Form 911 Rev March , Fill in Capable Application for Taxpayer Assistance Order ATAO

What is the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO

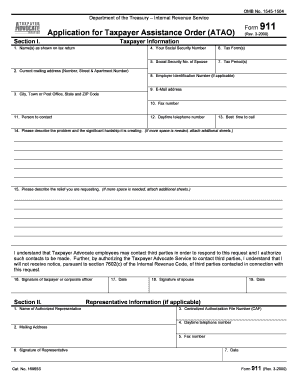

The Form 911 Rev March, officially known as the Fill In Capable Application For Taxpayer Assistance Order (ATAO), is a document used by taxpayers in the United States to request assistance from the Internal Revenue Service (IRS) when they face difficulties in resolving tax issues. This form is particularly useful for individuals who require immediate help due to financial hardship or other pressing circumstances. It allows taxpayers to formally communicate their situation to the IRS and seek appropriate assistance to address their tax-related concerns.

How to use the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO

Using the Form 911 Rev March involves several straightforward steps. First, taxpayers must accurately fill out the form, providing personal information such as name, address, and Social Security number. It is essential to clearly describe the nature of the tax issue and the type of assistance required. After completing the form, it should be submitted to the appropriate IRS office, either through mail or electronically, depending on the guidelines provided. This process ensures that the IRS can review the request and respond in a timely manner.

Steps to complete the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO

Completing the Form 911 Rev March requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information, including your tax identification number and contact details.

- Clearly outline your tax issue, including any relevant dates and amounts.

- Indicate the specific assistance you are requesting from the IRS.

- Review the form for accuracy and completeness before submission.

- Submit the form to the designated IRS office via the preferred method.

Eligibility Criteria

To qualify for assistance through the Form 911 Rev March, applicants must meet certain eligibility criteria. This includes demonstrating a legitimate tax issue that requires IRS intervention. Additionally, applicants should provide evidence of financial hardship or other compelling circumstances that justify the need for assistance. Understanding these criteria is crucial for ensuring that the application is accepted and processed efficiently.

Required Documents

When submitting the Form 911 Rev March, it is important to include any necessary supporting documents. These may include:

- Proof of income or financial hardship, such as pay stubs or bank statements.

- Copies of previous correspondence with the IRS related to the tax issue.

- Any relevant tax documents that support your case, such as tax returns or notices from the IRS.

Providing these documents can help strengthen your application and expedite the assistance process.

Form Submission Methods

The Form 911 Rev March can be submitted to the IRS through various methods. Taxpayers can choose to send the completed form by mail, ensuring it is directed to the correct IRS office based on their location and the nature of their request. Alternatively, some jurisdictions may allow electronic submission of the form. It is advisable to check the IRS guidelines for the most current submission options to ensure compliance.

Quick guide on how to complete form 911 rev march fill in capable application for taxpayer assistance order atao

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 911 Rev March , Fill In Capable Application For Taxpayer Assistance Order ATAO

Create this form in 5 minutes!

How to create an eSignature for the form 911 rev march fill in capable application for taxpayer assistance order atao

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO?

The Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO is a document used by taxpayers to request assistance from the IRS. It is designed to help eligible individuals who may face financial hardships or other issues with their tax obligations. By completing this form, you can initiate a request for taxpayer assistance efficiently.

-

How can airSlate SignNow assist in filling out the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO?

airSlate SignNow provides an easy-to-use platform to fill out and eSign the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO. With its intuitive interface, you can complete the form digitally and securely. This streamlines the process, ensuring your application is ready for submission without any hassles.

-

Is there a cost associated with using airSlate SignNow to complete the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan includes features that help you fill in and eSign documents like the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO. Select the plan that best suits your requirements to enjoy our cost-effective solutions.

-

What features does airSlate SignNow provide for the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO?

airSlate SignNow offers multiple features, including document templates, secure eSigning, and collaboration tools to assist you with the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO. These features make it easy to fill out the form and ensure a seamless experience from start to finish.

-

Can I integrate airSlate SignNow with other applications for managing my Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO?

Absolutely! airSlate SignNow supports integrations with a variety of applications, allowing you to manage the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO alongside other tools you use. This enhances your workflow efficiency and helps keep all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO?

Using airSlate SignNow for the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO provides several benefits, including time savings, enhanced security, and legal compliance. The platform simplifies the form completion process, allowing you to focus on what matters while keeping your sensitive information protected.

-

Is the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO accepted electronically?

Yes, the IRS accepts electronically signed forms like the Form 911 Rev March, Fill In Capable Application For Taxpayer Assistance Order ATAO when submitted through approved channels. Utilizing airSlate SignNow ensures that your eSignature is compliant with federal regulations, making the submission process smoother and more efficient.

Get more for Form 911 Rev March , Fill In Capable Application For Taxpayer Assistance Order ATAO

Find out other Form 911 Rev March , Fill In Capable Application For Taxpayer Assistance Order ATAO

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile