Form 1040 ES NR Fillin Version

What is the Form 1040 ES NR Fillin Version

The Form 1040 ES NR Fillin Version is a tax form used by non-resident aliens in the United States to estimate and pay their federal income tax. This form is specifically designed for individuals who do not meet the criteria for resident alien status but have income that is subject to U.S. taxation. The form allows non-resident taxpayers to calculate their estimated tax payments, ensuring compliance with U.S. tax obligations. It is crucial for non-residents to understand their tax responsibilities, as failure to file or pay taxes can lead to penalties.

How to use the Form 1040 ES NR Fillin Version

Using the Form 1040 ES NR Fillin Version involves several key steps. First, gather all necessary financial information, including income sources and applicable deductions. Next, complete the form by filling in the required fields, which include personal information and estimated tax amounts. After filling out the form, review it for accuracy to avoid mistakes that could lead to issues with the IRS. Finally, submit the form according to the instructions provided, either by mailing it to the appropriate address or using electronic filing options if available.

Steps to complete the Form 1040 ES NR Fillin Version

Completing the Form 1040 ES NR Fillin Version requires careful attention to detail. Follow these steps:

- Obtain the form from the IRS website or other authorized sources.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Calculate your estimated income for the year, taking into account any deductions you may qualify for.

- Determine your estimated tax liability based on your income and applicable tax rates.

- Enter your estimated tax payments for the year, which can be made in quarterly installments.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadlines to avoid penalties.

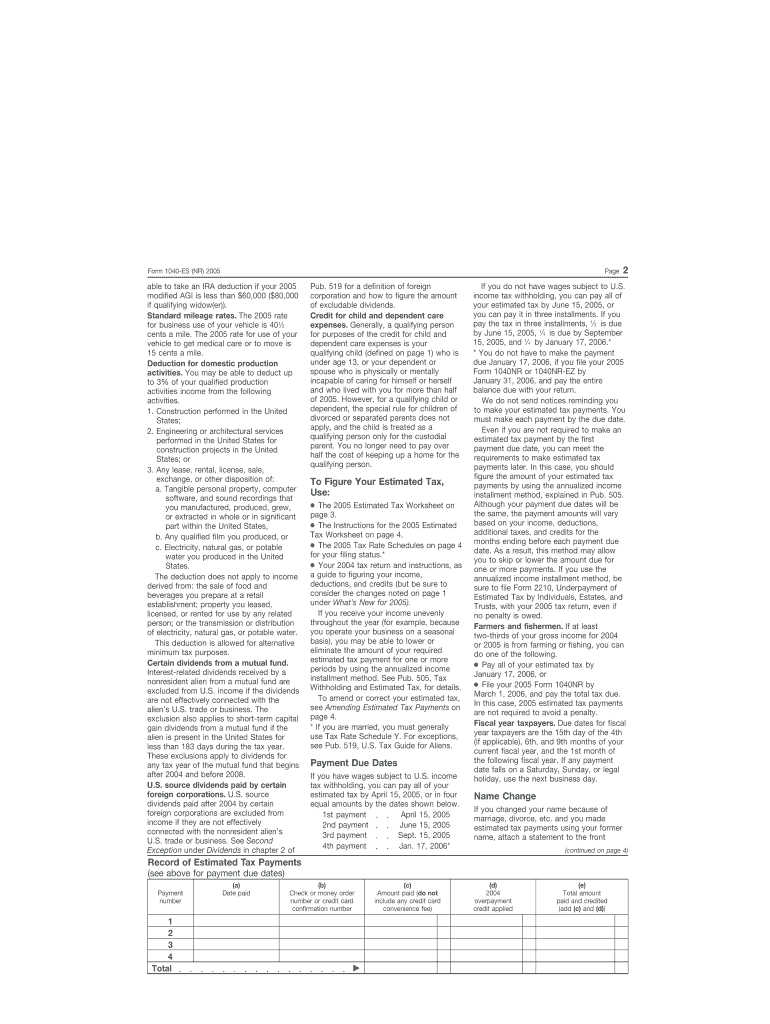

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form 1040 ES NR Fillin Version. Typically, non-resident aliens must make their estimated tax payments in four quarterly installments. The deadlines for these payments usually fall on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes, so timely submission is crucial for compliance.

Legal use of the Form 1040 ES NR Fillin Version

The Form 1040 ES NR Fillin Version is legally required for non-resident aliens who expect to owe tax of one thousand dollars or more when filing their annual return. This form serves as a means to estimate tax liability and make payments throughout the year, aligning with U.S. tax laws. Proper use of the form ensures that non-residents fulfill their tax obligations and avoid potential legal issues with the IRS.

Key elements of the Form 1040 ES NR Fillin Version

Several key elements define the Form 1040 ES NR Fillin Version. These include:

- Personal Information: Taxpayer's name, address, and identification number.

- Estimated Income: A detailed account of expected income for the tax year.

- Tax Calculation: A section for calculating estimated tax liability based on income and deductions.

- Payment Schedule: Information on how to make estimated tax payments, including due dates.

Quick guide on how to complete form 1040 es nr fillin version

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 es nr fillin version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 ES NR Fillin Version?

The Form 1040 ES NR Fillin Version is a tax form designed for non-resident aliens to estimate and pay their U.S. income tax obligations. This version allows users to input their data electronically, ensuring accuracy and ease of use. By using the Form 1040 ES NR Fillin Version, you can efficiently manage your tax responsibilities.

-

How can I get started with the Form 1040 ES NR Fillin Version?

Getting started with the Form 1040 ES NR Fillin Version is simple. Visit the airSlate SignNow website, and you'll find an intuitive platform that guides you through the eSigning process. You'll be able to upload your documents, fill out the form, and eSign seamlessly, all within one user-friendly interface.

-

Is the Form 1040 ES NR Fillin Version available for free?

While airSlate SignNow offers a range of pricing plans, the Form 1040 ES NR Fillin Version is included in our cost-effective solutions. We provide various subscription options to suit different needs, ensuring that you can access the form without breaking the bank. Check out our pricing page for detailed information about packages.

-

What features does the Form 1040 ES NR Fillin Version offer?

The Form 1040 ES NR Fillin Version includes features like customizable fields, automatic calculations, and an easy-to-navigate interface. These functionalities ensure that you can fill out your tax information accurately and quickly. Additionally, our user-friendly tools facilitate a smooth eSigning and document management experience.

-

Can I integrate the Form 1040 ES NR Fillin Version with other software?

Yes, airSlate SignNow allows for easy integration of the Form 1040 ES NR Fillin Version with various third-party applications. This capability simplifies your workflow, enabling you to manage documents efficiently across different platforms. Explore our integration options to maximize productivity and streamline your tax processes.

-

What benefits can I expect from using the Form 1040 ES NR Fillin Version?

Using the Form 1040 ES NR Fillin Version offers several benefits, including time savings and increased accuracy in your tax filings. The electronic format minimizes the risk of errors and ensures that your information is up-to-date. Moreover, eSigning features enhance your document security and compliance with tax regulations.

-

Is customer support available for the Form 1040 ES NR Fillin Version?

Absolutely! Our dedicated customer support team is available to assist you with any questions or issues related to the Form 1040 ES NR Fillin Version. Whether you need help navigating the platform or understanding specific features, we are here to provide prompt and effective support.

Get more for Form 1040 ES NR Fillin Version

Find out other Form 1040 ES NR Fillin Version

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure