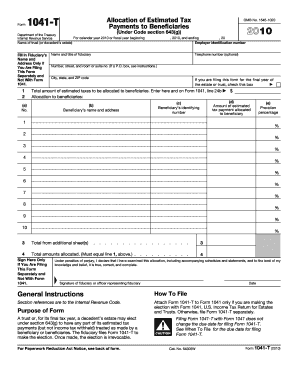

Department of the Treasury for Calendar Year or Fiscal Year Beginning Internal Revenue Service Name of Trust or Decedent's Form

Understanding the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate

The Department of the Treasury oversees the financial management of the United States government, including the Internal Revenue Service (IRS). The form related to the name of a trust or decedent's estate is crucial for tax purposes, as it helps in reporting income and determining tax liabilities. This form is typically used when a trust or estate has income that needs to be reported for a specific calendar year or fiscal year. It ensures compliance with federal tax laws and provides a clear record of financial activities associated with the trust or estate.

Steps to Complete the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate

Completing this form involves several key steps:

- Gather all necessary documentation, including income statements and expense records related to the trust or estate.

- Identify the correct tax year for which the form is being filed, whether it is a calendar year or a fiscal year.

- Fill in the required fields accurately, including the name of the trust or estate, the taxpayer identification number, and income details.

- Review the completed form for accuracy to prevent any errors that could lead to penalties.

- Submit the form by the designated deadline, ensuring it is sent to the correct IRS address.

Legal Use of the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate

This form serves a legal purpose in the context of tax reporting for trusts and estates. It is required by the IRS to ensure that all income generated by the trust or estate is reported and taxed appropriately. Failure to submit this form can result in legal consequences, including fines and penalties. Additionally, it is essential for the proper distribution of assets and for fulfilling fiduciary responsibilities.

Filing Deadlines / Important Dates

Timely filing of the Department Of The Treasury form is crucial. The deadlines typically align with the tax year end, which can be either December 31 for calendar year filers or the last day of the fiscal year for those using a fiscal year. Generally, the form must be filed by the 15th day of the fourth month following the end of the tax year. It is important to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements.

Required Documents

To complete the Department Of The Treasury form accurately, certain documents are necessary:

- Taxpayer identification number for the trust or estate.

- Income statements, such as Form 1099 or K-1, detailing earnings.

- Records of expenses that can be deducted.

- Previous tax returns for reference, if applicable.

IRS Guidelines

The IRS provides specific guidelines for filling out the Department Of The Treasury form. These guidelines include instructions on how to report different types of income, allowable deductions, and any applicable tax credits. It is essential to adhere to these guidelines to ensure compliance and avoid issues with the IRS. Regularly reviewing the IRS website or consulting with a tax professional can help keep you informed about any updates or changes in regulations.

Quick guide on how to complete department of the treasury for calendar year or fiscal year beginning internal revenue service name of trust or decedents estate

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage [SKS] from any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Leverage the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, burdensome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from your chosen device. Alter and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury for calendar year or fiscal year beginning internal revenue service name of trust or decedents estate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for submitting the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate?

To submit the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate, you can utilize airSlate SignNow's user-friendly platform. Upload your documents, apply electronic signatures, and send them securely. Our service ensures compliance with IRS regulations, making the process efficient and straightforward.

-

How does airSlate SignNow ensure compliance with the Department Of The Treasury regulations?

airSlate SignNow is designed with compliance in mind, particularly concerning documents related to the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate. We provide templates and guides to help you meet all requirements while eSigning. With encryption and secure storage, your documents remain protected throughout the process.

-

What are the cost options for using airSlate SignNow for Department Of The Treasury documents?

airSlate SignNow offers a range of pricing plans that cater to different business needs, including those focused on the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate. Our flexible pricing ensures you only pay for what you need, with options for monthly or annual subscriptions that can signNowly reduce costs for bulk signing operations.

-

Can airSlate SignNow integrate with other software for managing Department Of The Treasury forms?

Yes, airSlate SignNow can seamlessly integrate with various software applications to improve your workflow for the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate. Whether you are using CRM systems or document management tools, our platform offers integrations that enhance productivity and ensure your documents are handled efficiently.

-

What features of airSlate SignNow are beneficial for handling decedent's estate documents?

airSlate SignNow has powerful features that make managing documents related to the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate easier. Key features include customizable templates, secure eSigning, and cloud-based access, which enable you to organize, track, and execute signatures quickly and securely while ensuring compliance with relevant laws.

-

How can I ensure the security of my Department Of The Treasury documents with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies to protect your Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate documents. Furthermore, our secure cloud storage and authentication measures ensure that your sensitive information remains confidential and accessible only to authorized users.

-

Are there any user-friendly features on airSlate SignNow for first-time users dealing with trust documents?

Absolutely! airSlate SignNow is designed with first-time users in mind, especially for those handling the Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's Estate. Our intuitive interface guides you through the eSigning process, and we also offer tutorials and customer support to make your experience smooth and hassle-free.

Get more for Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's

Find out other Department Of The Treasury For Calendar Year Or Fiscal Year Beginning Internal Revenue Service Name Of Trust or Decedent's

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free