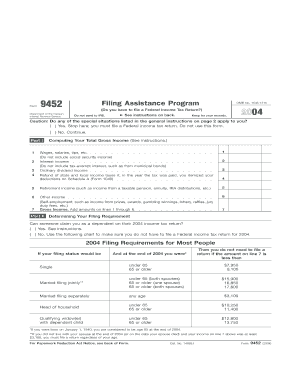

Form 9452 Filing Assistance Program Do You Have to File a Federal Income Tax Return

Understanding the Form 9452 Filing Assistance Program

The Form 9452 Filing Assistance Program is designed to aid individuals who may need help in determining whether they are required to file a federal income tax return. This program is particularly beneficial for those who may not have a clear understanding of their filing obligations based on their income, filing status, or other factors. By utilizing this program, taxpayers can receive guidance tailored to their specific circumstances, ensuring they comply with federal tax laws.

Steps to Utilize the Form 9452 Filing Assistance Program

To effectively use the Form 9452 Filing Assistance Program, individuals should follow a series of straightforward steps:

- Gather necessary financial documents, including W-2s, 1099s, and any other income records.

- Review your total income and filing status to assess your potential obligation to file.

- Complete the Form 9452, providing accurate information regarding your income and circumstances.

- Submit the completed form to the appropriate IRS office or utilize designated online resources for assistance.

Eligibility Criteria for the Form 9452 Filing Assistance Program

Eligibility for the Form 9452 Filing Assistance Program is generally based on specific criteria, including:

- Income level: Individuals with lower income may qualify for assistance.

- Filing status: Certain statuses, such as single, married filing jointly, or head of household, can affect eligibility.

- Special circumstances: Taxpayers facing unique situations, such as disability or recent life changes, may also qualify.

Required Documents for the Form 9452 Filing Assistance Program

To complete the Form 9452 Filing Assistance Program effectively, individuals should prepare the following documents:

- Proof of income, such as pay stubs or tax documents like W-2s and 1099s.

- Identification information, including Social Security numbers for all dependents.

- Any relevant tax forms from previous years that may impact current filing requirements.

IRS Guidelines for the Form 9452 Filing Assistance Program

The IRS provides specific guidelines regarding the use of the Form 9452 Filing Assistance Program. Taxpayers are encouraged to consult the IRS website or contact their offices for detailed instructions. These guidelines outline:

- How to correctly fill out the form to ensure all necessary information is included.

- Deadlines for submission to avoid penalties or complications.

- Resources available for additional support, including hotlines and local assistance centers.

Form Submission Methods for the Form 9452 Filing Assistance Program

Individuals can submit the Form 9452 Filing Assistance Program through various methods, including:

- Online submission via the IRS website, where applicable.

- Mailing the completed form to the designated IRS office.

- In-person visits to local IRS offices for direct assistance and submission.

Quick guide on how to complete form 9452 filing assistance program do you have to file a federal income tax return

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] with minimal effort

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 9452 Filing Assistance Program Do You Have To File A Federal Income Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 9452 filing assistance program do you have to file a federal income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 9452 Filing Assistance Program?

The Form 9452 Filing Assistance Program is designed to help individuals determine whether they need to file a federal income tax return. This program provides guidance and resources to ensure you're compliant with your tax obligations.

-

Do I have to use the Form 9452 Filing Assistance Program to file my taxes?

No, while the Form 9452 Filing Assistance Program offers valuable assistance, you are not required to use it. However, this program simplifies the process and ensures you have all the necessary information for your federal income tax return.

-

How much does the Form 9452 Filing Assistance Program cost?

The Form 9452 Filing Assistance Program is offered at competitive pricing to provide affordable assistance. Check our website for the latest pricing options and any promotions we may have to ensure you get the best value.

-

What features does the Form 9452 Filing Assistance Program offer?

The Form 9452 Filing Assistance Program includes features like step-by-step guidance, personalized support, and online resources to help you navigate whether you need to file a federal income tax return. Our intuitive platform makes it easier for users to understand their tax obligations.

-

What are the benefits of using the Form 9452 Filing Assistance Program?

Utilizing the Form 9452 Filing Assistance Program can save you time and reduce stress during tax season. By helping you determine your filing requirements, you can ensure compliance with tax laws and avoid potential penalties.

-

Can the Form 9452 Filing Assistance Program integrate with my existing tax software?

Yes, the Form 9452 Filing Assistance Program is designed to be compatible with various tax software solutions. Integration options allow for a seamless experience, enabling you to utilize our program alongside your existing tools.

-

Is support available if I have questions regarding the Form 9452 Filing Assistance Program?

Absolutely! Our customer support team is available to answer any questions you have about the Form 9452 Filing Assistance Program. We strive to provide comprehensive support to ensure you understand your filing requirements.

Get more for Form 9452 Filing Assistance Program Do You Have To File A Federal Income Tax Return

Find out other Form 9452 Filing Assistance Program Do You Have To File A Federal Income Tax Return

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later