Form 8889 Fill in Capable Health Savings Accounts HSAs

What is the Form 8889 Fill In Capable Health Savings Accounts HSAs

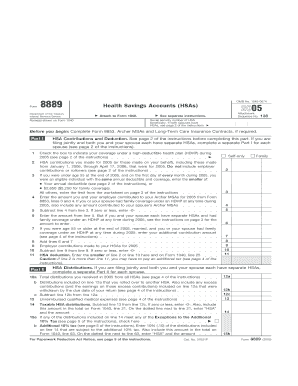

The Form 8889 is a tax document used by individuals to report contributions to and distributions from Health Savings Accounts (HSAs). HSAs are tax-advantaged accounts designed to help individuals save for medical expenses. This form is essential for taxpayers who wish to claim deductions for contributions made to their HSAs or report any distributions taken from these accounts. Understanding the purpose of Form 8889 is crucial for ensuring compliance with IRS regulations and for maximizing tax benefits associated with HSAs.

How to use the Form 8889 Fill In Capable Health Savings Accounts HSAs

Using Form 8889 involves several key steps. First, gather relevant information about your HSA contributions and distributions for the tax year. Next, complete the form by filling out sections that detail your contributions, distributions, and any other pertinent information. It is important to accurately report the amounts contributed and withdrawn to avoid discrepancies with the IRS. After completing the form, attach it to your federal tax return and submit it by the deadline to ensure proper processing.

Steps to complete the Form 8889 Fill In Capable Health Savings Accounts HSAs

Completing Form 8889 requires a systematic approach:

- Begin by entering your personal information, including your name and Social Security number.

- Report the total contributions made to your HSA during the tax year in Part I.

- In Part II, detail any distributions taken from your HSA, including the purpose of those distributions.

- Calculate any tax deductions or penalties applicable based on your contributions and distributions.

- Review the completed form for accuracy, ensuring all figures are correct before submission.

Key elements of the Form 8889 Fill In Capable Health Savings Accounts HSAs

Form 8889 consists of several key elements that taxpayers must understand. These include:

- Part I: This section focuses on contributions to the HSA, including amounts contributed by the taxpayer and any employer contributions.

- Part II: This section addresses distributions, detailing how funds were used and whether they were for qualified medical expenses.

- Tax implications: The form also outlines potential tax deductions and penalties for non-qualified distributions.

IRS Guidelines

The IRS provides specific guidelines for using Form 8889, which include eligibility criteria for HSAs, contribution limits, and rules regarding distributions. Taxpayers should familiarize themselves with these guidelines to ensure compliance and to maximize the tax advantages of their HSAs. The IRS updates these guidelines periodically, so it is important to refer to the latest information when preparing the form.

Filing Deadlines / Important Dates

Form 8889 must be filed along with your federal tax return, which is typically due on April fifteenth of each year. If you are unable to file by this date, you may request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these important dates ensures that you remain compliant with IRS regulations and avoid unnecessary fees.

Quick guide on how to complete form 8889 fill in capable health savings accounts hsas

Complete [SKS] effortlessly on any gadget

Digital document management has surged in popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this task.

- Produce your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your updates.

- Choose your delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8889 Fill In Capable Health Savings Accounts HSAs

Create this form in 5 minutes!

How to create an eSignature for the form 8889 fill in capable health savings accounts hsas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8889, and how does it relate to Health Savings Accounts (HSAs)?

Form 8889 is used to report Health Savings Accounts (HSAs) contributions, distributions, and deductions. It is essential for individuals utilizing Form 8889 Fill In Capable Health Savings Accounts HSAs to ensure compliance with IRS regulations. By accurately completing this form, you can maximize your HSA benefits while minimizing potential tax liabilities.

-

How can airSlate SignNow help me manage Form 8889 for my HSAs?

airSlate SignNow provides an efficient platform to manage Form 8889 Fill In Capable Health Savings Accounts HSAs. Our solutions enable users to easily fill in, sign, and store necessary documents securely. This simplifies your HSA management, ensuring all your tax forms are accurate and accessible.

-

What are the pricing options for using airSlate SignNow to manage Form 8889?

airSlate SignNow offers flexible pricing plans tailored for individuals and businesses managing Form 8889 Fill In Capable Health Savings Accounts HSAs. Our options range from basic packages for casual users to comprehensive plans for larger enterprises. Visit our pricing page to find the perfect plan for your needs.

-

Can I integrate airSlate SignNow with other financial software to manage my HSAs?

Yes, airSlate SignNow easily integrates with various financial software applications to assist with managing Form 8889 Fill In Capable Health Savings Accounts HSAs. This integration allows for seamless data transfer and ensures that your HSA information is up-to-date across platforms. Check our integrations page for specific compatibility.

-

What are the benefits of using airSlate SignNow for submitting Form 8889?

Using airSlate SignNow for submitting Form 8889 Fill In Capable Health Savings Accounts HSAs offers numerous benefits, including enhanced efficiency, improved accuracy, and secure document management. Our platform aids in reducing the risk of errors associated with traditional paper methods. You can also track document status and receive notifications for added convenience.

-

Is there customer support available for questions about Form 8889 and HSAs?

Absolutely! airSlate SignNow provides dedicated customer support for all inquiries related to Form 8889 Fill In Capable Health Savings Accounts HSAs. Our knowledgeable team is available to assist you via live chat, email, or phone. We strive to ensure that you have all the information you need to effectively manage your HSAs.

-

What features does airSlate SignNow offer for managing health savings accounts?

airSlate SignNow offers features specifically tailored for managing Form 8889 Fill In Capable Health Savings Accounts HSAs, including secure eSigning, document templates, and automated workflows. These tools simplify the process of managing your HSA documents and enhance compliance with IRS requirements. Explore our feature set to maximize your HSA benefits.

Get more for Form 8889 Fill In Capable Health Savings Accounts HSAs

Find out other Form 8889 Fill In Capable Health Savings Accounts HSAs

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form