Form 1040A Schedule 3 Fill in Capable Credit for the Elderly or the Disabled for Form 1040A Filers

Understanding the Form 1040A Schedule 3 Credit for the Elderly or the Disabled

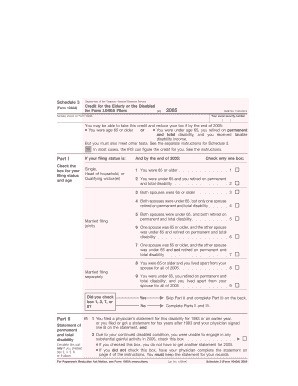

The Form 1040A Schedule 3 is specifically designed for taxpayers who are eligible for the Credit for the Elderly or the Disabled. This credit aims to provide financial relief to individuals aged sixty-five or older, or those who are permanently and totally disabled. It is important for eligible taxpayers to understand the criteria and benefits associated with this credit, as it can significantly reduce their tax liability.

Steps to Complete the Form 1040A Schedule 3

Completing the Form 1040A Schedule 3 involves several key steps. First, gather all necessary personal information, including your age and disability status. Next, ensure you have your adjusted gross income (AGI) ready, as this will determine your eligibility for the credit. Fill out the form by providing accurate details in the designated sections, including any relevant income sources. Finally, review the completed form for accuracy before submitting it with your Form 1040A.

Eligibility Criteria for the Credit

To qualify for the Credit for the Elderly or the Disabled on the Form 1040A Schedule 3, certain eligibility criteria must be met. Taxpayers must be at least sixty-five years old or be permanently and totally disabled. Additionally, there are income limits that apply; your adjusted gross income must fall below a specific threshold to qualify for the credit. It is essential to check the latest IRS guidelines to ensure compliance with these requirements.

Required Documents for Filing

When filing the Form 1040A Schedule 3, certain documents are necessary to support your claim for the Credit for the Elderly or the Disabled. You will need proof of age, such as a birth certificate or driver's license, and documentation confirming your disability status, if applicable. Additionally, gather any tax documents that reflect your income, including W-2 forms and 1099s, to accurately report your financial situation.

IRS Guidelines for the Credit

The IRS provides specific guidelines for taxpayers claiming the Credit for the Elderly or the Disabled using the Form 1040A Schedule 3. These guidelines outline the eligibility criteria, income limits, and the process for claiming the credit. It is vital to review these guidelines thoroughly to ensure that all requirements are met and to avoid any potential issues during the filing process.

Form Submission Methods

Taxpayers can submit the Form 1040A Schedule 3 through various methods. The form can be filed electronically using tax preparation software that supports e-filing, which is a convenient option for many. Alternatively, taxpayers may choose to mail the completed form along with their Form 1040A to the appropriate IRS address. In-person submissions are also possible at designated IRS offices, although this option may require prior appointments.

Quick guide on how to complete form 1040a schedule 3 fill in capable credit for the elderly or the disabled for form 1040a filers

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers

Create this form in 5 minutes!

How to create an eSignature for the form 1040a schedule 3 fill in capable credit for the elderly or the disabled for form 1040a filers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled?

The Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled is a tax credit designed to assist qualifying elderly or disabled individuals when filing their taxes using Form 1040A. This credit can help reduce the overall tax burden, making it essential for eligible filers to understand its benefits and requirements.

-

How can airSlate SignNow help with completing Form 1040A Schedule 3?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers. Our user-friendly interface allows users to input information easily, ensuring accuracy and compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for Form 1040A Schedule 3?

Yes, airSlate SignNow offers a subscription-based pricing model that is cost-effective for businesses and individual users alike. The pricing plans are designed to provide access to essential features, including the ability to fill in and sign the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled.

-

What features does airSlate SignNow offer for tax document preparation?

airSlate SignNow includes features such as eSignature solutions, document templates, and real-time collaboration tools, which are all beneficial when preparing the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers. These features help streamline the document preparation process and ensure that all required information is accurately captured.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow allows for seamless integration with various accounting and financial software, enhancing the overall productivity of users preparing the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers. This integration ensures that you can easily manage your documents and tax filings in one central location.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow when filing taxes, especially for the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled, provides numerous benefits, including time savings, improved accuracy, and enhanced security. By using our platform, you can efficiently manage and sign your tax documents with peace of mind.

-

Is airSlate SignNow user-friendly for seniors or disabled users?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for seniors or disabled users who need assistance with the Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers. Our intuitive design helps users navigate through the process with ease, ensuring they can complete their forms without hassle.

Get more for Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers

Find out other Form 1040A Schedule 3 Fill In Capable Credit For The Elderly Or The Disabled For Form 1040A Filers

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template