1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat Form

What is the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

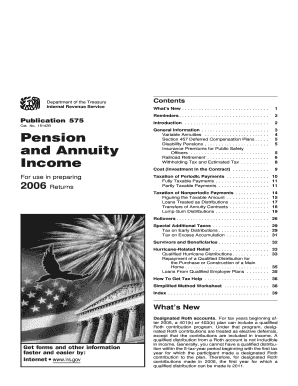

The 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat is an informational document published by the IRS that provides guidance on tax implications related to certain transactions and events. This publication outlines the rules and regulations that taxpayers must follow to ensure compliance with federal tax laws. It serves as a resource for individuals and businesses to understand their responsibilities and the necessary steps to take when reporting specific types of income or deductions.

How to use the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

To effectively use the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat, taxpayers should first read through the entire document to familiarize themselves with its contents. It is important to identify the sections that are relevant to your specific tax situation. The publication provides detailed explanations of various tax rules, examples of how to apply them, and any necessary forms that may need to be completed. Taxpayers should take notes on key points and consult the publication as needed when preparing their tax returns.

Steps to complete the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

Completing the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat involves several key steps:

- Review the publication thoroughly to understand the relevant tax rules.

- Gather all necessary documents and information related to your income and deductions.

- Follow the guidelines outlined in the publication to accurately report your income.

- Complete any required forms as specified in the publication.

- Double-check your entries for accuracy before submission.

Legal use of the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

The legal use of the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat is crucial for compliance with IRS regulations. Taxpayers must adhere to the guidelines provided in the publication to avoid potential penalties or audits. Understanding the legal implications of the information contained within this document helps ensure that taxpayers fulfill their obligations and accurately report their financial activities in accordance with federal tax laws.

Key elements of the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

Key elements of the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat include:

- Definitions of terms and concepts relevant to the publication.

- Detailed instructions for reporting specific types of income.

- Examples illustrating common scenarios and how to handle them.

- Information on required forms and submission processes.

- References to other IRS publications for further guidance.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. Important dates typically include the due date for filing tax returns, deadlines for making estimated tax payments, and any other relevant timelines specified by the IRS. Staying informed about these dates helps prevent late filings and associated penalties.

Quick guide on how to complete 1 2 2 3 4 5 5 5 6 8 9 publication 575 cat

Effortlessly Prepare [SKS] on Any Device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the proper form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] across any platform using the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight signNow sections of your documents or conceal sensitive information with tools offered specifically by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you'd like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

Create this form in 5 minutes!

How to create an eSignature for the 1 2 2 3 4 5 5 5 6 8 9 publication 575 cat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat.?

The 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. provides detailed guidance on tax forms and regulations. Understanding this publication is crucial for ensuring compliance and maximizing your tax benefits. airSlate SignNow can help you electronically sign and manage documents related to this publication effectively.

-

How does airSlate SignNow integrate with the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat.?

airSlate SignNow allows users to streamline their document management in relation to the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. You can quickly send, edit, and sign necessary forms that are informed by the guidelines in this publication. This integration simplifies the process of managing tax documents.

-

Is airSlate SignNow cost-effective for businesses dealing with 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. documents?

Yes, airSlate SignNow offers a cost-effective solution for businesses that need to handle documentation related to the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. Our pricing plans are designed to fit various budgets while delivering essential e-signature functionality. This ensures you can manage your tax documentation without breaking the bank.

-

What features does airSlate SignNow offer that are relevant to the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat.?

AirSlate SignNow includes features such as document templates, secure e-signatures, and real-time tracking which are particularly helpful for managing the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. documents. These tools enhance efficiency and ensure compliance with regulatory requirements. You can easily create, send, and manage your documents all in one place.

-

How can I ensure compliance with the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. using airSlate SignNow?

By utilizing airSlate SignNow, you can stay compliant with the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. through features that allow for secure document handling and e-signatures. Our platform ensures that all your documentation adheres to the necessary regulations, thus providing peace of mind during the tax process.

-

Can I use airSlate SignNow for mobile signing of documents related to the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat.?

Absolutely! AirSlate SignNow is mobile-friendly, allowing you to sign and send documents related to the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. from any device. This flexibility ensures you can work from anywhere, making it a great choice for busy professionals who need to manage their tax documents on the go.

-

What are the main benefits of using airSlate SignNow for the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat.?

The main benefits of using airSlate SignNow for the 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat. include improved efficiency, document security, and reduced paper usage. Our platform simplifies the signing process and minimizes the risk of errors in your tax documentation. This ultimately saves you time and resources.

Get more for 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

Find out other 1 2 2 3 4 5 5 5 6 8 9 Publication 575 Cat

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online