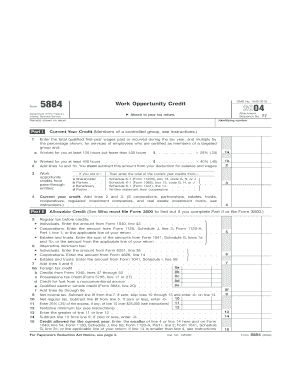

Form 5884 Work Opportunity Credit Attach to Your Tax Return

What is the Form 5884 Work Opportunity Credit Attach To Your Tax Return

The Form 5884 is used to claim the Work Opportunity Credit, a tax incentive for employers who hire individuals from certain target groups facing significant barriers to employment. This credit aims to encourage the hiring of individuals who may otherwise struggle to find work, including veterans, individuals receiving government assistance, and those with disabilities. By attaching Form 5884 to your tax return, you can reduce your tax liability based on the qualified wages paid to these employees.

How to use the Form 5884 Work Opportunity Credit Attach To Your Tax Return

To utilize Form 5884 effectively, employers must first determine eligibility based on the targeted groups outlined by the IRS. After identifying qualified employees, complete the form by providing necessary details such as the employee's name, Social Security number, and the amount of qualified wages paid. Once filled out, attach the completed Form 5884 to your tax return when filing. This process allows you to claim the credit and potentially lower your overall tax bill.

Steps to complete the Form 5884 Work Opportunity Credit Attach To Your Tax Return

Completing Form 5884 involves several key steps:

- Gather information about your business and the employees for whom you are claiming the credit.

- Identify the target group status of each qualified employee.

- Fill out the required sections of Form 5884, including employee details and wage amounts.

- Calculate the credit amount based on the qualified wages paid.

- Attach the completed form to your tax return before submission.

Eligibility Criteria

To qualify for the Work Opportunity Credit, employers must hire individuals from specific target groups. These groups include:

- Veterans

- Individuals receiving Temporary Assistance for Needy Families (TANF)

- Individuals receiving Supplemental Nutrition Assistance Program (SNAP) benefits

- Long-term unemployed individuals

- Individuals with disabilities

Employers should ensure that the hired individuals meet the criteria before claiming the credit on Form 5884.

IRS Guidelines

The IRS provides detailed guidelines for the Work Opportunity Credit, including eligibility requirements, qualifying wages, and documentation needed to support claims. Employers should refer to the IRS instructions for Form 5884 to ensure compliance with all regulations. It's essential to keep accurate records of employee eligibility and wages paid, as the IRS may request documentation during audits.

Required Documents

When claiming the Work Opportunity Credit using Form 5884, employers should maintain the following documentation:

- Form 5884 itself, completed accurately.

- Documentation confirming the employee's eligibility, such as certification from the state workforce agency.

- Records of wages paid to qualified employees.

Having these documents readily available can streamline the tax filing process and support the credit claim if needed.

Quick guide on how to complete form 5884 work opportunity credit attach to your tax return

Complete [SKS] effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically available from airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your updates.

- Choose how you would like to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5884 Work Opportunity Credit Attach To Your Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 5884 work opportunity credit attach to your tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5884 Work Opportunity Credit Attach To Your Tax Return?

The Form 5884 Work Opportunity Credit Attach To Your Tax Return is a tax form used to claim the Work Opportunity Tax Credit (WOTC) for employers who hire individuals from targeted groups. This credit helps businesses offset the costs of hiring by providing a substantial tax benefit. Understanding how to properly complete this form is crucial for maximizing your tax credits.

-

How can I eSign the Form 5884 Work Opportunity Credit Attach To Your Tax Return using airSlate SignNow?

With airSlate SignNow, you can easily eSign the Form 5884 Work Opportunity Credit Attach To Your Tax Return online. Simply upload the form, add the required signatures, and send it for signing. Our platform ensures a secure and streamlined process, enabling you to complete your tax documents promptly.

-

What are the benefits of using airSlate SignNow for tax documents like Form 5884?

Using airSlate SignNow for tax documents like Form 5884 Work Opportunity Credit Attach To Your Tax Return offers several benefits, including enhanced security, easy accessibility, and time savings. Our platform allows you to sign and send documents from anywhere, reducing the hassle of paper documents. Additionally, you'll have access to templates and tracking features that simplify the filing process.

-

Does airSlate SignNow offer any integrations that can help with Form 5884?

Yes, airSlate SignNow offers integrations with various accounting and tax software that can assist in managing the Form 5884 Work Opportunity Credit Attach To Your Tax Return. By connecting your tax software with our platform, you can streamline your workflow and ensure that your forms are accurately filled and submitted on time.

-

How much does it cost to use airSlate SignNow for signing forms like Form 5884?

airSlate SignNow provides a cost-effective solution for signing forms, including the Form 5884 Work Opportunity Credit Attach To Your Tax Return. Our pricing plans are designed to fit different business needs, offering features from basic signing to more advanced document management. You can start with a free trial to see how our service can benefit you before committing to a plan.

-

Is airSlate SignNow secure for handling sensitive tax documents like Form 5884?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Form 5884 Work Opportunity Credit Attach To Your Tax Return. We use encryption, secure data storage, and comply with regulatory requirements to ensure your information remains confidential and protected throughout the signing process.

-

Can I save my Form 5884 Work Opportunity Credit Attach To Your Tax Return in airSlate SignNow for future use?

Yes! airSlate SignNow allows you to save templates, including the Form 5884 Work Opportunity Credit Attach To Your Tax Return, for future use. This feature enables you to quickly access and modify your forms whenever needed, saving you time and effort during tax season or whenever you need to file this credit.

Get more for Form 5884 Work Opportunity Credit Attach To Your Tax Return

Find out other Form 5884 Work Opportunity Credit Attach To Your Tax Return

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word