Form 990 W Worksheet Fill in Capable Estimated Tax on Unrelated Business Taxable Income for Tax Exempt Organizations

Understanding the Form 990 W Worksheet

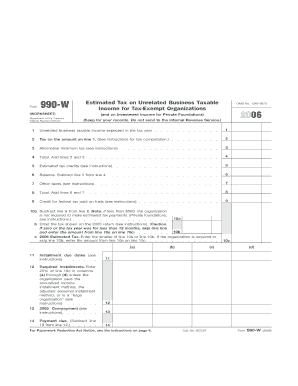

The Form 990 W Worksheet is a crucial tool for tax-exempt organizations that generate unrelated business taxable income (UBTI). This form helps organizations calculate their estimated tax obligations on UBTI, ensuring compliance with IRS regulations. By accurately completing this worksheet, organizations can determine the appropriate estimated tax payments required throughout the year, thus avoiding potential penalties for underpayment.

How to Complete the Form 990 W Worksheet

To effectively fill out the Form 990 W Worksheet, organizations should follow a systematic approach. Begin by gathering all necessary financial information related to unrelated business activities. This includes revenue generated from these activities and any associated expenses. Next, input the relevant figures into the designated sections of the worksheet, ensuring accuracy in calculations. It is essential to review the completed form for any discrepancies before submission to prevent issues with the IRS.

Key Components of the Form 990 W Worksheet

The Form 990 W Worksheet consists of several key components that must be accurately filled out. These include:

- Gross Income: Total revenue from unrelated business activities.

- Allowable Deductions: Expenses directly related to generating UBTI.

- Taxable Income: The net income after deductions, which is subject to tax.

- Estimated Tax Calculation: The estimated tax amount based on the taxable income.

Understanding these components is vital for determining the correct estimated tax obligations.

Obtaining the Form 990 W Worksheet

Organizations can obtain the Form 990 W Worksheet directly from the IRS website or through tax professionals who assist with nonprofit tax matters. It is advisable to ensure that the most current version of the form is used, as tax regulations and requirements may change annually. Keeping a copy of the form on hand can facilitate easier completion during tax season.

Important Filing Deadlines

Filing deadlines for the Form 990 W Worksheet are typically aligned with the organization’s fiscal year-end. Organizations must submit their estimated tax payments quarterly, with specific due dates set by the IRS. It is crucial to adhere to these deadlines to avoid penalties and interest on late payments. Keeping a calendar of these dates can help organizations stay compliant.

IRS Guidelines for Nonprofit Organizations

The IRS provides specific guidelines regarding the completion and submission of the Form 990 W Worksheet. Organizations must familiarize themselves with these guidelines to ensure compliance. This includes understanding what constitutes UBTI, allowable deductions, and the overall implications of failing to report accurately. Consulting the IRS website or a tax professional can provide additional clarity on these regulations.

Quick guide on how to complete form 990 w worksheet fill in capable estimated tax on unrelated business taxable income for tax exempt organizations

Effortlessly Prepare [SKS] on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without inconvenience. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, and the hassle of printing new copies due to errors. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] while ensuring exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations

Create this form in 5 minutes!

How to create an eSignature for the form 990 w worksheet fill in capable estimated tax on unrelated business taxable income for tax exempt organizations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income?

The Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income is a crucial document for tax-exempt organizations. It helps these entities calculate and report their estimated taxes on unrelated business taxable income, ensuring compliance with IRS regulations. Proper completion of this form is essential for avoiding penalties and maintaining tax-exempt status.

-

How does airSlate SignNow assist with the Form 990 W Worksheet?

airSlate SignNow provides an easy-to-use platform that allows organizations to digitally fill in and eSign the Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income. Our features streamline the process of completing and submitting the form, ensuring you can focus on other important aspects of your organization. The intuitive design also reduces the likelihood of errors.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income offers numerous benefits, including reduced paperwork and enhanced convenience. Our platform allows for secure eSigning, trackable workflows, and cloud storage, making document management hassle-free. This results in saved time and improved efficiency for tax-exempt organizations.

-

Is airSlate SignNow cost-effective for nonprofits?

Yes, airSlate SignNow offers competitive pricing tailored for nonprofit organizations looking to simplify their document management processes, including the Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income. Our pricing models are designed to fit within budget constraints, allowing you to take advantage of our powerful tools without straining your resources. This ensures that your organization can file necessary tax forms efficiently.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can seamlessly integrate with leading accounting software, enhancing your ability to manage financial documents, including the Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income. Our integrations allow for quick data transfer between platforms, reducing double entry and increasing accuracy. This ensures all financial records are up-to-date and easily accessible.

-

How secure is the data when using airSlate SignNow?

airSlate SignNow prioritizes data security and compliance, ensuring that all information related to your Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income is kept confidential and protected. We use industry-standard encryption and secure servers to safeguard your documents. This commitment to security gives users peace of mind while managing sensitive tax documents.

-

What support do you offer for users completing form 990?

Our support team is dedicated to helping you with any questions or issues related to the Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income. We offer comprehensive resources, including tutorials, FAQs, and live support to guide you through the document preparation and submission process. Our goal is to ensure you have all the tools and assistance needed for a smooth experience.

Get more for Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations

Find out other Form 990 W Worksheet Fill In Capable Estimated Tax On Unrelated Business Taxable Income For Tax Exempt Organizations

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online