Irs Schedule F Form

What is the IRS Schedule F Form

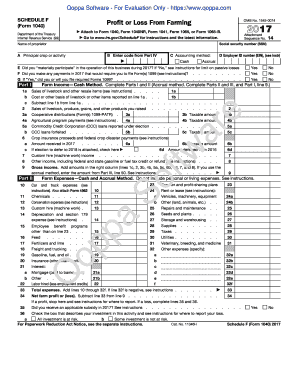

The IRS Schedule F Form is a tax document used by farmers to report their income and expenses related to farming activities. This form is essential for individuals who operate a farm as a sole proprietorship, allowing them to detail their earnings and costs incurred during the tax year. It is an integral part of the individual income tax return, specifically Form 1040, and helps determine the taxable income from farming operations.

How to Use the IRS Schedule F Form

Using the IRS Schedule F Form involves several steps to accurately report farming income and expenses. Taxpayers must first gather all relevant financial records, including sales receipts, expense invoices, and any other documentation related to farming activities. Once the necessary information is compiled, individuals can fill out the form by entering their total income from farming, followed by detailed listings of allowable expenses such as feed, seed, and equipment costs. It is important to ensure that all figures are accurate to avoid discrepancies with the IRS.

Steps to Complete the IRS Schedule F Form

Completing the IRS Schedule F Form requires careful attention to detail. Here are the steps to follow:

- Gather all financial documents related to farming income and expenses.

- Complete the income section by reporting total sales from farming activities.

- List all deductible expenses in the appropriate categories, such as operating and capital expenses.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Transfer the net profit or loss to Form 1040, where it will be included in your overall income.

Key Elements of the IRS Schedule F Form

The IRS Schedule F Form includes several key elements that taxpayers must be aware of:

- Part I: This section covers income, including sales of livestock, produce, and other farm products.

- Part II: This part focuses on expenses, which are categorized into various types, such as labor, repairs, and depreciation.

- Net Profit or Loss: The form concludes with a calculation of net profit or loss, which is crucial for determining tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule F Form align with the general tax return deadlines. Typically, the form must be submitted by April fifteenth of the following tax year. If taxpayers require additional time, they may file for an extension, allowing them to submit their return by October fifteenth. It is essential to keep track of these dates to avoid penalties and ensure compliance with IRS regulations.

Form Submission Methods

Taxpayers can submit the IRS Schedule F Form through various methods, including:

- Online: Many tax preparation software programs allow users to complete and file the form electronically.

- Mail: Taxpayers can print the completed form and send it to the appropriate IRS address based on their location.

- In-Person: Some individuals may choose to file their taxes in person with a tax professional who can assist with the process.

Quick guide on how to complete irs schedule f form

Complete [SKS] effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs schedule f form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Irs Schedule F Form?

The Irs Schedule F Form is a tax document used by farmers and ranchers to report income and expenses associated with farming activities. This form allows taxpayers to detail their farming income, costs, and losses, ensuring accurate reporting on their annual tax returns.

-

How can airSlate SignNow help with the Irs Schedule F Form?

airSlate SignNow provides an efficient platform for sending and electronically signing the Irs Schedule F Form, streamlining the tax filing process. With user-friendly features, businesses can ensure they complete and file this essential form seamlessly.

-

What pricing plans does airSlate SignNow offer for eSigning documents like the Irs Schedule F Form?

airSlate SignNow offers competitive pricing plans that cater to various business needs, ensuring accessibility for all users needing to eSign vital documents like the Irs Schedule F Form. You can choose from monthly or annual plans, depending on your usage requirements.

-

Are there any specific features for managing the Irs Schedule F Form in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing documents like the Irs Schedule F Form, including templates, audit trails, and real-time tracking. These functionalities help users stay organized and compliant while preparing their tax documents.

-

Can multiple users collaborate on the Irs Schedule F Form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the Irs Schedule F Form, facilitating efficient communication and teamwork. This collaborative feature is essential for accountants and farmers working together to complete their tax filings.

-

What integrations are available for using the Irs Schedule F Form with airSlate SignNow?

airSlate SignNow integrates seamlessly with various accounting and business management software, making it easy to access the Irs Schedule F Form from your preferred platform. These integrations enhance workflow efficiency and improve data accuracy across your financial documents.

-

How secure is airSlate SignNow when handling the Irs Schedule F Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Irs Schedule F Form. The platform employs advanced encryption and compliance measures to protect user data and ensure secure transactions.

Get more for Irs Schedule F Form

Find out other Irs Schedule F Form

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself