Form 5305 RA Rev March Fill in Capable Roth Individual Retirement Custodial Account

What is the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

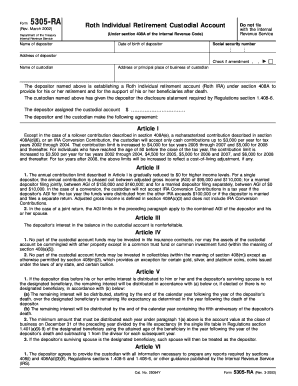

The Form 5305 RA Rev March is a crucial document used to establish a Roth Individual Retirement Custodial Account (IRA). This form is designed for individuals who wish to create a custodial account that allows for tax-free growth of retirement savings. The Roth IRA is particularly beneficial as contributions are made with after-tax dollars, meaning that qualified withdrawals during retirement are tax-free. This form is a declaration that outlines the terms and conditions governing the account, ensuring compliance with IRS regulations.

How to use the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

Using the Form 5305 RA Rev March involves several straightforward steps. First, individuals must fill out the form accurately, providing personal information such as name, address, and Social Security number. Next, the account holder must specify the contributions to be made and agree to the terms outlined in the document. Once completed, the form must be signed and dated by both the account holder and the custodian. This establishes a legally binding agreement for managing the Roth IRA and ensures that both parties understand their responsibilities.

Steps to complete the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

Completing the Form 5305 RA Rev March requires careful attention to detail. The following steps are essential:

- Obtain the form from a reliable source, such as the IRS website or a financial institution.

- Fill in your personal information, including your full name, address, and Social Security number.

- Indicate the amount of your contributions and any specific investment instructions.

- Review the terms and conditions outlined in the form to ensure understanding.

- Sign and date the form, ensuring that the custodian also provides their signature.

Key elements of the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

Several key elements define the Form 5305 RA Rev March. These include:

- The identification of the account holder and custodian.

- The contribution limits and rules regarding withdrawals.

- The investment options available within the Roth IRA.

- The rights and responsibilities of both the account holder and custodian.

- Compliance with IRS regulations and guidelines for maintaining the account.

Legal use of the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

The legal use of the Form 5305 RA Rev March is vital for establishing a valid Roth IRA. This form must be filled out accurately to comply with IRS regulations. It serves as a formal agreement between the account holder and the custodian, outlining the legal framework for managing the account. Failure to adhere to the guidelines can result in penalties or disqualification of the account's tax advantages. Therefore, it is essential to understand the legal implications of the form and ensure that all information is correct and complete.

Eligibility Criteria

To establish a Roth IRA using the Form 5305 RA Rev March, individuals must meet specific eligibility criteria. These include:

- Being of legal age to enter into a contract, typically at least eighteen years old.

- Having earned income that meets or exceeds the contribution limits set by the IRS.

- Meeting the income eligibility requirements, as high earners may face restrictions on contributions.

Quick guide on how to complete form 5305 ra rev march fill in capable roth individual retirement custodial account

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The Easiest Way to Alter and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you wish to send your document, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign [SKS] and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

Create this form in 5 minutes!

How to create an eSignature for the form 5305 ra rev march fill in capable roth individual retirement custodial account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account?

The Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account is a specific IRS form used to establish a Roth IRA custodial account. This account allows individuals to save for retirement with tax-free growth on investments. By using this form, you can ensure that your account meets the necessary IRS requirements.

-

How do I complete the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account?

Completing the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account requires entering your personal information, such as your name and Social Security number. It's essential to follow the instructions provided on the form carefully to ensure compliance with IRS regulations. Utilizing resources like airSlate SignNow can simplify this process for you.

-

What are the benefits of using a Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account?

The primary benefit of a Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account is the potential for tax-free growth on your retirement savings. You also have flexibility in how you withdraw funds, as contributions can be accessed tax-free. Additionally, this account can offer you a consistent investment vehicle for long-term wealth accumulation.

-

Are there any fees associated with the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account?

Fees can vary depending on the financial institution holding your Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account. Some banks and investment firms may charge maintenance fees, transaction fees, or account establishment charges. It's important to review these costs before opening your account to ensure you're making an informed decision.

-

How can I integrate my Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account with other financial tools?

Many financial institutions offer integration options for managing your Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account alongside other financial tools. This might include syncing with budgeting software or accounting resources to track your investments. Contact your provider to learn about the best integration practices.

-

Is there a contribution limit for the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account?

Yes, there is a contribution limit associated with the Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account. As of 2023, individuals under 50 can contribute up to $6,500, while those aged 50 and older can contribute an additional catch-up contribution of $1,000. It's crucial to check the latest IRS guidelines for any changes to these limits.

-

What types of investments can I hold in a Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account?

You can hold a wide array of investments in a Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account, including stocks, bonds, mutual funds, and ETFs. The specific options available will depend on the financial institution where your account is held. Diversifying your investments can help enhance your retirement savings strategy.

Get more for Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

Find out other Form 5305 RA Rev March Fill In Capable Roth Individual Retirement Custodial Account

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT