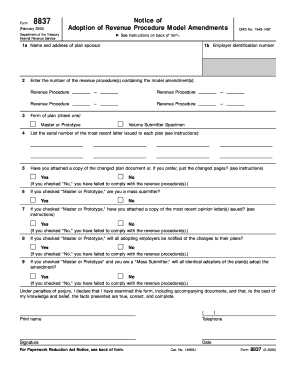

Form 8837

What is the Form 8837

The Form 8837, officially known as the IRS Form 8837, is a tax form used by taxpayers to claim certain tax benefits related to the treatment of certain income. It is primarily utilized for reporting and claiming tax credits or deductions that are applicable to specific circumstances outlined by the IRS. Understanding the purpose of this form is essential for individuals and businesses looking to maximize their tax benefits while ensuring compliance with federal regulations.

How to use the Form 8837

To effectively use the Form 8837, taxpayers must first determine their eligibility for the specific tax benefits it offers. This involves reviewing the IRS guidelines related to the form. Once eligibility is confirmed, individuals should gather all necessary documentation that supports their claim. The form requires detailed information about income, deductions, and credits, which must be accurately reported. After completing the form, it should be submitted according to IRS instructions, either electronically or via mail.

Steps to complete the Form 8837

Completing the Form 8837 involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Review IRS guidelines to ensure eligibility for the benefits being claimed.

- Fill out the form accurately, providing all required information.

- Double-check for any errors or omissions before submission.

- Submit the completed form to the IRS by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8837 are crucial for compliance. Generally, the form must be submitted by the tax filing deadline for the year in which the benefits are being claimed. This date typically falls on April fifteenth for most taxpayers. However, extensions may apply in certain situations, so it's important to check the IRS guidelines for any updates or changes to these deadlines.

Required Documents

When preparing to complete the Form 8837, specific documents are required to support the claims made. These may include:

- Income statements such as W-2s or 1099s.

- Documentation of any deductions or credits being claimed.

- Previous tax returns for reference.

- Any additional forms or schedules that may be relevant to the claim.

IRS Guidelines

The IRS provides detailed guidelines for the use of Form 8837, outlining eligibility criteria, required information, and submission procedures. It is essential for taxpayers to familiarize themselves with these guidelines to ensure accurate completion of the form. The IRS website offers resources and FAQs that can assist in understanding the requirements and avoiding common pitfalls during the filing process.

Quick guide on how to complete form 8837

Effortlessly Prepare Form 8837 on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features required to swiftly create, modify, and eSign your files without delays. Handle Form 8837 on any device with the airSlate SignNow apps available for Android or iOS, and enhance any document-related process today.

How to Edit and eSign Form 8837 with Ease

- Locate Form 8837 and select Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive details using the tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or missing files, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8837 to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8837

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8837 and why is it important?

Form 8837 is a crucial document used for claiming tax credits under the Foreign Tax Credit program. It allows businesses and individuals to ensure they receive the appropriate tax credits while filing their taxes. Understanding form 8837 is essential for maximizing potential tax savings.

-

How can airSlate SignNow help with signing form 8837?

AirSlate SignNow provides an efficient platform for electronically signing form 8837. With its user-friendly interface, users can easily upload, sign, and send their completed forms securely. This streamlines the process, saving time and reducing the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for form 8837?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. These plans are designed to be cost-effective, ensuring users can affordably access the features necessary for managing documents like form 8837. Explore our pricing section to find the best option for you.

-

What features does airSlate SignNow offer for managing form 8837?

AirSlate SignNow offers a range of features for managing form 8837, including document templates, customizable workflows, and real-time tracking. These features enhance collaboration and efficiency, ensuring that your forms are completed and filed accurately. Focus on completing your tax duties without the worry of manual errors.

-

Can I integrate airSlate SignNow with other applications for handling form 8837?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and CRM systems. This integration capability allows businesses to streamline their workflow when dealing with form 8837 and other documentation. Enhance your productivity with these powerful connections.

-

What benefits does electronic signing of form 8837 provide?

Electronic signing of form 8837 through airSlate SignNow offers numerous benefits including enhanced security, faster processing times, and reduced paperwork. It simplifies the filing process, allowing for a smooth transition from signing to submission. Businesses can operate more efficiently and maintain compliance effortlessly.

-

How does airSlate SignNow ensure the security of form 8837?

AirSlate SignNow prioritizes the security of your documents, including form 8837, with advanced encryption and compliance with industry standards. This means your sensitive information is protected throughout the signing process. Trust airSlate SignNow to safeguard your data while ensuring you can manage your forms efficiently.

Get more for Form 8837

Find out other Form 8837

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter