Form 1041 T Allocation of Estimated Tax Payments to Beneficiaries under Code Section 643g for Calendar Year or Fiscal Year Begin

Understanding Form 1041 T

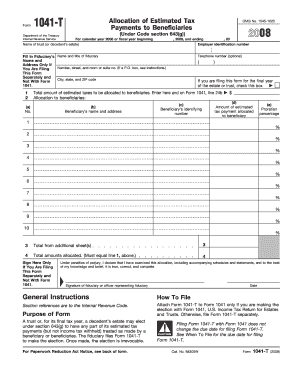

The Form 1041 T Allocation of Estimated Tax Payments to Beneficiaries under Code Section 643(g) is a crucial document for estates and trusts in the United States. This form allows fiduciaries to allocate estimated tax payments made on behalf of the estate or trust to its beneficiaries. By doing so, it ensures that beneficiaries receive credit for their share of the estimated tax payments when they file their personal tax returns. This allocation is particularly important for tax planning and compliance, as it can affect the overall tax liability of the beneficiaries.

Steps to Complete Form 1041 T

Completing the Form 1041 T involves several important steps. First, gather all necessary financial information regarding the estate or trust, including income, deductions, and prior estimated tax payments. Next, accurately fill in the identifying information for the estate or trust at the top of the form. Then, allocate the estimated tax payments to each beneficiary based on their respective shares. It is essential to ensure that the total allocated payments do not exceed the total estimated tax payments made. Finally, review the form for accuracy and completeness before submitting it to the IRS.

Obtaining Form 1041 T

The Form 1041 T can be obtained directly from the Internal Revenue Service (IRS) website or through tax preparation software that includes IRS forms. It is advisable to ensure that you are using the most current version of the form, as tax laws and requirements can change. Additionally, many tax professionals can provide this form as part of their services, ensuring that it is filled out correctly and in compliance with current regulations.

Key Elements of Form 1041 T

Several key elements must be included when completing the Form 1041 T. These include the name and taxpayer identification number of the estate or trust, the tax year for which the allocation is being made, and the names and identification numbers of the beneficiaries. Additionally, the form requires a detailed breakdown of the estimated tax payments made and how they are allocated among the beneficiaries. Accurate reporting of these elements is critical for compliance and to avoid potential penalties.

Legal Use of Form 1041 T

The legal use of Form 1041 T is governed by the provisions of the Internal Revenue Code, specifically Section 643(g). This form is used in the context of estates and trusts to ensure that estimated tax payments are properly allocated to beneficiaries. It is important for fiduciaries to understand their responsibilities under the law, as improper allocation can lead to tax complications for both the estate and the beneficiaries. Filing the form correctly helps maintain compliance with IRS regulations and ensures that beneficiaries receive the appropriate tax credits.

Filing Deadlines for Form 1041 T

Filing deadlines for Form 1041 T align with the tax deadlines for estates and trusts. Generally, the form must be filed by the 15th day of the fourth month following the close of the tax year. For estates and trusts that operate on a calendar year, this means the form is typically due by April 15 of the following year. It is essential to adhere to these deadlines to avoid late filing penalties and ensure that beneficiaries receive their tax allocations in a timely manner.

Examples of Using Form 1041 T

Using Form 1041 T can be illustrated through various scenarios. For instance, if an estate has made estimated tax payments of $10,000 and has three beneficiaries, the fiduciary must determine how much of the $10,000 to allocate to each beneficiary based on their respective shares. If one beneficiary is entitled to fifty percent of the estate, they would receive a $5,000 allocation. Properly documenting this allocation on Form 1041 T ensures that each beneficiary can claim their share on their individual tax returns, reflecting the estimated payments made on their behalf.

Quick guide on how to complete form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g for calendar year or fiscal year

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the suitable form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and electronically sign [SKS] without hassle

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), a link invitation, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g For Calendar Year Or Fiscal Year Begin

Create this form in 5 minutes!

How to create an eSignature for the form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g for calendar year or fiscal year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g?

Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g is a tax form used by estates or trusts to allocate estimated tax payments made on behalf of beneficiaries. This form helps clarify how taxes should be divided among beneficiaries for the specified calendar year or fiscal year. Proper use of this form can ensure compliance with IRS regulations and accurate tax reporting.

-

How can airSlate SignNow simplify my Form 1041 T filing process?

airSlate SignNow offers an easy-to-use platform that streamlines the preparation and e-signing of Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. You can create, send, and sign documents electronically, reducing paperwork and expediting the filing process. This efficiency ensures that you meet deadlines and maintain compliance without the hassle of traditional methods.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides flexible pricing plans designed to cater to different business needs. Whether you're a small business or a large enterprise, there's a plan that accommodates your scale of usage. Investing in airSlate SignNow can enhance your document management processes, especially for tax-related forms like Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, enhancing your workflow efficiency. You can connect to popular tools such as Google Drive, Dropbox, and various CRMs. This integration enables you to manage documents related to Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g without switching between platforms.

-

What benefits does airSlate SignNow provide for handling tax documents?

airSlate SignNow provides numerous benefits for managing tax documents, including secure e-signatures, automated workflows, and real-time updates. These features ensure that your Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g is processed quickly and accurately. This reliability helps reduce errors and saves you valuable time during tax season.

-

Is airSlate SignNow suitable for small businesses requiring Form 1041 T?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, including small enterprises that need to file Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. Its user-friendly interface and cost-effective solutions make it an ideal choice for small business owners navigating their tax filing obligations.

-

Can I track changes made to my Form 1041 T using airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor changes and view the history of your documents, including Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g. This feature promotes transparency and accountability within your document workflow. You can easily access previous versions and see who made changes and when.

Get more for Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g For Calendar Year Or Fiscal Year Begin

- How to complete membership form tennessee department of treasury

- Tennessee denial form

- Application for motor vehicle identification certification form

- Ss4444 form

- Rv f1315201 form

- Request for official ged transcript tn online form

- Tn dept of agriculture feed favility license form

- Tennessee industrial machinery authorization form

Find out other Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g For Calendar Year Or Fiscal Year Begin

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now