Form 8915 Fill in Capable

What is the Form 8915 Fill In Capable

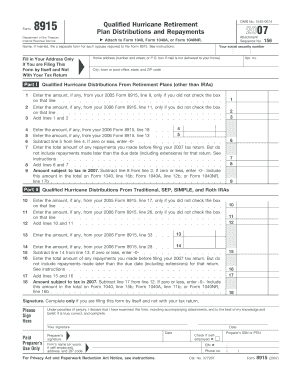

The Form 8915, officially known as the Qualified Disaster Retirement Plan Distributions and Repayments, is a tax form used by individuals who have taken distributions from their retirement plans due to a qualified disaster. This form enables taxpayers to report these distributions and any repayments they may make. It is particularly relevant for those affected by specific federally declared disasters, allowing them to manage their tax obligations effectively while addressing financial challenges.

How to use the Form 8915 Fill In Capable

Using Form 8915 involves several steps to ensure accurate reporting of disaster-related distributions. First, gather all necessary documentation regarding your retirement plan distributions. Next, fill out the form by providing your personal information, including your name and Social Security number. You will also need to specify the amount of the distribution and any repayments made. Finally, review the completed form for accuracy before submitting it with your tax return.

Steps to complete the Form 8915 Fill In Capable

Completing Form 8915 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information at the top of the form.

- Identify the qualified disaster that prompted the distribution.

- Report the total amount of distributions received from your retirement account.

- Indicate any repayments made towards these distributions.

- Ensure all calculations are accurate and consistent with your tax records.

- Sign and date the form before submission.

Key elements of the Form 8915 Fill In Capable

Form 8915 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Personal Information: Name, address, and Social Security number.

- Distribution Amount: Total amount withdrawn from the retirement account.

- Qualified Disaster Details: Information about the disaster that qualifies the distribution.

- Repayment Information: Amounts repaid to the retirement account, if applicable.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8915. Taxpayers must ensure they meet the eligibility criteria for disaster-related distributions. The IRS outlines the types of disasters that qualify and the tax implications of these distributions. It is essential to refer to the latest IRS publications for any updates or changes to the guidelines to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines for Form 8915 align with the general tax filing deadlines. Typically, individual taxpayers must submit their tax returns by April 15 of the following year. However, if you are affected by a disaster, the IRS may extend deadlines. It is important to stay informed about any specific extensions or changes related to your situation.

Quick guide on how to complete form 8915 fill in capable

Effortlessly prepare [SKS] on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

Edit and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8915 Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 8915 fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 'Form 8915 Fill In Capable' and how does it work?

The 'Form 8915 Fill In Capable' feature allows users to easily complete and eSign IRS Form 8915 digitally. With airSlate SignNow, businesses can efficiently fill in the form fields directly online, ensuring accurate submissions. This capability streamlines the process for tax-related documents, saving time and reducing errors.

-

Is there a cost for using the 'Form 8915 Fill In Capable' feature?

Yes, airSlate SignNow offers various pricing plans that include the 'Form 8915 Fill In Capable' feature. These plans are designed to cater to different business needs, providing a cost-effective solution for document management. Interested users can explore our pricing page to find the best plan for them.

-

What are the benefits of using airSlate SignNow's 'Form 8915 Fill In Capable' feature?

Using the 'Form 8915 Fill In Capable' feature enhances efficiency, reduces paperwork, and simplifies the eSigning process. Users can complete forms quickly and securely, which is especially beneficial during tax season. Moreover, it ensures compliance with IRS standards, providing peace of mind.

-

Can I integrate 'Form 8915 Fill In Capable' with other applications?

Absolutely! airSlate SignNow allows seamless integration with various applications to enhance your workflow, including CRM and accounting software. By integrating the 'Form 8915 Fill In Capable' feature, businesses can automate data input and streamline processes further.

-

Is technical support available for the 'Form 8915 Fill In Capable' feature?

Yes, airSlate SignNow provides comprehensive technical support for the 'Form 8915 Fill In Capable' feature. Users can access a knowledge base, tutorials, and personalized assistance to ensure they make the most of the feature. Our dedicated support team is ready to help resolve any issues.

-

How secure is my data when using 'Form 8915 Fill In Capable'?

Security is a top priority at airSlate SignNow. When using the 'Form 8915 Fill In Capable' feature, all data is encrypted and stored securely to protect sensitive information. We comply with industry standards to ensure that your documents are safe from unauthorized access.

-

Can I access my completed 'Form 8915 Fill In Capable' documents later?

Yes, users can easily access their completed forms through airSlate SignNow's user-friendly interface. Once the 'Form 8915 Fill In Capable' is filled out and signed, it is stored securely in your account for future reference. This feature allows for easy retrieval and management of all your documents.

Get more for Form 8915 Fill In Capable

- Philly pd form

- Signature declaration form

- 219 bn crpf location form

- Form 300 withdrawal request utah educational savings plan uesp

- Deemed surrender certificate indian passport form

- Sample expungement letter to judge form

- Marriage officiant amp couples contract hatteras wedding ministries form

- Cms medication administration observation form

Find out other Form 8915 Fill In Capable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors