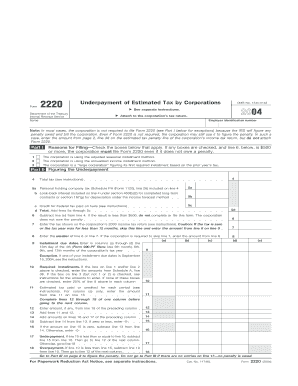

Form 2220 Underpayment of Estimated Tax by Corporations See Separate Instructions

What is the Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions

The Form 2220 is a tax form used by corporations to report underpayment of estimated taxes. This form is essential for corporations that do not meet their estimated tax payment obligations throughout the year. By filing this form, corporations can calculate any penalties associated with underpayment and ensure compliance with IRS regulations. Understanding the purpose of Form 2220 helps corporations manage their tax liabilities effectively and avoid unexpected financial penalties.

How to use the Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions

Using Form 2220 involves several steps to ensure accurate reporting of underpayment. Corporations must first determine if they owe a penalty for underpayment of estimated taxes. This is typically assessed if the total tax due is not met through timely estimated payments. Once the corporation identifies a potential penalty, they can complete Form 2220 to calculate the exact amount owed. It is crucial to review the IRS instructions carefully to ensure all calculations are correct and that the form is submitted on time.

Steps to complete the Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions

Completing Form 2220 requires attention to detail and adherence to IRS guidelines. Here are the key steps:

- Gather necessary financial information, including total tax liability and estimated tax payments made throughout the year.

- Determine the required payment amounts for each quarter based on the corporation's tax liability.

- Calculate any underpayment for each quarter and the corresponding penalties using the provided worksheets in the form.

- Complete the form by filling in the calculated amounts and any additional required information.

- Review the form for accuracy before submission to avoid delays or penalties.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing Form 2220. The form is typically due on the same date as the corporation's income tax return, which is usually the fifteenth day of the fourth month following the end of the tax year. For corporations operating on a calendar year, this means the due date is April 15. If the corporation files for an extension, the deadline for Form 2220 will also extend accordingly. It is important to note these dates to avoid late penalties.

Penalties for Non-Compliance

Failure to file Form 2220 or to pay the calculated penalties can result in significant consequences for corporations. The IRS may impose additional penalties for late filing or underpayment, which can accumulate over time. Corporations may also face interest charges on any unpaid amounts. Understanding these penalties emphasizes the importance of timely and accurate filing of Form 2220 to maintain compliance and avoid financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 2220. These guidelines include instructions on eligibility for penalty relief, calculations for underpayment, and the necessary documentation to accompany the form. Corporations should refer to the IRS instructions for Form 2220 to ensure compliance with all requirements. Adhering to these guidelines helps corporations navigate the complexities of tax obligations effectively.

Quick guide on how to complete form 2220 underpayment of estimated tax by corporations see separate instructions

Complete [SKS] effortlessly on any device

Online document management has grown increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and eSign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to adjust and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the instruments we offer to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors necessitating the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions

Create this form in 5 minutes!

How to create an eSignature for the form 2220 underpayment of estimated tax by corporations see separate instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions?

Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions is a tax form used by corporations to calculate any underpayment of estimated tax. This form helps businesses ensure compliance with tax obligations and avoid penalties. It's essential for corporations to understand this form to manage their tax liabilities effectively.

-

How does airSlate SignNow assist with the completion of Form 2220?

airSlate SignNow simplifies the process of completing Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions by providing user-friendly tools for document management. With eSigning capabilities, businesses can easily fill out, sign, and share their forms securely. This efficiency helps streamline compliance with tax regulations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. By choosing a plan, users can access essential features for managing forms like Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions. This affordability helps businesses maintain compliance without breaking the bank.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow integrates seamlessly with popular software like Google Drive, Dropbox, and more. This integration allows users to access and manage their documents, including Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions, from one central platform. The ability to connect with tools you already use enhances productivity and efficiency.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions, offers several benefits such as streamlined workflows, easy collaboration, and secure document storage. The platform's intuitive design makes it easy for users to manage their tax obligations without hassle, ensuring compliance and reducing errors.

-

Is airSlate SignNow secure for signing tax documents?

Absolutely! airSlate SignNow employs top-tier security measures to protect your documents, including Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions. With features such as encryption, secure access, and audit trails, users can trust that their sensitive tax information is kept safe and confidential.

-

How can airSlate SignNow help with compliance for corporations?

airSlate SignNow aids corporations in maintaining compliance by providing tools to efficiently manage required documents like Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions. The platform ensures that all necessary paperwork is filled out correctly and submitted on time, reducing the risk of penalties and ensuring peace of mind for businesses.

Get more for Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions

Find out other Form 2220 Underpayment Of Estimated Tax By Corporations See Separate Instructions

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament