Form 4835 Fill in Capable Farm Rental Income and Expenses

What is the Form 4835 Fill In Capable Farm Rental Income And Expenses

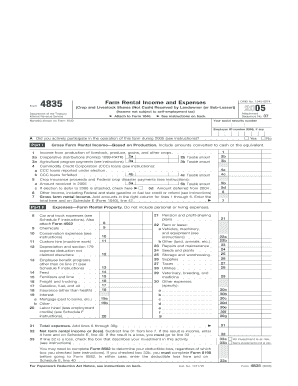

The Form 4835 is a tax form used by individuals who receive rental income from farming activities. This form allows taxpayers to report income and expenses related to the rental of farmland. It is specifically designed for those who are not actively engaged in farming but earn income from leasing their land to farmers. The information reported on this form is essential for calculating taxable income and ensuring compliance with IRS regulations.

How to use the Form 4835 Fill In Capable Farm Rental Income And Expenses

Using Form 4835 involves several steps to accurately report farm rental income and expenses. Taxpayers should first gather all relevant financial documents, including records of rental agreements, income received, and any expenses incurred related to the rental property. Once the necessary information is collected, the form can be filled out by entering the total rental income on the appropriate line and detailing any expenses, such as maintenance or property taxes. It is important to ensure that all entries are accurate to avoid issues with the IRS.

Steps to complete the Form 4835 Fill In Capable Farm Rental Income And Expenses

Completing Form 4835 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial records related to farm rental income and expenses.

- Begin filling out the form by entering your name, address, and Social Security number.

- Report the total rental income received from leasing farmland.

- List all allowable expenses associated with the rental activity, such as repairs, depreciation, and property taxes.

- Calculate the net income or loss by subtracting total expenses from total income.

- Review the form for accuracy and completeness before submission.

Key elements of the Form 4835 Fill In Capable Farm Rental Income And Expenses

Form 4835 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Identification Information: Taxpayer's name, address, and Social Security number.

- Income Section: Total rental income received from leasing farmland.

- Expense Section: Detailed listing of all expenses related to the rental activity.

- Net Income Calculation: The difference between total income and total expenses.

IRS Guidelines

The IRS provides specific guidelines on how to fill out Form 4835. Taxpayers must adhere to these guidelines to ensure compliance. This includes understanding which expenses are deductible, how to report income accurately, and the importance of maintaining supporting documentation. Familiarizing oneself with IRS publications related to farm rental income can also provide valuable insights into proper reporting practices.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form 4835. Typically, the form must be submitted by the tax return due date, which is usually April fifteenth for individual taxpayers. If additional time is needed, taxpayers may file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 4835 fill in capable farm rental income and expenses

Complete [SKS] effortlessly on any device

Virtual document administration has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

How to edit and electronically sign [SKS] without any hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4835 Fill In Capable Farm Rental Income And Expenses

Create this form in 5 minutes!

How to create an eSignature for the form 4835 fill in capable farm rental income and expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4835 used for in relation to farm rental income?

The Form 4835 Fill In Capable Farm Rental Income And Expenses is utilized by landowners to report farm rental income and expenses for tax purposes. This form helps in determining the taxable income generated from renting out farmland, ensuring accurate reporting to the IRS.

-

How does airSlate SignNow facilitate filling out Form 4835?

With airSlate SignNow, users can easily fill in the Form 4835 Fill In Capable Farm Rental Income And Expenses online. The tool offers a user-friendly interface and various templates, making it simple to input necessary information and eSign the document efficiently.

-

What features are included in airSlate SignNow for Form 4835?

airSlate SignNow includes features such as customizable templates for Form 4835 Fill In Capable Farm Rental Income And Expenses, eSignature capabilities, and secure cloud storage. These features streamline the process of managing farm rental income documentation and enhance productivity.

-

Is airSlate SignNow a cost-effective solution for managing Form 4835?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 4835 Fill In Capable Farm Rental Income And Expenses and other documents. With affordable pricing plans, businesses can efficiently handle their documentation needs without overspending.

-

What are the benefits of using airSlate SignNow for farm rental documentation?

Using airSlate SignNow for your Form 4835 Fill In Capable Farm Rental Income And Expenses brings several benefits, including enhanced efficiency, reduced paperwork, and the ability to track document status in real-time. Overall, it simplifies the management of farm rental income processes.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow offers seamless integrations with various accounting software, enabling users to manage their Form 4835 Fill In Capable Farm Rental Income And Expenses alongside their existing financial systems. This integration ensures continuity and accuracy in financial reporting.

-

How secure is airSlate SignNow for storing Form 4835 documents?

airSlate SignNow prioritizes security, providing robust encryption and secure cloud storage for all documents, including the Form 4835 Fill In Capable Farm Rental Income And Expenses. Users can feel confident that their sensitive information is protected while using the platform.

Get more for Form 4835 Fill In Capable Farm Rental Income And Expenses

Find out other Form 4835 Fill In Capable Farm Rental Income And Expenses

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation