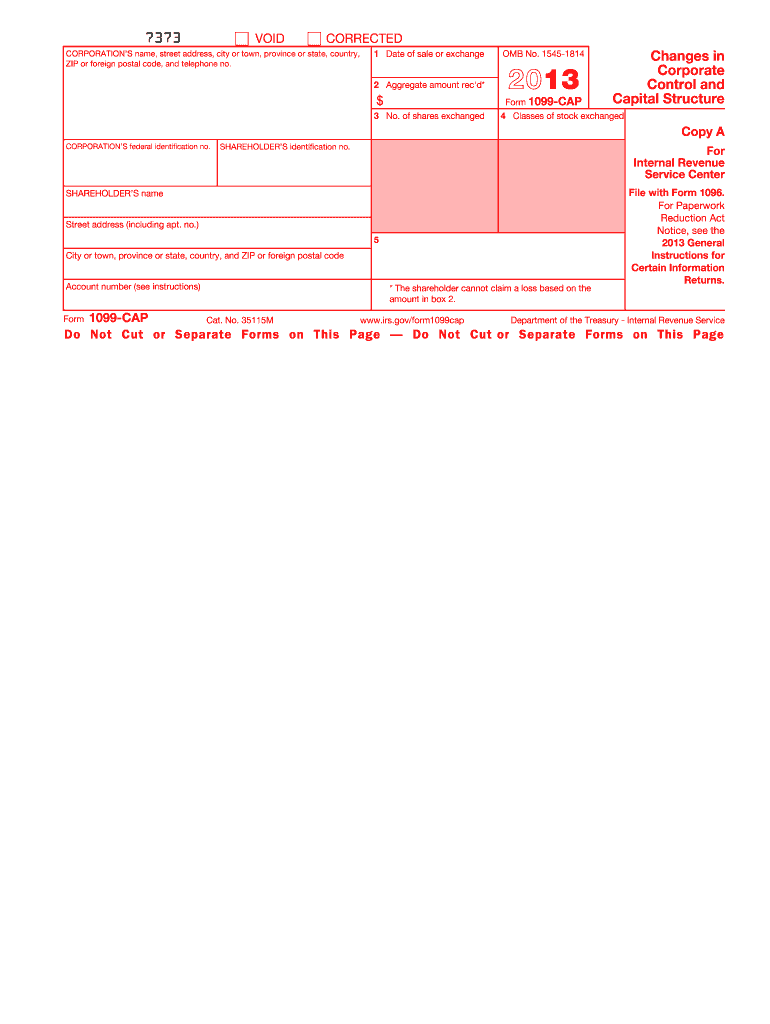

Form 1099 CAP Changes in Corporate Control and Capital Structure

What is the Form 1099 CAP Changes In Corporate Control And Capital Structure

The Form 1099 CAP is a tax document used to report changes in corporate control and capital structure. This form is essential for corporations that undergo significant alterations in ownership or capital arrangements. It provides the Internal Revenue Service (IRS) with crucial information regarding the financial transactions that affect a corporation's equity structure. These changes may include mergers, acquisitions, or other significant shifts that impact the company's financial standing.

How to use the Form 1099 CAP Changes In Corporate Control And Capital Structure

To effectively use the Form 1099 CAP, businesses must accurately report any changes in their corporate control or capital structure. This involves detailing the nature of the changes, including the parties involved and the financial implications. The form should be filled out with precision, ensuring all required fields are completed. It is important to maintain clear records of the transactions that necessitate the filing of this form, as it serves as a formal declaration to the IRS.

Steps to complete the Form 1099 CAP Changes In Corporate Control And Capital Structure

Completing the Form 1099 CAP involves several key steps:

- Gather necessary information about the corporate changes, including dates and involved parties.

- Fill out the form with accurate details, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the applicable deadline.

Legal use of the Form 1099 CAP Changes In Corporate Control And Capital Structure

The legal use of Form 1099 CAP is crucial for compliance with IRS regulations. Corporations are required to file this form when there are significant changes in their capital structure or control. Failure to file the form may result in penalties or legal repercussions. It is important for businesses to understand the legal implications of their corporate changes and ensure that they are reporting them accurately and timely.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 CAP are typically aligned with the IRS annual tax filing calendar. Corporations must submit the form by the specified due date, which is generally within a certain number of days following the change in corporate control or capital structure. Keeping track of these important dates is essential to avoid late penalties and ensure compliance with IRS requirements.

Who Issues the Form

The Form 1099 CAP is issued by the corporation undergoing changes in its control or capital structure. It is the responsibility of the corporation to prepare and submit this form to the IRS. Additionally, copies may need to be provided to any parties involved in the transaction, ensuring transparency and proper record-keeping.

Quick guide on how to complete form 1099 cap changes in corporate control and capital structure

Set Up [SKS] Effortlessly on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Simplest Method to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your eSignature using the Sign feature, which takes only seconds and holds the same legal authority as an ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or a shared link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1099 CAP Changes In Corporate Control And Capital Structure

Create this form in 5 minutes!

How to create an eSignature for the form 1099 cap changes in corporate control and capital structure

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Form 1099 CAP Changes In Corporate Control And Capital Structure?

Form 1099 CAP Changes In Corporate Control And Capital Structure refers to the reporting requirements for corporations experiencing shifts in ownership or capital that must be disclosed. Understanding these changes is crucial for compliance and maintaining accurate financial records. airSlate SignNow can help streamline the documentation process for these reporting requirements.

-

How does airSlate SignNow support the processing of Form 1099 CAP Changes In Corporate Control And Capital Structure?

airSlate SignNow provides an efficient platform for firms to prepare and sign the necessary documents related to Form 1099 CAP Changes In Corporate Control And Capital Structure. With customizable templates and an intuitive interface, our solution simplifies document management, ensuring that your adjustments are documented properly and securely.

-

What pricing plans does airSlate SignNow offer for handling Form 1099 CAP Changes In Corporate Control And Capital Structure?

We offer various pricing plans tailored to meet the needs of businesses of all sizes. Each plan includes features that facilitate the efficient handling of Form 1099 CAP Changes In Corporate Control And Capital Structure, maximizing your investment while ensuring compliance with regulatory requirements. For detailed pricing information, please visit our pricing page.

-

What features are included in airSlate SignNow for managing Form 1099 CAP Changes In Corporate Control And Capital Structure?

airSlate SignNow includes several key features such as customizable templates, electronic signatures, and secure cloud storage that are essential for managing Form 1099 CAP Changes In Corporate Control And Capital Structure. These features enhance your ability to easily create, send, and eSign documents while maintaining compliance and security.

-

How can I ensure compliance with Form 1099 CAP Changes In Corporate Control And Capital Structure using airSlate SignNow?

By utilizing airSlate SignNow's automated workflows and compliance features, you can ensure that all documentation related to Form 1099 CAP Changes In Corporate Control And Capital Structure meets legal standards. Our platform provides reminders, audit trails, and secure storage to help you stay compliant with the latest regulations.

-

Does airSlate SignNow integrate with other software to assist with Form 1099 CAP Changes In Corporate Control And Capital Structure?

Yes, airSlate SignNow offers numerous integrations with popular software applications that can streamline your workflow related to Form 1099 CAP Changes In Corporate Control And Capital Structure. These integrations allow for seamless data transfer and efficient document management, optimizing your overall operational efficiency.

-

Can I customize documents related to Form 1099 CAP Changes In Corporate Control And Capital Structure in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize templates specifically for Form 1099 CAP Changes In Corporate Control And Capital Structure. You can tailor your documents to fit your business needs, ensuring that all relevant information is captured and presented in a professional format.

Get more for Form 1099 CAP Changes In Corporate Control And Capital Structure

- Seizure preparedness plan teva pharmaceuticals form

- Yut nori rules pdf form

- Affidavit regarding sale of a motor vehicle off highway motorcycle co tuscarawas oh form

- Biographical sketch fillable form

- Gdca exam form

- Statement of values insurance excel template form

- Sc pt 100 fillable form

- Endorsement form template

Find out other Form 1099 CAP Changes In Corporate Control And Capital Structure

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement