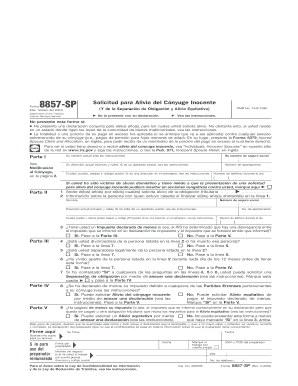

Form 8857 SP Rev February Fill in Capable Solicitud Para Alivio Del C Nyuge Inocente

What is the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente

The Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente is a tax form used by individuals in the United States to request relief from joint tax liability. This form is specifically designed for taxpayers who believe they should not be held responsible for tax debts incurred during a marriage. The form allows individuals to seek innocent spouse relief, which can provide significant financial relief in certain circumstances.

How to use the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente

To effectively use the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente, individuals must fill it out accurately, providing all required information about their financial situation and the tax liability in question. This includes details about income, assets, and any relevant tax returns. Once completed, the form must be submitted to the IRS for consideration of the relief request.

Steps to complete the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente

Completing the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente involves several key steps:

- Gather necessary documentation, including tax returns and financial statements.

- Fill in personal information, including your name, Social Security number, and address.

- Provide details about your spouse, including their name and Social Security number.

- Explain the circumstances that led to the tax liability and why you believe you qualify for relief.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for relief under the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente, certain eligibility criteria must be met. The requesting spouse must demonstrate that they did not know, and had no reason to know, about the tax liability when signing the joint return. Additionally, the request must be made within two years of the IRS taking collection action against the requesting spouse.

Required Documents

When submitting the Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente, several documents may be required to support the request. These can include:

- Copies of joint tax returns for the years in question.

- Financial statements that detail income and expenses.

- Any correspondence from the IRS regarding the tax liability.

- Proof of separation or divorce, if applicable.

Form Submission Methods

The Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente can be submitted to the IRS through various methods. Taxpayers may choose to file the form by mail, ensuring it is sent to the appropriate IRS address based on their location. Alternatively, individuals may opt to submit the form electronically if they are using compatible tax software that supports this submission method.

Quick guide on how to complete form 8857 sp rev february fill in capable solicitud para alivio del c nyuge inocente

Effortlessly prepare [SKS] on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or cover sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente

Create this form in 5 minutes!

How to create an eSignature for the form 8857 sp rev february fill in capable solicitud para alivio del c nyuge inocente

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente?

Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente is a request for innocent spouse relief from the IRS. This form allows individuals to seek relief from joint tax liabilities under specific circumstances. It's essential for those who believe they should not be held responsible for tax debts incurred by their spouse.

-

How does airSlate SignNow help with filling out Form 8857 SP Rev February?

airSlate SignNow provides an easy-to-use platform to fill out Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente. Our intuitive interface simplifies the form-filling process, saving you time and reducing errors. You can also save your progress and return later, ensuring a complete and accurate submission.

-

Is there a cost associated with using airSlate SignNow for Form 8857 SP Rev February?

Yes, there is a subscription fee for using airSlate SignNow. Our pricing plans are competitive and designed to be cost-effective for individuals and businesses alike. You'll gain access to our full suite of features, including document signing, storage, and easy access to Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente.

-

What features should I expect while using airSlate SignNow for my documents?

airSlate SignNow offers various features to facilitate document management, including eSigning, unlimited document storage, and advanced security measures. You can easily customize and fill out Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente and ensure compliance with IRS requirements. Collaboration tools enable multiple users to work on documents seamlessly.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports various integrations with popular applications, enhancing your workflow efficiency. By integrating with tools such as Google Drive and Dropbox, you can easily access your documents, including Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente, from multiple platforms.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow to fill out and sign tax forms, like Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente, offers numerous benefits. Our platform is user-friendly, ensuring that all users can navigate it seamlessly. Plus, you'll enjoy the convenience of remote access, saving physical storage space and enabling quick document retrieval.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform implements robust encryption and security protocols to protect all your sensitive information, including data related to Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente. We also provide audit trails for all document activities to ensure full accountability.

Get more for Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente

Find out other Form 8857 SP Rev February Fill In Capable Solicitud Para Alivio Del C Nyuge Inocente

- Sign Alaska Banking Purchase Order Template Myself

- Help Me With Sign Alaska Banking Lease Agreement Template

- Sign Alabama Banking Quitclaim Deed Computer

- Sign Alabama Banking Quitclaim Deed Now

- How Can I Sign Arkansas Banking Moving Checklist

- Sign California Banking Claim Online

- Sign Arkansas Banking Affidavit Of Heirship Safe

- How To Sign Arkansas Banking Forbearance Agreement

- Sign Arizona Banking Permission Slip Easy

- Can I Sign California Banking Lease Agreement Template

- How Do I Sign Colorado Banking Credit Memo

- Help Me With Sign Colorado Banking Credit Memo

- How Can I Sign Colorado Banking Credit Memo

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe