Department of the Treasury Internal Revenue Service Notice 1382 January Changes for Form 1023 Mailing Address Parts IX and X Cha

Understanding the Department Of The Treasury Internal Revenue Service Notice 1382

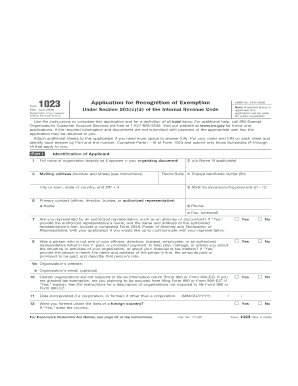

The Department Of The Treasury Internal Revenue Service Notice 1382 outlines important changes related to Form 1023, which is the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. This notice specifically addresses modifications to the mailing address for Parts IX and X of the form. These changes are crucial for organizations seeking tax-exempt status as they ensure that applications are sent to the correct location for processing.

Steps to Complete Form 1023 with Notice 1382 Changes

To complete Form 1023 in light of the changes specified in Notice 1382, organizations should follow these steps:

- Review the updated mailing address for Parts IX and X as indicated in the notice.

- Gather all necessary information and documentation required for the application.

- Fill out Form 1023 completely, ensuring all sections are addressed according to the new guidelines.

- Double-check for accuracy and completeness before submission.

- Submit the form to the updated mailing address provided in Notice 1382.

Key Elements of Notice 1382

Notice 1382 includes several key elements that organizations must understand:

- Updated mailing addresses for Parts IX and X of Form 1023.

- Clarifications on the types of organizations eligible for tax-exempt status.

- Guidance on the documentation required to support the application.

- Details on any deadlines or important dates related to the submission process.

Filing Deadlines and Important Dates

Organizations should be aware of specific filing deadlines associated with Form 1023. Notice 1382 may highlight important dates that affect when applications must be submitted to ensure timely processing and compliance with IRS regulations.

Eligibility Criteria for Form 1023

To qualify for tax-exempt status under Section 501(c)(3), organizations must meet certain eligibility criteria. These criteria include being organized and operated exclusively for exempt purposes, ensuring that no part of the net earnings benefits any private shareholder or individual, and adhering to the limitations on political activities and lobbying.

Application Process and Approval Time

The application process for Form 1023 can vary in duration. After submission, organizations should anticipate a review period during which the IRS will assess the application. The approval time can depend on the completeness of the application, the volume of applications being processed, and any additional information the IRS may require.

Quick guide on how to complete department of the treasury internal revenue service notice 1382 january changes for form 1023 mailing address parts ix and x

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the necessary template and securely keep it online. airSlate SignNow equips you with all the features required to create, edit, and eSign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools available to complete your document.

- Mark important sections of the documents or obscure sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the stress of lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Department Of The Treasury Internal Revenue Service Notice 1382 January Changes For Form 1023 Mailing Address Parts IX And X Cha

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury internal revenue service notice 1382 january changes for form 1023 mailing address parts ix and x

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key updates in the Department Of The Treasury Internal Revenue Service Notice 1382 regarding Form 1023?

The Department Of The Treasury Internal Revenue Service Notice 1382 outlines vital changes to the mailing address requirements for Form 1023. Specifically, Parts IX and X of the form have been updated to ensure that applications for recognition of exemption under Section 501(c)(3) are mailed to the correct address, enhancing processing efficiency and response times.

-

How do the changes in the Department Of The Treasury Internal Revenue Service Notice 1382 impact my Form 1023 submission?

The changes outlined in the Department Of The Treasury Internal Revenue Service Notice 1382 mean that applicants must adhere to the new mailing address guidelines in Parts IX and X of Form 1023. Failing to use the correct address may result in delays, making it crucial for organizations to familiarize themselves with these updates.

-

What benefits does airSlate SignNow offer for submitting Form 1023 electronically?

airSlate SignNow provides a seamless and cost-effective solution for electronically submitting Form 1023. By using eSignatures and digital document management, organizations can ensure compliance with the changes specified in the Department Of The Treasury Internal Revenue Service Notice 1382, while also accelerating their application process.

-

Can airSlate SignNow help track the status of my Form 1023 application?

Yes, airSlate SignNow offers tracking features that allow users to monitor the status of their Form 1023 applications. This capability is essential for staying updated on the submission status, especially in light of the recent changes highlighted in the Department Of The Treasury Internal Revenue Service Notice 1382.

-

Are there any pricing plans for using airSlate SignNow for Form 1023 submissions?

Absolutely! airSlate SignNow offers various pricing plans that cater to different organizational needs. These plans provide value through efficient document management and compliance with the Department Of The Treasury Internal Revenue Service Notice 1382 regarding the amended Form 1023 submissions.

-

What features does airSlate SignNow include for nonprofits applying for 501(c)(3) status?

AirSlate SignNow includes a variety of features designed specifically for nonprofits, such as eSignatures, document templates, and streamlined workflow tools. These features are critical for complying with the new mailing address requirements outlined in the Department Of The Treasury Internal Revenue Service Notice 1382 for Form 1023.

-

Is airSlate SignNow compliant with IRS requirements for Form 1023?

Yes, airSlate SignNow is designed to comply with IRS requirements, including the recent updates in the Department Of The Treasury Internal Revenue Service Notice 1382. This ensures that all users can submit Form 1023 electronically while adhering to new guidelines efficiently.

Get more for Department Of The Treasury Internal Revenue Service Notice 1382 January Changes For Form 1023 Mailing Address Parts IX And X Cha

- Express scripts 27499367 form

- Form 1399

- Ndis provider toolkit module 5 service agreements form

- Privacy release form congressman gerry connolly

- Building permit application other remarks city of houston form

- Sdcera health insurance allowance form

- Wyoming wolfs 109a form

- Fulton county magistrate court form

Find out other Department Of The Treasury Internal Revenue Service Notice 1382 January Changes For Form 1023 Mailing Address Parts IX And X Cha

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy