Instructions for Form 2220 Underpayment of Estimated Tax by Corporations Section References Are to the Internal Revenue Code Unl

Understanding Form 2220 for Underpayment of Estimated Tax by Corporations

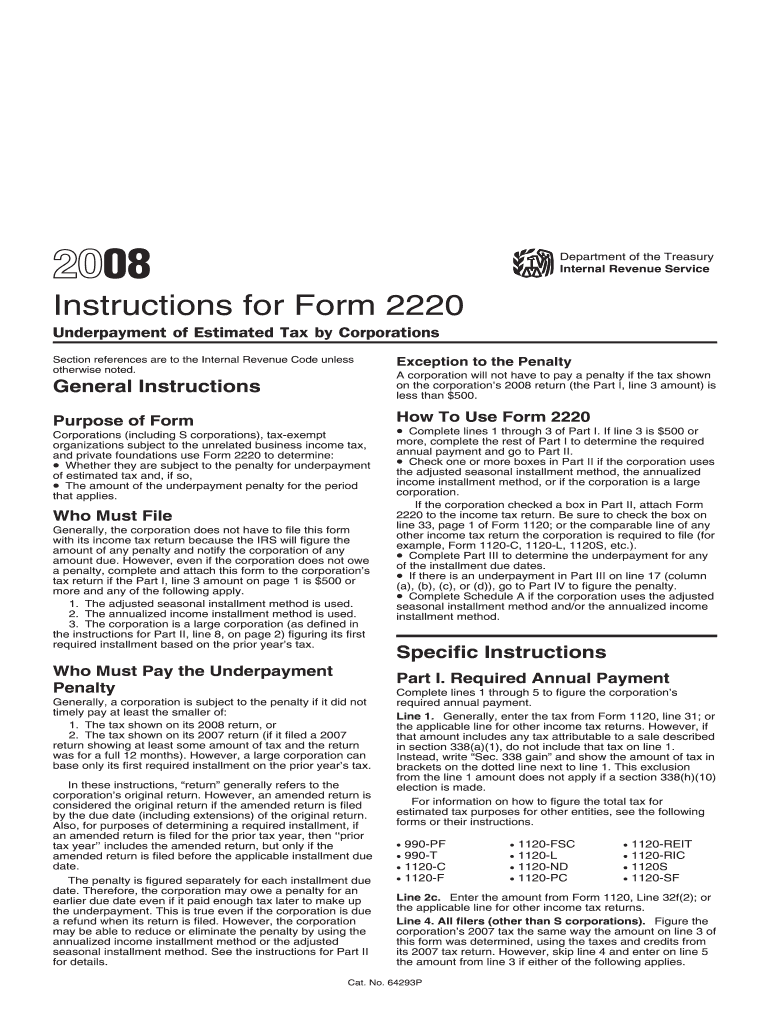

The Instructions for Form 2220 provide guidance for corporations that may have underpaid their estimated tax. This form is essential for determining whether a corporation owes a penalty for underpayment. It is designed to help businesses calculate the amount of tax owed based on their estimated income and tax liabilities. Corporations must adhere to the guidelines set forth in the Internal Revenue Code to ensure compliance and avoid penalties.

Steps to Complete Form 2220

Completing Form 2220 involves several key steps. First, corporations need to gather their financial information, including income statements and tax records. Next, they must calculate their expected tax liability for the year. This includes determining the amount of estimated tax payments made throughout the year. After calculating the total tax liability, corporations can compare it to their actual payments to identify any underpayment. Finally, the form must be filled out accurately, reflecting all calculations and submitted by the due date.

Key Elements of Form 2220

Form 2220 includes vital sections that corporations must understand. These sections cover the calculation of underpayment penalties, the required information for each payment period, and any exceptions that may apply. Corporations should pay close attention to the definitions of terms used in the form, as well as the instructions for completing each section accurately. Understanding these elements is crucial for ensuring that the form is filled out correctly and submitted on time.

Filing Deadlines for Form 2220

Corporations must be aware of the filing deadlines associated with Form 2220. Typically, the form is due on the same date as the corporation's tax return. If a corporation is unable to pay the full amount of tax owed, they must still file the form by the deadline to avoid additional penalties. Keeping track of these dates is essential for maintaining compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 2220 can result in significant penalties. Corporations that underpay their estimated tax may be subject to interest charges and late fees. The IRS may impose additional penalties if the form is not filed correctly or on time. Understanding these potential consequences can motivate corporations to ensure accurate and timely submissions.

Obtaining Form 2220

Corporations can obtain Form 2220 and its instructions directly from the IRS website or through various tax preparation software. It is important to ensure that the most current version of the form is used, as tax laws and regulations may change. Accessing the form online allows for easy printing and completion, facilitating a smoother filing process.

Quick guide on how to complete instructions for form 2220 underpayment of estimated tax by corporations section references are to the internal revenue code

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents swiftly without wait times. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations Section References Are To The Internal Revenue Code Unl

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 2220 underpayment of estimated tax by corporations section references are to the internal revenue code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations?

The Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations are designed to guide corporations in calculating their estimated tax liability and determining if they owe any penalties for underpayment. These instructions reference specific sections of the Internal Revenue Code, providing clarity on compliance requirements. Understanding these instructions helps corporations manage their tax obligations effectively.

-

How can airSlate SignNow assist with submitting Form 2220?

airSlate SignNow streamlines the process of submitting Form 2220 by enabling users to electronically sign and send documents efficiently. With its user-friendly interface, corporations can easily fill out the necessary sections related to the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations. This eliminates paperwork hassles and speeds up submission time.

-

Are there any costs associated with using airSlate SignNow for tax-related documents?

Yes, while airSlate SignNow offers an array of features, there are subscription plans that cater to various business needs. Each plan provides access to tools that help manage documents related to taxes, including the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations. It's a cost-effective solution that scales with your business.

-

What features does airSlate SignNow have that benefit corporations handling tax forms?

airSlate SignNow includes features such as document templates, collaboration tools, and secure cloud storage, all of which can enhance the process of managing tax forms like the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations. These features streamline workflows and help ensure that all related documentation is organized and accessible.

-

Is airSlate SignNow compliant with IRS regulations for tax documents?

Absolutely! airSlate SignNow meets all necessary compliance standards for handling tax documents, ensuring that your use of the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations aligns with IRS guidelines. The platform employs encryption and security measures to protect sensitive information.

-

Can airSlate SignNow integrate with accounting software for better tax management?

Yes, airSlate SignNow offers integrations with various accounting software systems, making it easier for corporations to manage their tax-related forms, including the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations. These integrations streamline data transfer and enhance overall efficiency in tax processing.

-

What benefits does electronic signing provide for tax document management?

Electronic signing through airSlate SignNow provides numerous benefits for tax document management, including faster turnaround times, reduced paperwork, and a more secure signing process. Corporations can easily manage their obligations regarding the Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations, ensuring timely submissions and compliance with federal regulations.

Get more for Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations Section References Are To The Internal Revenue Code Unl

- Essential document locator checklist form

- 946 form for mdhs

- Application for handicapped license plate or placard hamilton form

- Affidavit of non receipt form

- Quick reference guide template form

- Houston isd tax office form

- Exemptions asr sccgov org form

- Confined space training certificate template form

Find out other Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations Section References Are To The Internal Revenue Code Unl

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe