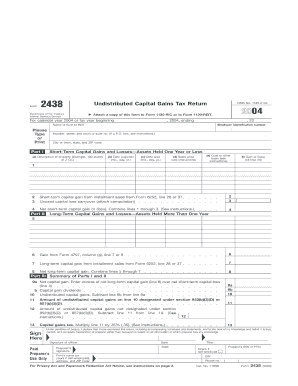

Form 2438 Undistributed Capital Gains Tax Return

What is the Form 2438 Undistributed Capital Gains Tax Return

The Form 2438 Undistributed Capital Gains Tax Return is a tax form used by regulated investment companies (RICs) to report undistributed capital gains to the Internal Revenue Service (IRS). This form is essential for RICs that need to distribute capital gains to their shareholders while complying with tax regulations. By filing this form, RICs can avoid double taxation on these gains, as it allows them to pass the tax liability onto their shareholders instead.

How to obtain the Form 2438 Undistributed Capital Gains Tax Return

To obtain the Form 2438, individuals or organizations can visit the IRS website, where the form is available for download in PDF format. Alternatively, taxpayers may request a physical copy from the IRS by contacting them directly. It is important to ensure that the most recent version of the form is used to comply with current tax laws.

Steps to complete the Form 2438 Undistributed Capital Gains Tax Return

Completing the Form 2438 involves several key steps:

- Gather necessary financial information, including details of capital gains and distributions.

- Fill out the identifying information, such as the name and address of the investment company.

- Report the total capital gains and any amounts that are being distributed to shareholders.

- Calculate the tax liability based on the undistributed gains.

- Review the form for accuracy before submission.

Key elements of the Form 2438 Undistributed Capital Gains Tax Return

Several key elements must be included when filling out the Form 2438. These include:

- Investment Company Information: Name, address, and taxpayer identification number.

- Capital Gains: Total amount of capital gains realized during the tax year.

- Distributions: Amounts distributed to shareholders and any undistributed amounts.

- Tax Calculation: Detailed calculation of the tax owed on undistributed gains.

Filing Deadlines / Important Dates

It is crucial for RICs to adhere to specific filing deadlines for the Form 2438. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the form is due by April 15 of the following year. Missing this deadline can result in penalties and interest on any unpaid taxes.

Penalties for Non-Compliance

Failure to file the Form 2438 or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, if the form is not filed correctly, the investment company may face issues with tax compliance, leading to further financial repercussions. It is advisable for RICs to ensure accuracy and timeliness in their filings to avoid these penalties.

Quick guide on how to complete form 2438 undistributed capital gains tax return

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features you require to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize key parts of the documents or obscure sensitive information with the features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2438 Undistributed Capital Gains Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 2438 undistributed capital gains tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2438 Undistributed Capital Gains Tax Return?

The Form 2438 Undistributed Capital Gains Tax Return is a tax document used by certain entities to report capital gains that have not been distributed to shareholders. This form helps to ensure compliance with IRS regulations and obligations related to undistributed gains. Understanding this form is crucial for businesses managing investment portfolios.

-

How does airSlate SignNow help with the Form 2438 Undistributed Capital Gains Tax Return?

airSlate SignNow provides a user-friendly platform that allows businesses to easily create, send, and eSign the Form 2438 Undistributed Capital Gains Tax Return. Its streamlined interface ensures that essential information is captured accurately, minimizing errors during submission. This makes the tax filing process more efficient for businesses.

-

Is airSlate SignNow cost-effective for handling the Form 2438 Undistributed Capital Gains Tax Return?

Yes, airSlate SignNow offers competitive pricing plans that accommodate various business sizes and needs. By utilizing this platform for the Form 2438 Undistributed Capital Gains Tax Return, businesses can reduce costs associated with paper filing and ensure timely submissions. The value and convenience it provides can ultimately save time and resources.

-

What features of airSlate SignNow are beneficial for managing the Form 2438 Undistributed Capital Gains Tax Return?

airSlate SignNow offers features such as secure eSigning, document storage, and customizable templates specifically designed for the Form 2438 Undistributed Capital Gains Tax Return. This ensures that users can manage their forms efficiently, track revisions, and maintain compliance with regulatory standards. Enhanced security protocols also protect sensitive tax information.

-

Can I integrate airSlate SignNow with my existing accounting software for the Form 2438 Undistributed Capital Gains Tax Return?

Absolutely! airSlate SignNow supports integrations with various accounting software solutions that facilitate the smooth handling of the Form 2438 Undistributed Capital Gains Tax Return. This allows users to link their financial data directly, reducing the risk of errors and improving overall efficiency in managing their tax documents.

-

What are the benefits of using airSlate SignNow to eSign the Form 2438 Undistributed Capital Gains Tax Return?

Using airSlate SignNow to eSign the Form 2438 Undistributed Capital Gains Tax Return offers several benefits, including faster turnaround times, reduced paperwork, and enhanced document tracking capabilities. Users can easily sign documents from any device, ensuring timely submissions, which is critical for compliance with tax deadlines. The entire process is simplified and more accessible.

-

How secure is the process of signing the Form 2438 Undistributed Capital Gains Tax Return with airSlate SignNow?

The security of sensitive documents, including the Form 2438 Undistributed Capital Gains Tax Return, is a top priority for airSlate SignNow. The platform employs advanced encryption and secure authentication methods to protect users' data throughout the signing process. This ensures that your financial information remains confidential and compliant with industry standards.

Get more for Form 2438 Undistributed Capital Gains Tax Return

Find out other Form 2438 Undistributed Capital Gains Tax Return

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free