G49 Form

What is the G49 Form

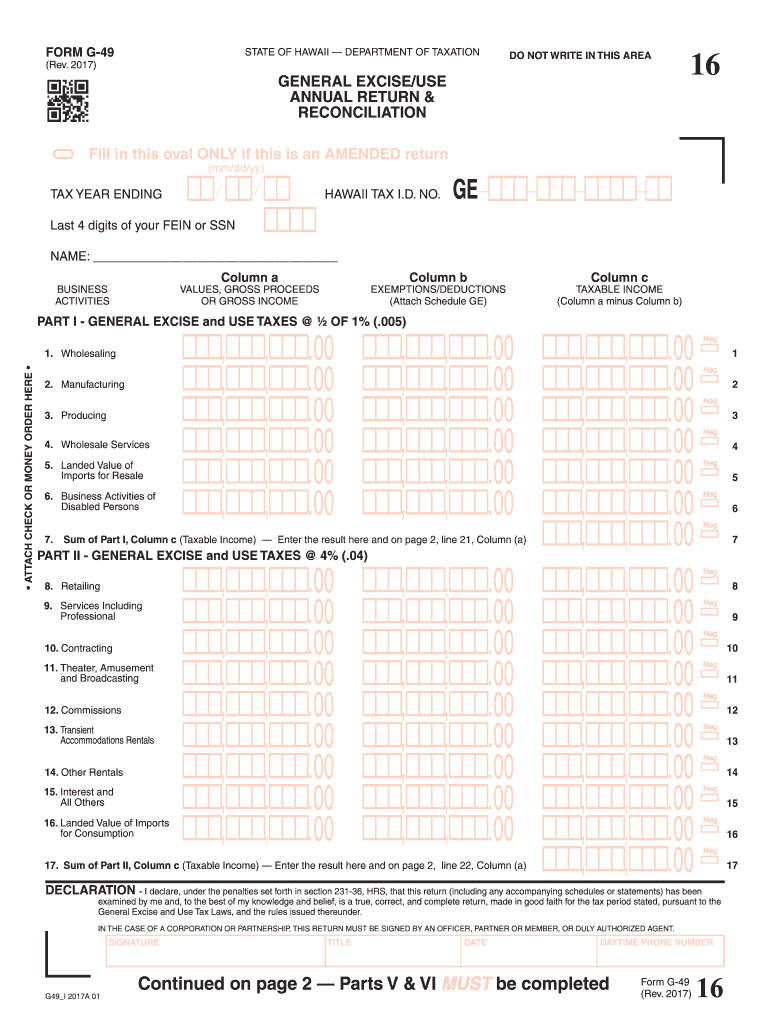

The G49 form, also known as the G-49 General Excise Tax Form, is a tax document used in Hawaii for reporting general excise tax liabilities. This form is essential for businesses operating in the state, as it allows them to report their gross income and calculate the amount of tax owed to the state. The G49 form is typically filed annually and is crucial for maintaining compliance with Hawaii's tax regulations.

How to use the G49 Form

Using the G49 form involves several steps to ensure accurate reporting of income and taxes owed. First, gather all necessary financial records, including sales receipts and expense reports. Next, complete the form by entering your total gross income, deductions, and any applicable credits. After calculating the tax owed, submit the form to the appropriate state tax authority. It is important to keep a copy of the completed form for your records.

Steps to complete the G49 Form

Completing the G49 form requires attention to detail. Follow these steps:

- Gather financial documents, including sales and expense records.

- Fill in your business information, including name, address, and tax identification number.

- Report your total gross income from all business activities.

- Calculate any deductions, such as business expenses.

- Determine the total excise tax owed based on your income and deductions.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the G49 form to avoid penalties. Generally, the form is due on the last day of the month following the end of the tax year. For businesses operating on a calendar year, this means the G49 form is typically due by January thirty-first of the following year. Always check for any updates or changes to deadlines from the Hawaii Department of Taxation.

Legal use of the G49 Form

The G49 form is legally required for businesses operating in Hawaii that are subject to the general excise tax. Failure to file this form can result in penalties and interest on unpaid taxes. It is important for business owners to understand their obligations under Hawaii tax law and ensure that they file the G49 form accurately and on time to maintain compliance.

Who Issues the Form

The G49 form is issued by the Hawaii Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Hawaii. The Department provides resources and guidance for completing the form and understanding tax obligations, making it easier for business owners to navigate the tax process.

Quick guide on how to complete g49 form

Complete G49 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without interruptions. Manage G49 Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign G49 Form without hassle

- Obtain G49 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign G49 Form and ensure excellent communication at any step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the g49 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the g49 2016 form and why is it important?

The g49 2016 form is a document used for reporting certain tax information, making it crucial for businesses to maintain compliance. Understanding its requirements helps ensure that your organization avoids penalties. With airSlate SignNow, you can easily manage and eSign the g49 2016 form for efficient processing.

-

How does airSlate SignNow simplify the signing process for the g49 2016 form?

airSlate SignNow streamlines the signing process by providing an intuitive platform for eSigning the g49 2016 form. Users can collect signatures quickly, reducing paperwork and enhancing efficiency. This capability is particularly beneficial for businesses handling multiple documents simultaneously.

-

Is there a cost associated with using airSlate SignNow for the g49 2016 form?

Yes, there is a subscription cost for using airSlate SignNow, but it is designed to be cost-effective. The pricing depends on your specific needs, including how many users and features you require. Investing in airSlate SignNow ensures you have a reliable solution for managing the g49 2016 form and other essential documents.

-

What features does airSlate SignNow offer for managing the g49 2016 form?

airSlate SignNow offers features like document templates, secure eSignature, and automated workflows, all tailored for managing the g49 2016 form efficiently. These features help reduce errors and save time during the signing process. Additionally, you can track the status of your documents in real-time.

-

Can airSlate SignNow integrate with other software for processing the g49 2016 form?

Absolutely! airSlate SignNow seamlessly integrates with various software platforms, enhancing your workflow for processing the g49 2016 form. Whether you're using CRM systems or cloud storage, these integrations ensure that your documents are accessible and managed effectively.

-

How secure is the airSlate SignNow platform for handling the g49 2016 form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the g49 2016 form. Our platform uses advanced encryption and security protocols to protect your data. You can eSign confidently knowing your documents are safe and secure.

-

What are the benefits of using airSlate SignNow for the g49 2016 form?

Using airSlate SignNow for the g49 2016 form brings multiple benefits, such as increased efficiency, reduced paperwork, and improved compliance. Our user-friendly interface allows for quick eSigning and easy document management. These advantages help businesses save time and focus on their core operations.

Get more for G49 Form

Find out other G49 Form

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe