1545 1668 Schedule K 1 Form 8865 Department of the Treasury Internal Revenue Service Tax Year Beginning and Ending or , , 200 Pa

Understanding the Schedule K-1 Form 8865

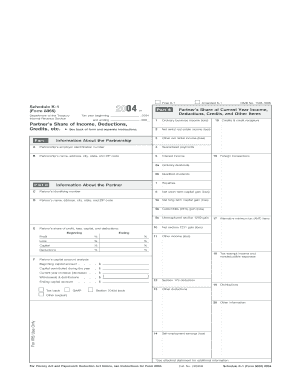

The Schedule K-1 Form 8865 is a tax document used by partners in a partnership to report their share of income, deductions, credits, and other items from the partnership. This form is essential for ensuring accurate tax reporting, as it provides detailed information about each partner's financial stake in the partnership for the tax year. The form is issued by the Department of the Treasury, Internal Revenue Service (IRS), and is a critical component of the partnership's tax return.

How to Use the Schedule K-1 Form 8865

To effectively use the Schedule K-1 Form 8865, partners must first receive their copy from the partnership. Each partner should review the information for accuracy, as it includes vital financial data that will affect their individual tax returns. The form should be attached to the partner's income tax return and used to report income, deductions, and credits. It is important for partners to keep a copy for their records, as it may be needed for future reference or audits.

Steps to Complete the Schedule K-1 Form 8865

Completing the Schedule K-1 Form 8865 involves several steps:

- Gather necessary financial documents, including the partnership's tax return and any relevant income statements.

- Fill out the partner's information section, ensuring that names, addresses, and taxpayer identification numbers are accurate.

- Report the partner's share of current year income, deductions, credits, and other items as provided by the partnership.

- Double-check all entries for accuracy and completeness before submitting the form.

Key Elements of the Schedule K-1 Form 8865

The Schedule K-1 Form 8865 contains several key elements that are crucial for tax reporting:

- Partner's Information: This section includes the partner's name, address, and taxpayer identification number.

- Partnership Information: Details about the partnership, including its name and employer identification number (EIN).

- Income and Deductions: A breakdown of the partner's share of income, deductions, credits, and other items for the tax year.

- Signature: The form must be signed by an authorized representative of the partnership to validate the information provided.

Legal Use of the Schedule K-1 Form 8865

The legal use of the Schedule K-1 Form 8865 is essential for compliance with IRS regulations. Partners are required to report the information accurately on their individual tax returns. Failure to do so may result in penalties or audits. It is important for partners to understand their obligations regarding the form and to seek professional tax advice if needed to ensure compliance with all applicable tax laws.

Filing Deadlines for the Schedule K-1 Form 8865

Filing deadlines for the Schedule K-1 Form 8865 align with the partnership's tax return deadlines. Generally, partnerships must file their returns by the fifteenth day of the third month following the end of their tax year. Partners should ensure they receive their K-1 forms in a timely manner to meet their individual tax filing deadlines, which are typically April 15 for most taxpayers.

Quick guide on how to complete 1545 1668 schedule k 1 form 8865 department of the treasury internal revenue service tax year beginning and ending or 200 part

Effortlessly Complete [SKS] on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal sustainable alternative to traditionally printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without hassles. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to initiate the process.

- Make use of the tools provided to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form via email, text message (SMS), invitation link, or download it onto your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 1668 Schedule K 1 Form 8865 Department Of The Treasury Internal Revenue Service Tax Year Beginning And Ending Or , , 200 Pa

Create this form in 5 minutes!

How to create an eSignature for the 1545 1668 schedule k 1 form 8865 department of the treasury internal revenue service tax year beginning and ending or 200 part

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 1668 Schedule K 1 Form 8865?

The 1545 1668 Schedule K 1 Form 8865 is a critical document required by the Department Of The Treasury Internal Revenue Service for reporting a partner's share of income, deductions, credits, and other items for tax purposes. This form details the tax year beginning and ending and helps partners understand their financial responsibilities.

-

How does airSlate SignNow help with the 1545 1668 Schedule K 1 Form 8865?

airSlate SignNow simplifies the process of managing the 1545 1668 Schedule K 1 Form 8865 by providing an easy-to-use platform for eSigning and sharing documents securely. Our solution allows businesses to manage all their tax documents efficiently, ensuring compliance and accuracy.

-

What are the main features of airSlate SignNow for handling tax documents?

Our platform offers features such as document templates, eSignature capabilities, and automated workflows specifically designed to streamline the completion of forms like the 1545 1668 Schedule K 1 Form 8865. These features enhance productivity and reduce the risk of errors in tax filings.

-

Is there a pricing plan for using airSlate SignNow?

Yes, airSlate SignNow provides competitive pricing plans that cater to businesses of all sizes. Each plan includes access to features that facilitate the management of essential tax forms, including the 1545 1668 Schedule K 1 Form 8865, ensuring you receive maximum value for your investment.

-

What benefits does eSigning provide for tax documents?

eSigning through airSlate SignNow offers numerous benefits for tax documents, including enhanced security, faster completion times, and the ability to track document status. Utilizing eSignatures for forms like the 1545 1668 Schedule K 1 Form 8865 ensures that you can submit your documents swiftly and safely.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow easily integrates with a variety of accounting and tax software solutions. This capability makes it simpler to handle essential forms such as the 1545 1668 Schedule K 1 Form 8865 while keeping your workflow efficient and organized.

-

How does airSlate SignNow ensure compliance with tax regulations?

airSlate SignNow is designed with compliance in mind, providing templates and workflows that help ensure that forms like the 1545 1668 Schedule K 1 Form 8865 meet IRS regulations. Our platform regularly updates to accommodate any changes in tax laws, ensuring you stay compliant.

Get more for 1545 1668 Schedule K 1 Form 8865 Department Of The Treasury Internal Revenue Service Tax Year Beginning And Ending Or , , 200 Pa

- Short form awi vpk 03s attendance verification 09 21 doc m jpeg s m e earlylearningcoalitionsarasota

- Henrico county sports physical form

- Usfj form 178 r

- Jeep wrangler jk repair manual pdf form

- Challan format in word 426507296

- Instructions form 1651 0012

- John deere 6081 engine torque specs form

- Trigonometry word problems form

Find out other 1545 1668 Schedule K 1 Form 8865 Department Of The Treasury Internal Revenue Service Tax Year Beginning And Ending Or , , 200 Pa

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement