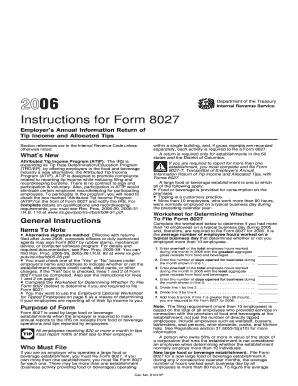

Instructions for Form 8027

Understanding Instructions For Form 8027

The Instructions For Form 8027 provide essential guidance for employers who are required to report tips received by employees in the food and beverage industry. This form is specifically designed for establishments that operate in these sectors, ensuring compliance with IRS regulations. The instructions detail the necessary steps to accurately complete the form, including how to report the total amount of tips received and any applicable allocations. Understanding these instructions is crucial for maintaining accurate records and fulfilling tax obligations.

Steps to Complete Instructions For Form 8027

Completing the Instructions For Form 8027 involves several key steps:

- Gather all relevant information regarding employee tips and sales.

- Calculate the total tips received by employees during the reporting period.

- Review the allocation methods for tips, ensuring they align with IRS guidelines.

- Fill out the form accurately, providing all required details as outlined in the instructions.

- Double-check the completed form for any errors before submission.

Obtaining Instructions For Form 8027

The Instructions For Form 8027 can be obtained directly from the IRS website or through authorized tax professionals. It is important to ensure that you have the most current version of the instructions, as updates may occur annually. Employers should also consider keeping a printed copy for reference when preparing their tax documentation.

Filing Deadlines and Important Dates

Timely submission of Form 8027 is crucial to avoid penalties. The form must typically be filed by the last day of February for the previous calendar year. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Employers should be aware of these dates to ensure compliance and avoid unnecessary fines.

Legal Use of Instructions For Form 8027

The Instructions For Form 8027 are legally mandated for employers in the food and beverage industry to report employee tips accurately. Failure to comply with these instructions can result in penalties from the IRS, including fines and interest on unpaid taxes. Understanding the legal implications of the instructions is essential for maintaining compliance and protecting your business.

Key Elements of Instructions For Form 8027

Several key elements are essential when working with Instructions For Form 8027:

- Tip Reporting: Accurate reporting of tips is crucial for compliance.

- Allocation Methods: Employers must understand how to allocate tips among employees.

- Record Keeping: Maintaining detailed records of tips and sales is necessary for accurate reporting.

- Submission Methods: Employers can submit the form electronically or via mail, depending on their preference.

Quick guide on how to complete instructions for form 8027

Complete [SKS] seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly option compared to conventional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 8027

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8027

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 8027?

The Instructions For Form 8027 provide detailed guidelines for employers regarding the reporting of annual information on payments made to employees. This form is specifically used for reporting certain payments and ensuring compliance with tax regulations. Understanding these instructions is crucial for accurate filing and avoiding potential penalties.

-

How can airSlate SignNow assist with completing the Instructions For Form 8027?

airSlate SignNow offers a streamlined platform to help businesses electronically sign and manage documents, including those related to the Instructions For Form 8027. By using our solution, you can easily share documents for e-signature, ensuring that all required forms are completed accurately and in compliance with regulations. This not only saves time but also enhances document security.

-

What features does airSlate SignNow provide for handling documents related to Form 8027?

airSlate SignNow offers features such as customizable templates, document sharing, and e-signature capabilities that simplify the process of completing the Instructions For Form 8027. Users can prepare and send documents quickly, track their status, and receive notifications when they are signed. This efficient workflow helps ensure that all necessary steps are taken in compliance with the form's instructions.

-

Is airSlate SignNow cost-effective for small businesses needing to follow the Instructions For Form 8027?

Yes, airSlate SignNow provides a cost-effective solution tailored to fit the needs of small businesses. With various pricing plans available, you can choose an option that best suits your budget while still gaining access to all essential features for managing the Instructions For Form 8027. Our platform is designed to minimize costs while maximizing efficiency.

-

Can airSlate SignNow integrate with other software tools for managing Form 8027?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and various CRM systems. These integrations allow you to centralize your document management processes, making it easier to follow the Instructions For Form 8027 without switching between multiple platforms. This enhances efficiency and streamlines your workflow.

-

What are the benefits of using airSlate SignNow for the Instructions For Form 8027?

Using airSlate SignNow to manage the Instructions For Form 8027 brings several benefits, including increased efficiency, improved compliance, and enhanced document security. Our user-friendly interface enables quick access to necessary tools, helping you complete forms accurately and submit them on time. Additionally, e-signatures add a layer of authenticity and legality to your documents.

-

How quickly can I get started with airSlate SignNow for Form 8027?

Getting started with airSlate SignNow is fast and straightforward. You can sign up online, and within minutes, you’ll have access to all the tools you need to work with the Instructions For Form 8027. Our intuitive onboarding process ensures that you’ll be up and running in no time, ready to manage your documents effectively.

Get more for Instructions For Form 8027

- Tcole l3 form

- Appendix 4a psom sne for children june 15th version doc neurology form

- Ucf map pdf form

- Iciq ui short form pdf

- 145502 pregnancy notes v13 117 06 13 hi preg info form

- Perceived stress scale bengali translation document kungfu psy cmu form

- Site connection proposal form

- Phlebotomy handbook 9th edition pdf download form

Find out other Instructions For Form 8027

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online