Form 8879 SP Fill in Capable IRS E File Signature Authorization Spanish Version

What is the Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

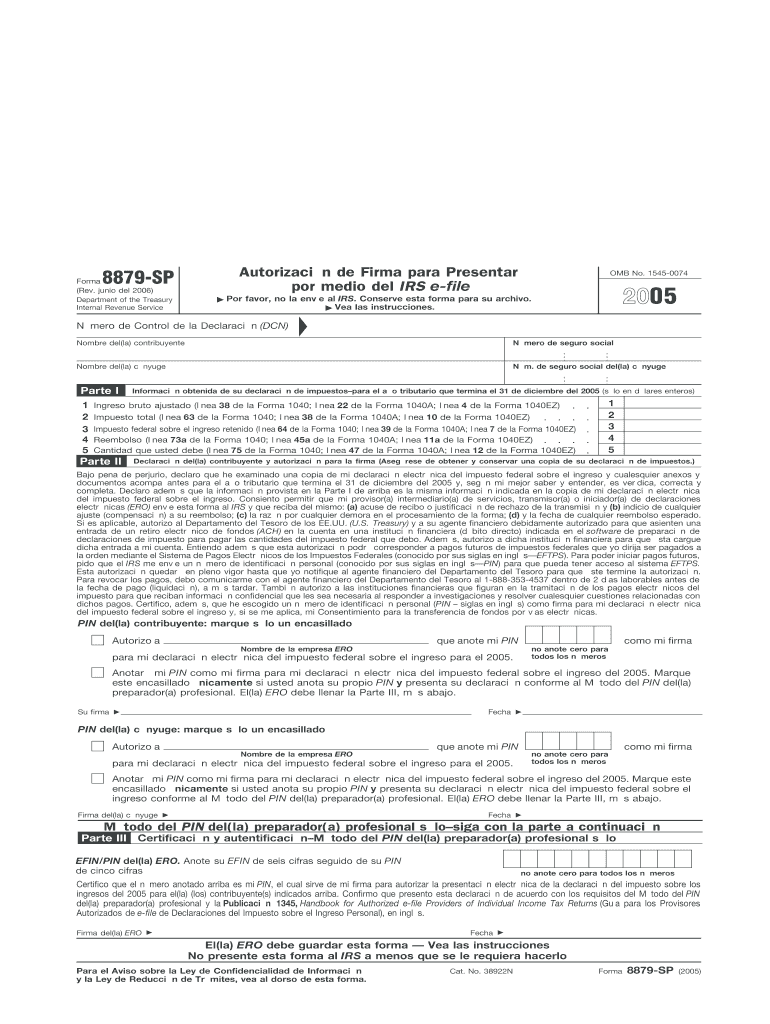

The Form 8879 SP is a critical document used by taxpayers who wish to authorize an electronic filing of their tax return in Spanish. This form serves as the IRS e-file signature authorization, allowing tax professionals to submit returns on behalf of their clients. The Spanish version ensures accessibility for Spanish-speaking taxpayers, facilitating a smoother filing process. By completing this form, taxpayers confirm that the information provided in their tax return is accurate and complete, thus complying with IRS regulations.

How to use the Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

To effectively use the Form 8879 SP, taxpayers should first ensure they have the correct version of the form. The form can be filled out digitally, allowing for easy completion and submission. After filling out the necessary information, the taxpayer must review the details carefully. Once confirmed, the taxpayer can electronically sign the form, which authorizes their tax preparer to file their return electronically. This process streamlines the filing experience, making it more efficient and less prone to errors.

Steps to complete the Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

Completing the Form 8879 SP involves several straightforward steps:

- Obtain the correct version of the form from a reliable source.

- Fill in personal information, including name, address, and Social Security number.

- Provide details of the tax return being filed, including the tax year and expected refund or balance due.

- Review the completed form for accuracy.

- Electronically sign the form to authorize the e-filing.

Following these steps ensures that the form is completed accurately and submitted in a timely manner.

Legal use of the Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

The legal use of the Form 8879 SP is essential for compliance with IRS regulations. This form serves as a declaration that the taxpayer has reviewed their tax return and agrees to the electronic submission. By signing the form, the taxpayer provides their consent for their tax preparer to file on their behalf. It is important to retain a copy of the signed form for personal records, as it may be required for future reference or in case of an audit.

Key elements of the Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

Several key elements are crucial to the Form 8879 SP:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Tax Return Details: Information about the tax year and the type of return being filed.

- Signature Section: Where the taxpayer electronically signs to authorize the e-filing.

- Tax Preparer Information: Details about the tax professional preparing the return.

Understanding these elements helps ensure that the form is filled out correctly and meets all legal requirements.

Quick guide on how to complete form 8879 sp fill in capable irs e file signature authorization spanish version

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues of lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign [SKS] to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

Create this form in 5 minutes!

How to create an eSignature for the form 8879 sp fill in capable irs e file signature authorization spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version?

Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version is a crucial document that allows taxpayers to electronically file their tax returns in Spanish. This form serves as an authorization for the e-filing process, ensuring compliance with IRS regulations. Utilizing this form simplifies tax preparation for Spanish-speaking taxpayers.

-

How does airSlate SignNow simplify the use of Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version?

airSlate SignNow streamlines the process of filling out and eSigning Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version. With an intuitive interface, users can easily edit the form and securely send it for electronic signature. This integrated approach saves time and reduces errors commonly associated with paper forms.

-

What are the pricing options for using airSlate SignNow to file Form 8879 SP?

airSlate SignNow offers flexible pricing plans designed to accommodate various business needs when preparing Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version. The plans include monthly and annual subscriptions, with features tailored to enhance the document signing experience. Visit our pricing page to find the plan that best fits your requirements.

-

What features does airSlate SignNow provide for Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version?

airSlate SignNow provides numerous features to enhance the efficiency of completing Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version. Key features include customizable templates, secure cloud storage, and real-time tracking of document status. Additionally, the platform allows for seamless collaboration between users and their clients.

-

How does eSigning Form 8879 SP with airSlate SignNow benefit users?

eSigning Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version with airSlate SignNow offers several benefits, including time efficiency and enhanced security. Users can complete the signing process from anywhere, resulting in faster tax filing. Moreover, electronic signatures are legally binding and provide an added layer of security over traditional methods.

-

Can I integrate airSlate SignNow with other software for filing Form 8879 SP?

Yes, airSlate SignNow can integrate with a variety of software applications to streamline the filing process for Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version. These integrations enable seamless data transfer and eliminate repetitive data entry. Check our integration options to see how you can enhance your workflow.

-

Is airSlate SignNow compliant with IRS regulations for Form 8879 SP?

Absolutely. airSlate SignNow is fully compliant with IRS regulations for eFiling Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version. Our platform adheres to the necessary legal requirements for electronic signatures, ensuring that your signed documents meet IRS standards.

Get more for Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

Find out other Form 8879 SP Fill In Capable IRS E file Signature Authorization Spanish Version

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed