Form 2210 F, Fill in Capable

What is the Form 2210 F, Fill In Capable

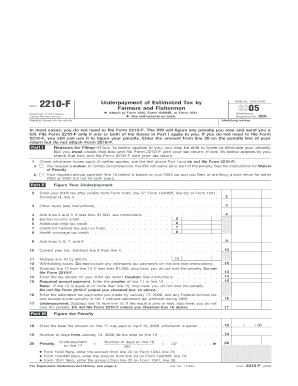

The Form 2210 F is a tax form used by individuals in the United States to calculate any penalties for underpayment of estimated tax. This form is specifically designed for taxpayers who may not meet the safe harbor requirements for avoiding penalties. It is important for individuals to understand their tax obligations and ensure compliance, particularly when their income fluctuates or when they have multiple sources of income. The Fill In Capable feature allows users to complete the form digitally, ensuring accuracy and ease of submission.

How to use the Form 2210 F, Fill In Capable

To effectively use the Form 2210 F, individuals should first gather all necessary financial information, including income sources, estimated tax payments, and any applicable credits. The form guides users through calculating their total tax liability and comparing it with the amounts they have already paid. It is crucial to follow the instructions carefully, as errors can lead to penalties. The Fill In Capable option enables users to fill out the form electronically, reducing the chances of mistakes and allowing for easy edits.

Steps to complete the Form 2210 F, Fill In Capable

Completing the Form 2210 F involves several key steps:

- Begin by entering personal information, including name and Social Security number.

- Calculate total income and determine the total tax liability for the year.

- Document any estimated tax payments made throughout the year.

- Use the form's calculations to determine if any penalties apply for underpayment.

- Review all entries for accuracy before submission.

Utilizing the Fill In Capable feature allows for easy adjustments and ensures that all necessary fields are completed correctly.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Form 2210 F. Generally, individuals must submit their tax returns by April fifteenth of each year. If additional time is needed, taxpayers can file for an extension, but they must still pay any owed taxes by the original deadline to avoid penalties. Keeping track of these dates helps ensure compliance and avoids unnecessary fees.

IRS Guidelines

The IRS provides specific guidelines for using the Form 2210 F. Taxpayers should refer to the IRS instructions for the form to understand eligibility criteria, filing requirements, and any recent changes to tax laws that may affect their filings. Adhering to these guidelines is crucial for accurate reporting and avoiding penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 2210 F can result in significant penalties. If a taxpayer underpays their estimated taxes, they may incur a penalty based on the amount of the underpayment and the duration of the underpayment period. Understanding these penalties can help individuals plan their estimated tax payments more effectively and avoid unexpected costs.

Quick guide on how to complete form 2210 f fill in capable

Complete [SKS] effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documentation, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents promptly without delays. Handle [SKS] on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Alter and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2210 f fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2210 F, Fill In Capable, and how can it benefit me?

Form 2210 F, Fill In Capable, is a tax form designed for individuals to report and potentially calculate any penalties for underpayment of estimated tax. By using airSlate SignNow, you can easily fill in this form, ensuring accuracy and compliance, while streamlining your tax preparation process.

-

How does airSlate SignNow simplify the process of filling out Form 2210 F?

With airSlate SignNow's intuitive interface, filling out Form 2210 F, Fill In Capable is straightforward. Our platform allows users to input information quickly, utilize templates for repeat use, and ensures that all fields are properly validated, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for Form 2210 F?

airSlate SignNow offers various pricing tiers to accommodate different needs, from individual users to businesses. Each plan includes access to fill out Form 2210 F, Fill In Capable, along with other features like document management and e-signing capabilities, providing excellent value for cost.

-

Is airSlate SignNow secure for handling sensitive tax documents like Form 2210 F?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption methods and adhere to stringent security protocols to ensure that all your documents, including Form 2210 F, Fill In Capable, are safely stored and transmitted.

-

Can I integrate airSlate SignNow with other tools I use for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software platforms. This allows you to easily incorporate Form 2210 F, Fill In Capable, into your existing workflow, enhancing your productivity and simplifying tax compliance.

-

What features does airSlate SignNow provide for managing Form 2210 F?

Our platform includes features such as customizable templates, real-time collaboration, and automatic reminders for deadlines. These tools ensure that filling out Form 2210 F, Fill In Capable is more efficient and helps you stay organized throughout the tax season.

-

Is technical support available if I have questions about Form 2210 F?

Yes, airSlate SignNow provides comprehensive customer support to assist with any questions regarding Form 2210 F, Fill In Capable. Our trained support team is available via chat, email, or phone to ensure that you receive prompt assistance whenever needed.

Get more for Form 2210 F, Fill In Capable

Find out other Form 2210 F, Fill In Capable

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online