Form 4913 Rev August

What is the Form 4913 Rev August

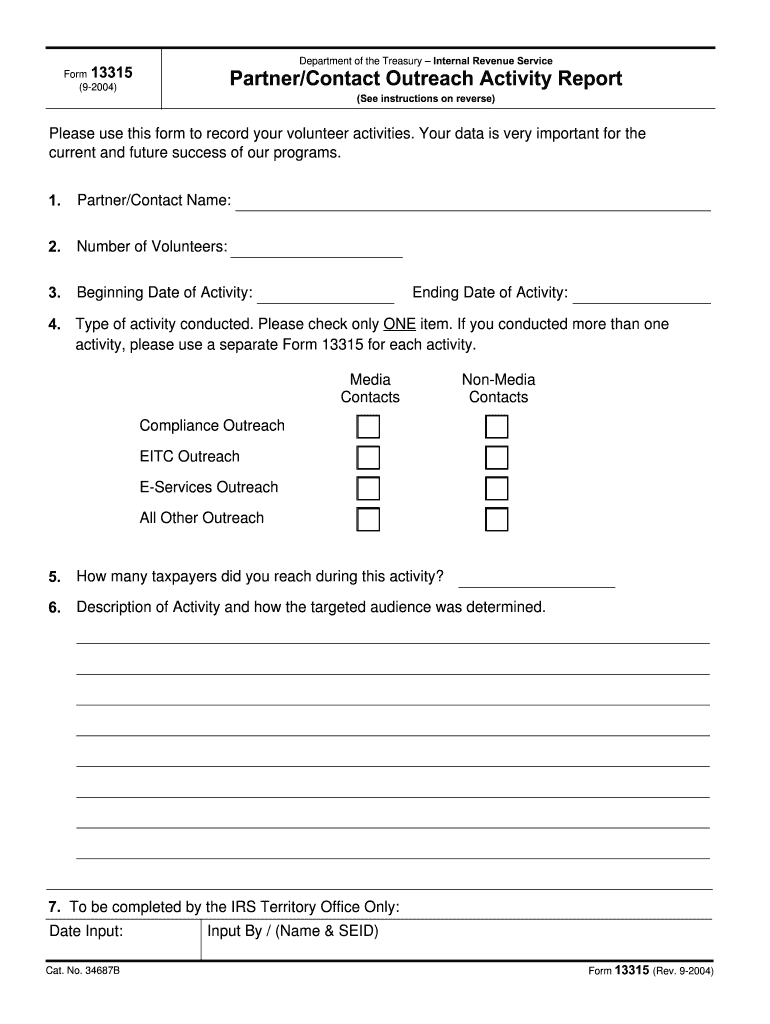

The Form 4913 Rev August is a specific document used primarily for reporting and compliance purposes within various sectors. This form is often utilized by businesses and individuals to ensure they meet regulatory requirements. It serves as an official declaration that may be required by government agencies or organizations for various administrative processes.

How to use the Form 4913 Rev August

Using the Form 4913 Rev August involves several steps to ensure accuracy and compliance. First, gather all necessary information and documents that pertain to the form’s requirements. Next, carefully fill out each section of the form, ensuring that all data is accurate and complete. After completing the form, review it for any errors or omissions before submission. Proper usage of this form is essential to avoid delays or penalties.

Steps to complete the Form 4913 Rev August

Completing the Form 4913 Rev August requires a systematic approach. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary supporting documents, such as identification or financial records.

- Fill in the required fields, ensuring all information is accurate and up-to-date.

- Double-check your entries for any mistakes or missing information.

- Submit the completed form according to the specified submission methods.

Key elements of the Form 4913 Rev August

The Form 4913 Rev August includes several key elements that must be accurately completed. These elements typically consist of:

- Identification information, including name and address.

- Specific data relevant to the purpose of the form.

- Signature and date fields to validate the submission.

- Any additional documentation required to support the information provided.

Who Issues the Form

The Form 4913 Rev August is typically issued by a designated government agency or regulatory body. This organization is responsible for overseeing compliance and ensuring that the form is used correctly within its jurisdiction. It is important to verify the issuing authority to ensure that you are using the most current version of the form.

Form Submission Methods

The Form 4913 Rev August can be submitted through various methods, depending on the requirements set by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Quick guide on how to complete form 4913 rev august

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which only takes moments and holds the same legal validity as a traditional pen-and-paper signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that require printing additional document copies. airSlate SignNow handles all your document management necessities in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure smooth communication at every stage of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4913 Rev August

Create this form in 5 minutes!

How to create an eSignature for the form 4913 rev august

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4913 Rev August?

Form 4913 Rev August is a crucial document used for specific compliance and reporting requirements. It ensures that businesses are adhering to the necessary regulations while offering convenience and efficiency in the management of these documents.

-

How does airSlate SignNow simplify the process of filling out Form 4913 Rev August?

airSlate SignNow streamlines the process by providing an intuitive interface for completing Form 4913 Rev August electronically. Users can easily input information, save progress, and share the form with relevant parties, eliminating the hassle of paper-based processes.

-

Are there any costs associated with using airSlate SignNow for Form 4913 Rev August?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan is designed to provide cost-effective solutions for sending and eSigning Form 4913 Rev August and other documents efficiently.

-

What features does airSlate SignNow offer for managing Form 4913 Rev August?

airSlate SignNow includes features such as eSigning, document sharing, and real-time tracking specifically for Form 4913 Rev August. These features enhance collaboration and ensure that all stakeholders can access and review the document easily.

-

Can I integrate airSlate SignNow with my existing tools when working on Form 4913 Rev August?

Absolutely! airSlate SignNow offers integrations with multiple third-party applications, providing seamless workflow integration for Form 4913 Rev August. This enables users to sync data across platforms and maintain a streamlined process.

-

What are the benefits of using airSlate SignNow for Form 4913 Rev August?

Using airSlate SignNow for Form 4913 Rev August brings signNow benefits, such as saving time and reducing errors associated with manual entry. The platform enhances compliance and provides a secure environment for document management.

-

Is it easy to share Form 4913 Rev August with team members using airSlate SignNow?

Yes, airSlate SignNow makes it incredibly easy to share Form 4913 Rev August with team members. You can send the document via a secure link, ensuring that everyone involved can have access and contribute to the completion of the form.

Get more for Form 4913 Rev August

Find out other Form 4913 Rev August

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online