehicle Power Excise Tax Department Of Revenue

- Ia 1040 form 47159616

- Laser safety officer form

- Application form museum collections

- Employee register of all interests declaration form

- Alliant energy autopay form

- Stimmzettel vorlage word form

- Www irs govpubirs access2021 form 1040 espr irs tax forms

- Form 8862sp rev december information to claim earned income credit after disallowance spanish version

Find out other Electric Vehicle Power Excise Tax Department Of Revenue

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template