Form 8804 Schedule a Fill in Capable Penalty for Underpayment of Estimated Section 1446 Tax by Partnerships

Understanding Form 8804 Schedule A and Its Purpose

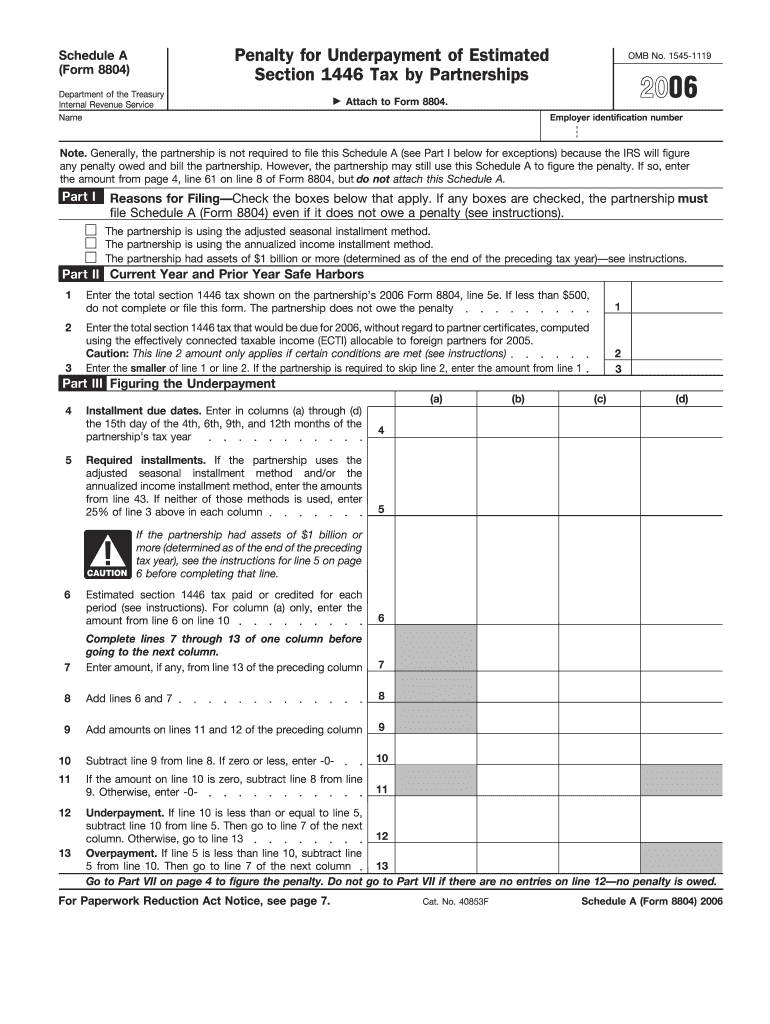

The Form 8804 Schedule A is specifically designed for partnerships to report their estimated Section 1446 tax obligations. This form is crucial for ensuring compliance with U.S. tax laws regarding foreign partners. If a partnership fails to pay the required estimated taxes, it may incur penalties for underpayment. Understanding the implications of this form helps partnerships avoid costly mistakes and ensures that they meet their tax responsibilities.

Steps to Complete Form 8804 Schedule A

Completing Form 8804 Schedule A involves several key steps. First, partnerships must gather all necessary financial information, including income and deductions related to foreign partners. Next, accurately calculate the estimated tax liability based on the partnership's income. The form requires specific details about each partner, including their share of the income and tax obligations. Finally, partnerships should review the completed form for accuracy before submission to avoid penalties.

Legal Use of Form 8804 Schedule A

Form 8804 Schedule A is legally mandated for partnerships that have foreign partners subject to Section 1446 tax. It serves as a declaration of the estimated tax owed and must be filed according to IRS guidelines. Compliance with this form is essential to avoid legal repercussions, including penalties for non-compliance. Partnerships should familiarize themselves with the legal requirements surrounding this form to ensure they remain in good standing with tax authorities.

Penalties for Non-Compliance with Form 8804 Schedule A

Partnerships that fail to file Form 8804 Schedule A or underpay their estimated Section 1446 tax may face significant penalties. The IRS imposes fines based on the amount of underpayment and the duration of the delay. Additionally, interest may accrue on any unpaid tax, further increasing the financial burden. Understanding these penalties emphasizes the importance of timely and accurate filing.

Obtaining Form 8804 Schedule A

Partnerships can obtain Form 8804 Schedule A directly from the IRS website or through authorized tax preparation software. It is important to ensure that the most current version of the form is used to comply with any recent tax law changes. Partnerships should verify that they have the correct form to avoid delays in processing and potential penalties.

Filing Deadlines for Form 8804 Schedule A

Filing deadlines for Form 8804 Schedule A are critical for partnerships to observe. Typically, the form must be filed annually, with specific deadlines set by the IRS. Partnerships should mark these dates on their calendars to ensure timely submission. Missing these deadlines can result in penalties and interest on unpaid taxes, making adherence to the schedule vital for compliance.

Quick guide on how to complete form 8804 schedule a fill in capable penalty for underpayment of estimated section 1446 tax by partnerships

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS], ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8804 Schedule A Fill In Capable Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Create this form in 5 minutes!

How to create an eSignature for the form 8804 schedule a fill in capable penalty for underpayment of estimated section 1446 tax by partnerships

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8804 Schedule A and why is it important?

The Form 8804 Schedule A is essential for partnerships to calculate the penalty for underpayment of estimated Section 1446 tax. Filing this form correctly helps partnerships avoid costly penalties and ensures compliance with IRS regulations. Using airSlate SignNow simplifies the process of eSigning and submitting this critical document.

-

How can airSlate SignNow assist with Form 8804 Schedule A?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the Form 8804 Schedule A. This streamlines the process, ensuring that all information is accurately captured and submitted on time. Our solution also minimizes the risk of errors, ultimately helping partnerships avoid underpayment penalties.

-

Are there any fees associated with filing Form 8804 Schedule A?

While there may be IRS fees associated with the actual submission of Form 8804 Schedule A, airSlate SignNow offers a cost-effective solution for eSigning and managing documents related to this form. Our pricing is transparent and designed to provide maximum value for businesses. By using our service, you can ensure a smooth filing process without unexpected costs.

-

What are the features of airSlate SignNow that support Form 8804 Schedule A?

airSlate SignNow includes features like document templates, customizable workflows, and secure eSigning that cater to the needs of partnerships filing Form 8804 Schedule A. These tools enhance efficiency and accuracy in preparing for compliance with Section 1446 tax regulations. Our platform also allows easy collaboration among partners, further simplifying the filing process.

-

Can I integrate airSlate SignNow with other accounting software for filing Form 8804 Schedule A?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier to file Form 8804 Schedule A. This integration allows for automatic data imports, minimizing manual entry and reducing the chance of errors. By streamlining your workflow, you can focus more on compliance and less on administrative tasks.

-

What benefits does airSlate SignNow provide for partnerships regarding tax documents?

Using airSlate SignNow for tax documents like Form 8804 Schedule A offers numerous benefits, including enhanced security, streamlined workflows, and ease of access. Our solution helps partnerships stay organized and compliant, reducing the risk of penalties related to underpayment of taxes. Moreover, our user-friendly interface ensures that even non-tech-savvy users can efficiently manage their tax documents.

-

How does airSlate SignNow ensure data security for sensitive tax information?

airSlate SignNow prioritizes data security by using advanced encryption and secure storage solutions to protect all documents, including Form 8804 Schedule A. We follow industry best practices to ensure that your sensitive information remains confidential and protected from unauthorized access. This commitment to security allows partnerships to focus on compliance without fear of data bsignNowes.

Get more for Form 8804 Schedule A Fill In Capable Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

Find out other Form 8804 Schedule A Fill In Capable Penalty For Underpayment Of Estimated Section 1446 Tax By Partnerships

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation