Form 4563 Rev December Fill in Capable Exclusion of Income for Bona Fide Residents of American Samoa

What is the Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa

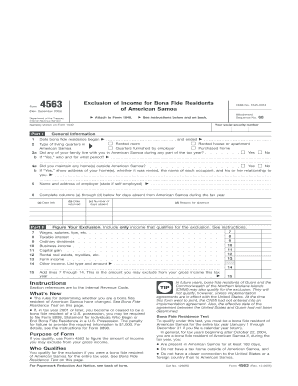

The Form 4563, officially titled "Exclusion of Income for Bona Fide Residents of American Samoa," is a tax form used by individuals who qualify as bona fide residents of American Samoa. This form allows eligible residents to exclude certain types of income from their federal gross income, thereby reducing their overall tax liability. The exclusion is specifically designed for individuals who meet the residency requirements and have earned income while living in American Samoa. Understanding the purpose and eligibility criteria of this form is essential for proper tax filing and compliance.

How to use the Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa

Using Form 4563 involves several steps to ensure accurate completion and submission. First, individuals must confirm their eligibility as bona fide residents of American Samoa. Next, they should gather all necessary financial documents, including income statements and any relevant tax information. The form requires detailed information about the individual's income sources, and it is crucial to fill out each section accurately. Once completed, the form can be submitted either electronically or via mail, depending on the individual's preference and the guidelines provided by the IRS.

Steps to complete the Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa

Completing Form 4563 involves a series of methodical steps:

- Confirm eligibility as a bona fide resident of American Samoa.

- Collect all relevant income documentation, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Detail your income sources and amounts, ensuring accuracy in reporting.

- Calculate the exclusion amount based on the guidelines provided in the form instructions.

- Review the completed form for any errors or omissions.

- Submit the form according to the preferred method: electronically or by mail.

Eligibility Criteria

To qualify for the exclusion of income under Form 4563, individuals must meet specific eligibility criteria. These include being a bona fide resident of American Samoa for the entire tax year, having income that is earned in American Samoa, and not being a U.S. citizen or resident alien for the entire year. Additionally, individuals must not have claimed the foreign earned income exclusion on any other tax return. It is important to review these criteria thoroughly to ensure compliance and avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 4563 align with the general tax filing deadlines set by the IRS. Typically, the form must be submitted by April fifteenth of the following tax year. However, if an extension is filed, the deadline may be extended to October fifteenth. It is crucial for individuals to stay informed about any changes to tax deadlines, especially those specific to American Samoa residents, to ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Form 4563 can be submitted through various methods to accommodate different preferences. Individuals may file the form electronically using approved tax software that supports Form 4563. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submission is generally not an option for this form, as the IRS encourages electronic filing for efficiency. Regardless of the method chosen, it is essential to retain copies of the submitted form and any supporting documents for personal records.

Quick guide on how to complete form 4563 rev december fill in capable exclusion of income for bona fide residents of american samoa

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without holdups. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choosing. Modify and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa

Create this form in 5 minutes!

How to create an eSignature for the form 4563 rev december fill in capable exclusion of income for bona fide residents of american samoa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa?

Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa is a tax form used by residents of American Samoa to claim the exclusion of certain income under U.S. tax laws. This form helps individuals qualified as 'bona fide residents' to potentially reduce their taxable income. Understanding this form is key to ensuring correct filing and maximizing applicable tax benefits.

-

How can airSlate SignNow help with filling out Form 4563 Rev December?

airSlate SignNow provides a user-friendly platform that allows you to fill out Form 4563 Rev December seamlessly. With customizable templates and easy drag-and-drop functionality, you can efficiently complete the form while ensuring compliance with all necessary guidelines. Additionally, you can electronically sign and save your documents securely.

-

Is there a cost associated with using airSlate SignNow for Form 4563 Rev December?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Depending on the features required for processes like signing and managing Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa, users can choose a plan that fits their budget. Starting with a free trial can help you gauge the service's value before committing.

-

Are there specific features in airSlate SignNow for handling tax forms like Form 4563 Rev December?

Absolutely! airSlate SignNow offers features that enhance efficiency in handling tax forms such as Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa. You can use workflow automation, real-time collaboration, and secure cloud storage to streamline the process from form completion to electronic signing.

-

Can I integrate airSlate SignNow with other software to manage Form 4563 Rev December?

Yes, airSlate SignNow supports integration with various third-party applications, streamlining the management of forms like Form 4563 Rev December. Integrate with popular software such as CRMs and cloud storage services to enhance your productivity and make document handling more efficient. This flexibility allows you to centralize your workflows effortlessly.

-

What benefits do I gain from using airSlate SignNow for Form 4563 Rev December?

Using airSlate SignNow for Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa provides several benefits, including enhanced accuracy, improved collaboration, and time-saving features. The platform allows for easy document sharing and tracking while ensuring secure electronic signatures are processed without hassle. This ultimately leads to a more streamlined filing process.

-

How can airSlate SignNow ensure the security of my Form 4563 Rev December?

airSlate SignNow implements strong security measures to protect your data, including advanced encryption protocols and secure access controls. When you use the platform for Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa, you can trust that your sensitive information is safe from unauthorized access. Regular audits and compliance with industry standards further enhance our security model.

Get more for Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa

Find out other Form 4563 Rev December Fill In Capable Exclusion Of Income For Bona Fide Residents Of American Samoa

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template