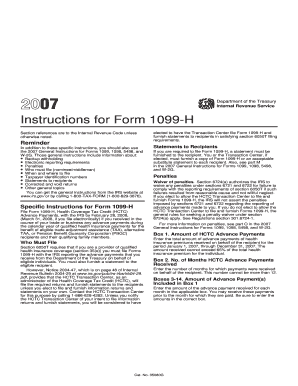

Instructions for Form 1099 H Section References Are to the Internal Revenue Code unless Otherwise Noted

Understanding Form 1099-H

The Instructions For Form 1099-H provide essential guidance for taxpayers and businesses regarding health coverage tax credits. This form is specifically designed for individuals who are eligible for the premium assistance tax credit under the Affordable Care Act. By understanding the purpose and requirements of Form 1099-H, users can ensure compliance and accurately report their health coverage costs.

Steps to Complete Form 1099-H

Completing Form 1099-H involves several key steps. First, gather all necessary documentation, including details about health coverage and any premium assistance received. Next, accurately fill out the form by entering the required information, such as your name, address, and the amount of premium assistance. Ensure that all entries match the information provided by your health insurance provider. Finally, review the completed form for accuracy before submitting it to the IRS.

Filing Deadlines for Form 1099-H

Filing deadlines are crucial for compliance with tax regulations. For Form 1099-H, the deadline for providing the form to recipients is typically January 31 of the year following the tax year. Additionally, the form must be filed with the IRS by February 28 if submitted by mail or March 31 if filed electronically. Adhering to these deadlines helps avoid penalties and ensures timely processing of tax returns.

Legal Use of Form 1099-H

Form 1099-H is legally required for reporting health coverage tax credits. Taxpayers must use this form to report any premium assistance received to ensure accurate tax filings. Failure to provide this information can result in penalties or delays in tax refunds. Understanding the legal implications of Form 1099-H helps individuals and businesses maintain compliance with IRS regulations.

Key Elements of Form 1099-H

Several key elements are essential for accurately completing Form 1099-H. These include the taxpayer's identification number, the amount of premium assistance received, and the details of the health coverage provider. Additionally, it is important to ensure that all information is current and matches IRS records. Familiarity with these elements can facilitate a smoother filing process.

Obtaining Form 1099-H

Form 1099-H can be obtained through the IRS website or by contacting the IRS directly. Taxpayers may also receive this form from their health insurance providers if they qualify for the health coverage tax credit. It is important to ensure that you have the most current version of the form to comply with IRS requirements.

Examples of Using Form 1099-H

Examples of using Form 1099-H include reporting premium assistance for individuals enrolled in a qualified health plan. For instance, if a taxpayer receives premium assistance to reduce their monthly health insurance costs, this amount must be reported on Form 1099-H. Accurate reporting helps ensure that taxpayers receive the appropriate credits and avoid issues with their tax returns.

Quick guide on how to complete instructions for form 1099 h section references are to the internal revenue code unless otherwise noted

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents an ideal eco-friendly replacement for traditional printed and signed papers, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, alter, and eSign your documents without any holdups. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to alter and eSign [SKS] with minimal effort

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools designed specifically for that functionality by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all entries and then click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that necessitate new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and eSign [SKS] and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1099 h section references are to the internal revenue code unless otherwise noted

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted?

The Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted provide guidelines on reporting health coverage tax credits. It's essential for businesses to understand these regulations to ensure compliance and avoid penalties. By following these instructions, you can accurately report the necessary information on your 1099 H forms.

-

How does airSlate SignNow help with the completion of Form 1099 H?

airSlate SignNow simplifies the process of completing Form 1099 H by providing customizable templates that align with the Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted. Our platform allows for easy data input and electronic signatures, ensuring a smoother workflow. This saves time and reduces the risk of errors in tax reporting.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for users to explore its features and benefits before committing to a subscription. During the trial, you can test functionalities that assist in understanding the Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted. This allows you to evaluate how our platform can streamline your document management process.

-

What integrations does airSlate SignNow support?

airSlate SignNow seamlessly integrates with various platforms such as Google Workspace, Salesforce, and Microsoft Office, enhancing productivity and workflow. These integrations support the needs of users dealing with Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted. By linking your preferred applications, you can manage documents and data more efficiently.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We utilize industry-standard encryption protocols and comply with regulations to protect your documents and data, especially when dealing with sensitive forms such as the Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted. You can be confident that your information remains secure throughout the signing process.

-

Can multiple users collaborate on documents in airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on documents in real-time. This feature is incredibly useful when working together to complete forms like the Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted. You can share documents, send requests for signatures, and track updates instantly.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents streamlines your workflow, enhances accuracy, and ensures compliance with the Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted. The platform's electronic signature capabilities expedite the process while maintaining a secure environment for sensitive information. This results in a more efficient tax preparation experience.

Get more for Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted

Find out other Instructions For Form 1099 H Section References Are To The Internal Revenue Code Unless Otherwise Noted

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe