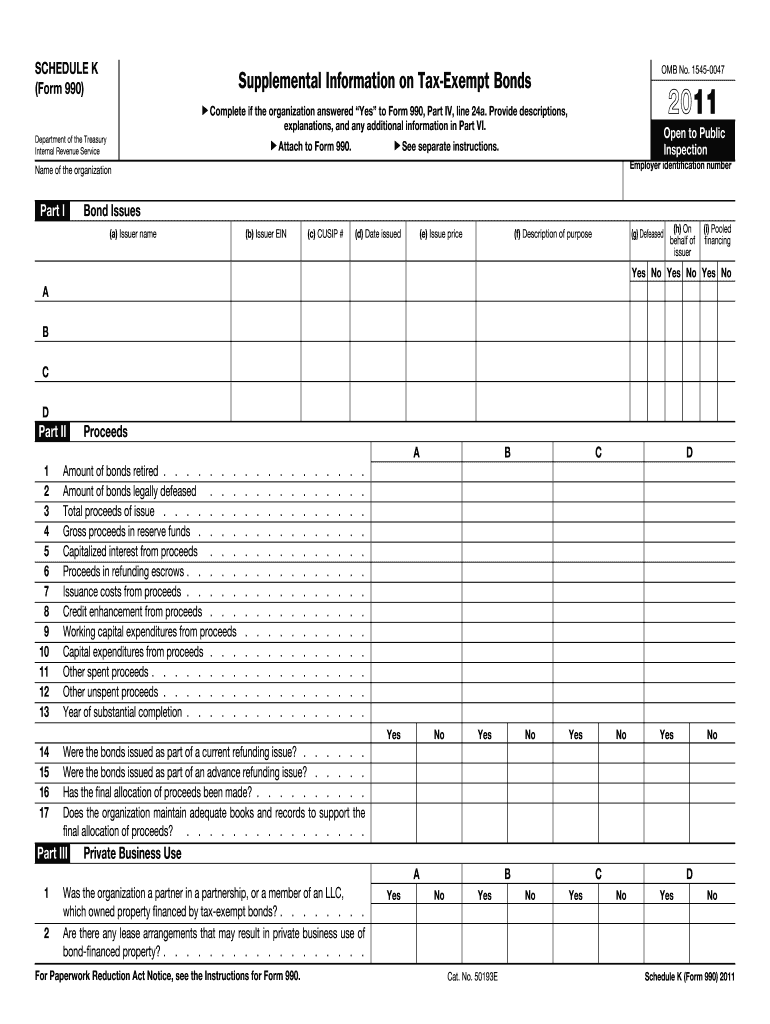

Form 990 Schedule K Supplemental Information on Tax Exempt Bonds

What is the Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

The Form 990 Schedule K is a supplemental document that tax-exempt organizations use to provide detailed information about their tax-exempt bonds. This form is part of the larger Form 990, which is an annual information return required by the Internal Revenue Service (IRS) for tax-exempt organizations. Schedule K specifically focuses on the reporting of tax-exempt bond activities, ensuring transparency and compliance with federal regulations. Organizations must disclose information about the bonds they have issued, including the purpose of the bonds, the proceeds, and any related expenditures.

How to use the Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

To effectively use the Form 990 Schedule K, organizations must first gather all relevant information regarding their tax-exempt bonds. This includes details about the bond issuance, such as the amount, interest rates, and the intended use of the funds. Once this information is collected, organizations can fill out the form by providing accurate and comprehensive responses to each section. It is essential to ensure that all information aligns with the organization’s financial records and IRS guidelines to avoid discrepancies during the filing process.

Steps to complete the Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

Completing the Form 990 Schedule K involves several key steps:

- Gather all necessary documentation related to the tax-exempt bonds, including bond agreements and financial statements.

- Review the IRS instructions for Form 990 and Schedule K to understand the specific reporting requirements.

- Fill out the form by entering the required information in the designated fields, ensuring accuracy and completeness.

- Double-check all entries against your organization’s records to confirm that the information is correct.

- Submit the completed form along with the main Form 990 by the appropriate filing deadline.

Key elements of the Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

The Form 990 Schedule K includes several critical elements that organizations must report. These elements typically consist of:

- Identification of the bonds issued, including the type and amount.

- Details on the purpose of the bonds and how the proceeds were utilized.

- Information about any related entities involved in the bond issuance.

- Compliance with federal tax laws and any applicable state regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 Schedule K. Organizations must adhere to these guidelines to ensure compliance and avoid potential penalties. Key aspects of the IRS guidelines include:

- Accurate reporting of all bond-related information.

- Timely submission of the form along with the main Form 990.

- Maintaining records that support the information reported on the form for at least three years.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 Schedule K. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May fifteenth. It is important to file on time to avoid penalties and ensure compliance with IRS regulations.

Quick guide on how to complete form 990 schedule k supplemental information on tax exempt bonds

Fill out [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed materials, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Craft your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule k supplemental information on tax exempt bonds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 990 Schedule K Supplemental Information On Tax Exempt Bonds?

Form 990 Schedule K Supplemental Information On Tax Exempt Bonds provides critical details about a tax-exempt organization's bonds. It helps organizations report their bond activity and ensures transparency in financial reporting. This schedule is essential for assessing compliance with various IRS regulations regarding tax-exempt financing.

-

How can airSlate SignNow assist with managing Form 990 Schedule K Supplemental Information On Tax Exempt Bonds?

airSlate SignNow simplifies the process of managing Form 990 Schedule K Supplemental Information On Tax Exempt Bonds by allowing users to easily prepare, send, and eSign necessary documents. Our platform ensures that all forms are organized and accessible, streamlining your compliance process. This reduces the risk of errors and saves valuable time during tax season.

-

What features does airSlate SignNow offer for handling Form 990 Schedule K?

airSlate SignNow features advanced eSignature capabilities, document templates, and automated workflows that are specifically beneficial for handling Form 990 Schedule K Supplemental Information On Tax Exempt Bonds. These features allow for easy customization and efficient document handling. Additionally, our solution is designed to enhance collaboration, ensuring all relevant parties can participate seamlessly.

-

Is airSlate SignNow cost-effective for organizations preparing Form 990 Schedule K?

Yes, airSlate SignNow is a highly cost-effective solution for organizations working on Form 990 Schedule K Supplemental Information On Tax Exempt Bonds. Our pricing plans are designed to fit various budgets, making it accessible for small to large organizations. The time and resources saved through our platform can lead to signNow financial benefits in the long run.

-

Can I integrate airSlate SignNow with other tools I use for tax compliance?

Absolutely! airSlate SignNow offers seamless integrations with various tax compliance and accounting software. This capability ensures that you can easily incorporate the platform into your existing workflow for managing Form 990 Schedule K Supplemental Information On Tax Exempt Bonds. By integrating with your tools, we help enhance overall productivity and reduce the risk of data discrepancies.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule K submissions?

Using airSlate SignNow for Form 990 Schedule K Supplemental Information On Tax Exempt Bonds submissions streamlines the documentation process and enhances accuracy. Our platform provides a secure environment for eSigning and document exchange, which speeds up approval times. Additionally, the easy-to-use interface ensures that all team members can participate in the tax compliance process effectively.

-

How does airSlate SignNow ensure the security of my Form 990 Schedule K data?

airSlate SignNow prioritizes your data security with robust encryption and stringent access controls for all Form 990 Schedule K Supplemental Information On Tax Exempt Bonds data. We ensure that all sensitive information is protected throughout the signing and document management process. By using industry-standard security protocols, we help maintain your organization's confidentiality and compliance.

Get more for Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

Find out other Form 990 Schedule K Supplemental Information On Tax Exempt Bonds

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now