December Department of the Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No Form

Understanding the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

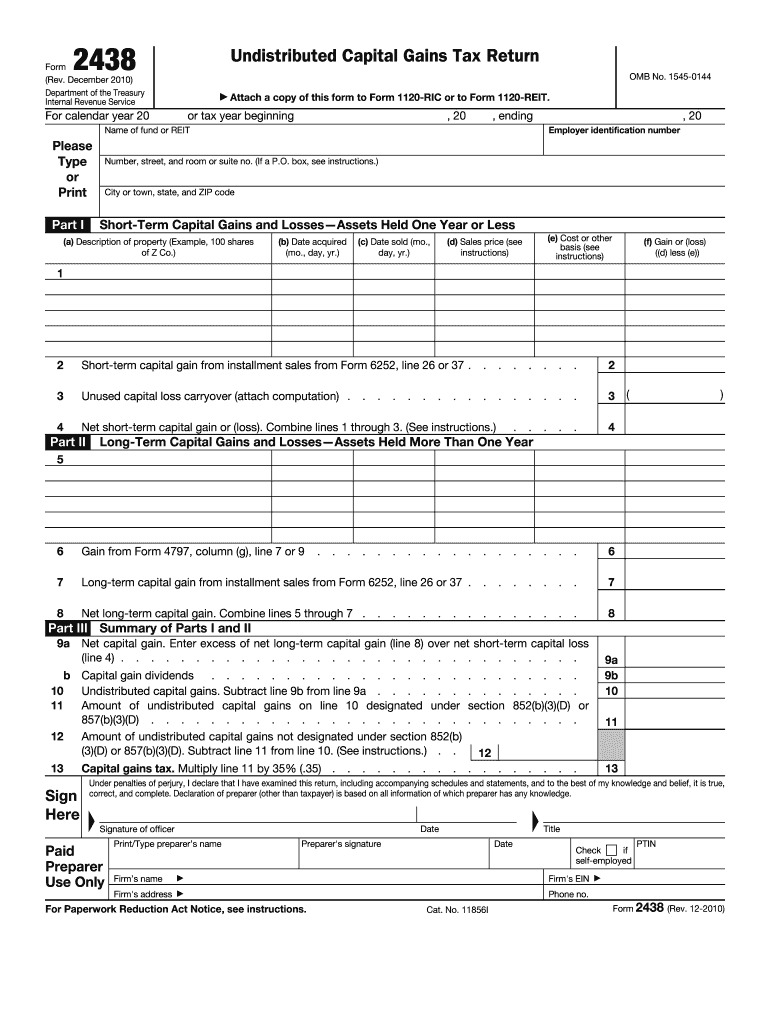

The December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return, often referred to as Form 2438, is a tax form used by certain entities to report undistributed capital gains. This form is primarily utilized by regulated investment companies (RICs) and real estate investment trusts (REITs) to disclose capital gains that have not been distributed to shareholders. The form is essential for compliance with IRS regulations and ensures that the tax obligations related to these gains are accurately reported.

Steps to Complete the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

Completing Form 2438 involves several key steps. First, gather all necessary financial documentation, including details of capital gains and distributions. Next, accurately fill out the form, ensuring all sections are completed, including the identification of the entity, the amount of undistributed capital gains, and any applicable deductions. After filling out the form, review it thoroughly for accuracy. Finally, submit the completed form to the IRS by the specified deadline to avoid potential penalties.

Legal Use of the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

Form 2438 serves a crucial legal function in the tax reporting process for RICs and REITs. It is a requirement under U.S. tax law to report undistributed capital gains to ensure compliance with IRS regulations. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. Entities must understand the legal implications of not submitting Form 2438, as it can affect their tax status and shareholder reporting obligations.

Filing Deadlines / Important Dates for the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

Timely filing of Form 2438 is critical. The IRS typically sets specific deadlines for submission, which can vary based on the entity's fiscal year-end. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year. Entities should be aware of these deadlines to ensure compliance and avoid late filing penalties. It is advisable to check the IRS website or consult with a tax professional for the most current deadlines.

Form Submission Methods for the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

Form 2438 can be submitted to the IRS through various methods. Entities have the option to file electronically using IRS e-file systems, which can expedite processing times. Alternatively, the form can be mailed directly to the appropriate IRS address, as specified in the form instructions. Some entities may also choose to submit the form in person at designated IRS offices. It is important to retain proof of submission for record-keeping purposes.

Required Documents for the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

To complete Form 2438, certain documents are required. Entities should gather financial statements that detail capital gains, distribution records, and any relevant tax documents. This documentation supports the figures reported on the form and is necessary for accurate completion. Having all required documents organized can streamline the filing process and help prevent errors.

Quick guide on how to complete december department of the treasury internal revenue service 2438 undistributed capital gains tax return omb no

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, laborious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

Create this form in 5 minutes!

How to create an eSignature for the december department of the treasury internal revenue service 2438 undistributed capital gains tax return omb no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No.?

The December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. is a tax form used by corporations to report undistributed capital gains. It helps ensure that businesses meet their tax obligations efficiently and accurately, particularly those concerning capital gains. Understanding this form is crucial for proper tax filings and compliance.

-

How can airSlate SignNow help with the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No.?

airSlate SignNow simplifies the process of signing and submitting forms, such as the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. With our platform, you can quickly eSign documents and store them securely, reducing the hassle of managing paperwork for tax filings.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features such as seamless eSignature capabilities, document templates, and audit trails, making it perfect for managing tax documents like the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. These features ensure your tax filings are handled efficiently and securely.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax forms?

Yes, airSlate SignNow offers a cost-effective solution for small businesses that need to manage tax forms, including the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. Our pricing plans are designed to be budget-friendly while providing essential features to streamline tax-related documentation.

-

What integrations does airSlate SignNow support for tax filing processes?

airSlate SignNow integrates with various accounting and finance applications to enhance your workflow when handling documents like the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. This allows for smoother transitions between document creation, signing, and filing.

-

How secure is airSlate SignNow for storing sensitive tax documents?

Security is a priority at airSlate SignNow, especially when handling sensitive documents such as the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. We employ advanced encryption, secure access controls, and regular security audits to protect your data.

-

Can I track the status of my documents through airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents in real-time. This feature is particularly useful for important tax forms like the December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No. so you can ensure timely submissions and follow-ups.

Get more for December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

Find out other December Department Of The Treasury Internal Revenue Service 2438 Undistributed Capital Gains Tax Return OMB No

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter