Form 941 Rev October Employer's Quarterly Federal Tax Return

What is the Form 941 Rev October Employer's Quarterly Federal Tax Return

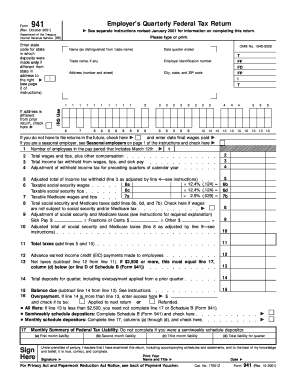

The Form 941 Rev October is a crucial document that employers in the United States use to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. This quarterly tax return provides the Internal Revenue Service (IRS) with essential information about the employer's payroll tax obligations. It is designed for businesses that have employees and must be filed every quarter, detailing the total wages paid, tips, and other compensation, as well as the taxes withheld from those amounts.

How to use the Form 941 Rev October Employer's Quarterly Federal Tax Return

Using Form 941 Rev October involves several steps to ensure accurate reporting. Employers must gather all relevant payroll information for the quarter, including total wages paid, tips, and the amount of taxes withheld. The form requires details about the employer's business, including the Employer Identification Number (EIN) and the number of employees. After completing the form, employers should review it for accuracy before submitting it to the IRS by the designated deadline.

Steps to complete the Form 941 Rev October Employer's Quarterly Federal Tax Return

Completing Form 941 Rev October involves a systematic approach:

- Gather payroll records for the quarter, including employee wages and tax withholdings.

- Fill out the employer information section, including the EIN and business name.

- Report total wages, tips, and other compensation in the appropriate sections.

- Calculate the total taxes owed, including Social Security and Medicare taxes.

- Sign and date the form to certify its accuracy.

- Submit the form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing Form 941 Rev October. The form is due on the last day of the month following the end of each quarter. For example, the deadlines are:

- For the first quarter (January to March), the deadline is April 30.

- For the second quarter (April to June), the deadline is July 31.

- For the third quarter (July to September), the deadline is October 31.

- For the fourth quarter (October to December), the deadline is January 31 of the following year.

Penalties for Non-Compliance

Failure to file Form 941 Rev October on time or accurately can result in significant penalties. The IRS may impose a penalty for late filing, which can be a percentage of the unpaid tax amount. Additionally, inaccuracies in reporting can lead to further penalties and interest charges on any outstanding tax liabilities. Employers are encouraged to ensure timely and accurate submissions to avoid these financial repercussions.

Digital vs. Paper Version

Employers have the option to file Form 941 Rev October either digitally or via paper submission. Filing electronically is often more efficient, allowing for quicker processing and confirmation of receipt. Digital submissions can also reduce the risk of errors, as many e-filing systems include checks and prompts to ensure accuracy. However, some employers may prefer to file a paper version for record-keeping purposes. Regardless of the method chosen, it is essential to adhere to the filing deadlines.

Quick guide on how to complete form 941 rev october employers quarterly federal tax return

Effortlessly prepare [SKS] on any device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes requiring new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 941 Rev October Employer's Quarterly Federal Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev october employers quarterly federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 941 Rev October Employer's Quarterly Federal Tax Return?

The Form 941 Rev October Employer's Quarterly Federal Tax Return is a document that employers use to report income taxes, social security tax, and Medicare tax withheld from employee's paychecks. It is crucial for compliance with federal tax obligations and needs to be submitted quarterly. Proper filing helps avoid penalties and ensures accurate tax records.

-

How can airSlate SignNow help me with the Form 941 Rev October Employer's Quarterly Federal Tax Return?

airSlate SignNow simplifies the process of completing the Form 941 Rev October Employer's Quarterly Federal Tax Return by offering an intuitive interface for document creation and electronic signatures. Our platform enables quick collaboration, making it easy to gather signatures from multiple parties efficiently. This streamlines your compliance process and saves you time.

-

Is airSlate SignNow cost-effective for my business's Form 941 Rev October Employer's Quarterly Federal Tax Return needs?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are competitive, providing excellent value for features like eSigning and document management. This helps your business reduce costs associated with paper and ink while ensuring timely submission of the Form 941 Rev October Employer's Quarterly Federal Tax Return.

-

What features does airSlate SignNow offer for handling the Form 941 Rev October Employer's Quarterly Federal Tax Return?

airSlate SignNow offers various features such as customizable templates, automated workflows, and secure eSigning specifically tailored for the Form 941 Rev October Employer's Quarterly Federal Tax Return. These features facilitate easy document preparation and compliance tracking. Additionally, our platform supports real-time updates and notifications to keep your team in the loop.

-

Can I integrate airSlate SignNow with other software tools for my Form 941 Rev October Employer's Quarterly Federal Tax Return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and HR software to enhance the efficiency of preparing the Form 941 Rev October Employer's Quarterly Federal Tax Return. This integration allows for automatic data synchronization, reducing manual entry errors and ensuring your tax documents are always accurate and up-to-date.

-

How secure is airSlate SignNow for submitting my Form 941 Rev October Employer's Quarterly Federal Tax Return?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and authentication protocols to protect sensitive data, including information contained in the Form 941 Rev October Employer's Quarterly Federal Tax Return. You can confidently eSign and transmit documents, knowing that your information is secure.

-

What support does airSlate SignNow provide for filing the Form 941 Rev October Employer's Quarterly Federal Tax Return?

We offer comprehensive customer support to assist users in smoothly navigating the submission of the Form 941 Rev October Employer's Quarterly Federal Tax Return. Our knowledgeable support team is available via live chat, email, or phone to address any queries you may have. This ensures you have the resources needed for successful compliance.

Get more for Form 941 Rev October Employer's Quarterly Federal Tax Return

Find out other Form 941 Rev October Employer's Quarterly Federal Tax Return

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy