Form 5884 Internal Revenue Service

What is the Form 5884 Internal Revenue Service

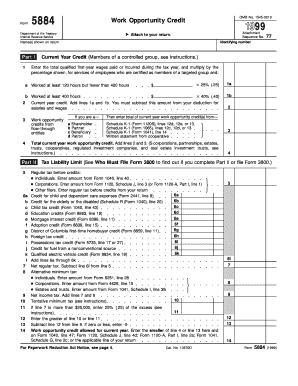

The Form 5884, issued by the Internal Revenue Service (IRS), is used to claim the Work Opportunity Credit. This credit is designed to encourage employers to hire individuals from certain target groups who face significant barriers to employment. The form allows businesses to reduce their federal tax liability by taking advantage of this credit, which can be beneficial for both the employer and the workforce.

How to use the Form 5884 Internal Revenue Service

To use Form 5884, employers must first determine if they have hired individuals from the specified target groups, such as veterans or individuals receiving government assistance. Once eligibility is confirmed, employers can complete the form by providing necessary details about the employees and the wages paid. The completed form is then submitted with the employer's tax return to claim the credit.

Steps to complete the Form 5884 Internal Revenue Service

Completing Form 5884 involves several steps:

- Gather information about the employees you are claiming the credit for, including their names, Social Security numbers, and the dates of hire.

- Determine the target group status of each employee, ensuring they meet the criteria set by the IRS.

- Fill out the form, providing all required information, including the total qualified wages paid to each eligible employee.

- Calculate the credit amount based on the wages and submit the form with your tax return.

Eligibility Criteria

To qualify for the Work Opportunity Credit using Form 5884, employers must hire individuals from designated target groups. These groups include, but are not limited to, veterans, long-term unemployed individuals, and recipients of certain government assistance programs. Employers must also ensure that the hired individuals work a minimum number of hours and that the wages paid meet specific thresholds established by the IRS.

Filing Deadlines / Important Dates

It is essential to file Form 5884 within the appropriate timeframe to ensure eligibility for the credit. Generally, the form must be submitted with the employer's tax return for the year in which the eligible employees were hired. Employers should be aware of the annual tax filing deadlines, typically falling on April fifteenth, to avoid missing the opportunity to claim the credit.

Form Submission Methods

Form 5884 can be submitted through various methods, depending on the employer's preference. Employers can file the form electronically through tax preparation software or submit a paper version by mail. It is important to follow the IRS guidelines for submission to ensure proper processing and to avoid delays in receiving the credit.

Quick guide on how to complete form 5884 internal revenue service

Complete Form 5884 Internal Revenue Service effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an outstanding eco-friendly substitute for traditional printed and signed documents, as you can obtain the required form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 5884 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 5884 Internal Revenue Service effortlessly

- Obtain Form 5884 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive details using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 5884 Internal Revenue Service and ensure excellent coordination at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5884 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 5884 from the Internal Revenue Service?

Form 5884 is a tax form used to claim the Small Business Jobs Act credit for eligible employers. It helps businesses calculate tax credits for hiring individuals from certain target groups. Understanding this form is essential for maximizing potential tax benefits for your business.

-

How can airSlate SignNow help with Form 5884 from the Internal Revenue Service?

airSlate SignNow streamlines the signing process for Form 5884 from the Internal Revenue Service by allowing users to eSign and send documents efficiently. This feature reduces the time it takes to gather signatures, helping businesses to submit their completed forms accurately and on time. With airSlate SignNow, you can ensure compliance while focusing on growth.

-

Is there a cost associated with using airSlate SignNow for Form 5884 from the Internal Revenue Service?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost will depend on the features you choose, such as the number of users and integrations. For businesses looking to handle Form 5884 from the Internal Revenue Service, using airSlate SignNow can be a cost-effective solution in the long run.

-

What features does airSlate SignNow offer for managing Form 5884 from the Internal Revenue Service?

airSlate SignNow provides features such as document templates, real-time tracking, and automated workflows for Form 5884 from the Internal Revenue Service. These functionalities enhance efficiency and reduce errors in paperwork. This means you can easily manage your document processes from start to finish.

-

Can I integrate airSlate SignNow with other tools for Form 5884 from the Internal Revenue Service?

Absolutely! airSlate SignNow integrates seamlessly with various popular tools such as Google Drive, Salesforce, and more. This means you can manage all aspects of your documentation concerning Form 5884 from the Internal Revenue Service without disrupting your workflow or switching between applications.

-

What are the benefits of using airSlate SignNow for Form 5884 from the Internal Revenue Service?

Using airSlate SignNow for Form 5884 from the Internal Revenue Service increases speed and accuracy in document handling. It reduces the need for paper documents, allowing for a more environmentally friendly approach. Additionally, with the ability to access forms from any device, you gain flexibility in managing your business processes.

-

Is airSlate SignNow secure for handling Form 5884 from the Internal Revenue Service?

Yes, airSlate SignNow employs advanced security protocols to ensure that documents, including Form 5884 from the Internal Revenue Service, are secure and confidential. With features like encryption and audit trails, users can trust that their sensitive information is protected during the signing process.

Get more for Form 5884 Internal Revenue Service

- T his form may be used for annual reporting of regularly scheduled sos ok

- Take in depoe bays rural urban sights statesman journal form

- Addressamp39 title oregon form

- Marketing fee agreement form

- Shingles shingrix vaccine consent form

- Content creator contract template form

- Software project contract template form

- Software sale contract template form

Find out other Form 5884 Internal Revenue Service

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form