Form 3468, Fill in Capable Investment Credit

What is Form 3468, Fill In Capable Investment Credit

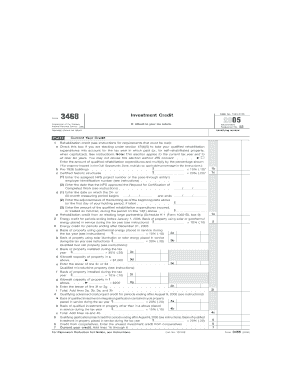

Form 3468 is a tax form used by businesses to claim the Investment Credit, which incentivizes investment in certain types of property. This form is especially relevant for businesses looking to take advantage of tax benefits associated with qualified investments in equipment and property. The Investment Credit can significantly reduce a business's tax liability, making it an essential tool for financial planning and investment strategies.

How to use Form 3468, Fill In Capable Investment Credit

To effectively use Form 3468, businesses must first determine their eligibility for the Investment Credit. This involves reviewing the types of investments that qualify under IRS guidelines. Once eligibility is confirmed, the form can be filled out by providing necessary details about the investments made, including the type of property, the date placed in service, and the amount of the credit being claimed. Accurate completion of the form is crucial to ensure the credit is received without issues.

Steps to complete Form 3468, Fill In Capable Investment Credit

Completing Form 3468 involves several key steps:

- Gather relevant documentation regarding the investments made.

- Fill in the basic information, including the taxpayer's name and identification number.

- Detail the qualified investments, specifying the type and date placed in service.

- Calculate the Investment Credit based on the applicable percentage for the type of property.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the Investment Credit on Form 3468, businesses must meet specific criteria set by the IRS. Eligible investments typically include certain types of machinery, equipment, and other tangible property used in a trade or business. The property must be new or used and placed in service during the tax year for which the credit is being claimed. Additionally, the property must be used predominantly in the United States to qualify for the credit.

Filing Deadlines / Important Dates

Filing deadlines for Form 3468 align with the standard tax return due dates. Generally, businesses must file their tax returns by April fifteenth of the following year. If additional time is needed, an extension can be requested, but the form must still be submitted by the extended deadline. It is essential for businesses to stay informed about any changes to filing dates that may arise due to legislative updates or IRS announcements.

Form Submission Methods (Online / Mail / In-Person)

Form 3468 can be submitted through various methods, depending on the preference of the taxpayer. Businesses can file the form electronically using approved tax software, which often streamlines the process and reduces the chance of errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not an option for this form, as the IRS encourages electronic filing for efficiency.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of Form 3468. These guidelines include detailed instructions on what qualifies as a qualified investment, how to calculate the credit, and the necessary documentation required to support the claim. It is important for businesses to refer to the latest IRS publications and instructions to ensure compliance and maximize their eligible credits.

Quick guide on how to complete form 3468 fill in capable investment credit

Prepare [SKS] effortlessly on any device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources you require to generate, modify, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3468, Fill In Capable Investment Credit

Create this form in 5 minutes!

How to create an eSignature for the form 3468 fill in capable investment credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 3468, Fill In Capable Investment Credit?

Form 3468, Fill In Capable Investment Credit is a tax form that allows businesses to claim investment credits for qualifying property. It enables organizations to reduce their tax liability effectively. Understanding how to utilize this form can unlock signNow financial benefits for your business.

-

How can I complete Form 3468 using airSlate SignNow?

With airSlate SignNow, you can easily complete Form 3468, Fill In Capable Investment Credit online. Our platform offers a user-friendly interface that allows you to fill in the necessary information quickly and accurately. Plus, you can eSign the document, ensuring a hassle-free submission process.

-

Are there any costs associated with using airSlate SignNow for Form 3468?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when completing Form 3468, Fill In Capable Investment Credit. Our plans are designed to be cost-effective while providing valuable features for eSigning and document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow provide for managing Form 3468?

airSlate SignNow offers multiple features for managing Form 3468, Fill In Capable Investment Credit, including customizable templates, in-depth tracking, and electronic signature capabilities. These features help streamline the completion process, improve accuracy, and enhance workflow efficiency. Our goal is to simplify your document management.

-

Can I integrate airSlate SignNow with existing software to handle Form 3468?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions to help you manage Form 3468, Fill In Capable Investment Credit more effectively. This allows for easier data transfer and better organization, enhancing your overall productivity. Check our integration options for a full list of supported applications.

-

What are the benefits of using airSlate SignNow for Form 3468?

Using airSlate SignNow for Form 3468, Fill In Capable Investment Credit provides numerous benefits, such as enhanced security, increased efficiency, and accessibility from any device. Our platform saves you time and reduces paper waste, helping your business go green. You'll also gain compliance with legal standards regarding electronic documents.

-

Is it secure to fill out Form 3468 using airSlate SignNow?

Yes, it is secure to fill out Form 3468, Fill In Capable Investment Credit using airSlate SignNow. We prioritize data security and use encryption technologies to protect your sensitive information. Additionally, our platform complies with industry standards to ensure your documents are safely stored and transmitted.

Get more for Form 3468, Fill In Capable Investment Credit

Find out other Form 3468, Fill In Capable Investment Credit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors