W 4 Fillable Form

What is the W-4 Fillable Form

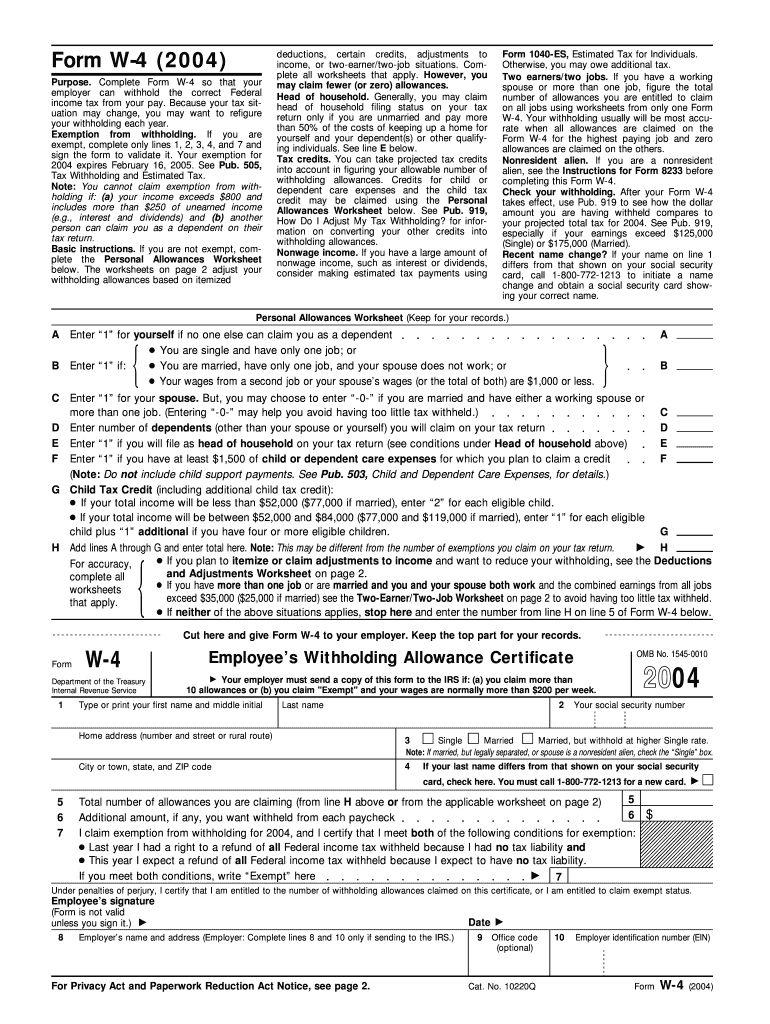

The W-4 Fillable Form, officially known as the Employee's Withholding Certificate, is a crucial document used by employees in the United States to inform their employer of their tax withholding preferences. This form helps determine the amount of federal income tax that should be withheld from an employee's paycheck. By accurately completing the W-4, employees can ensure that they are not overpaying or underpaying their taxes throughout the year.

How to use the W-4 Fillable Form

Using the W-4 Fillable Form is straightforward. Employees can fill out the form either digitally or by hand. To use the fillable version, individuals should download the form from the IRS website or a trusted source. Once opened, they can enter their personal information, including name, address, Social Security number, and filing status. The form also includes sections for claiming dependents and additional withholding amounts if necessary.

Steps to complete the W-4 Fillable Form

Completing the W-4 Fillable Form involves several key steps:

- Provide personal information: Fill in your name, address, and Social Security number.

- Select your filing status: Choose between single, married filing jointly, married filing separately, or head of household.

- Claim dependents: If applicable, indicate the number of dependents you are claiming and any associated tax credits.

- Adjust withholding: If you want to withhold additional amounts for tax purposes, specify the extra amount in the designated section.

- Sign and date the form: Ensure that you sign and date the form before submitting it to your employer.

Legal use of the W-4 Fillable Form

The W-4 Fillable Form is legally recognized by the IRS and must be completed by all employees who wish to have accurate federal income tax withheld from their paychecks. Employers are required to keep a copy of the W-4 on file for each employee, ensuring compliance with tax regulations. It is important to update the form whenever there are significant life changes, such as marriage, divorce, or the birth of a child, to reflect the correct withholding status.

IRS Guidelines

The IRS provides specific guidelines for completing the W-4 Fillable Form. These guidelines include instructions on how to determine the correct withholding amount based on personal circumstances and current tax laws. Employees are encouraged to use the IRS Withholding Estimator tool available on the IRS website to help calculate their withholding needs accurately. Staying informed about changes in tax law can also impact how the W-4 should be filled out.

Form Submission Methods

Once the W-4 Fillable Form is completed, it can be submitted to the employer through various methods. The most common submission methods include:

- Online: Many employers allow employees to submit the W-4 electronically through their payroll systems.

- Mail: Employees can print the completed form and mail it directly to their employer's human resources or payroll department.

- In-Person: Some employees may choose to deliver the form in person to ensure it is received and processed promptly.

Quick guide on how to complete w 4 fillable form

Prepare W 4 Fillable Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without obstacles. Manage W 4 Fillable Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign W 4 Fillable Form without hassle

- Obtain W 4 Fillable Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign W 4 Fillable Form and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 4 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W 4 Fillable Form?

The W 4 Fillable Form is a tax form used by employees to indicate their tax withholding preferences. This form allows users to easily enter their information online, ensuring accuracy and compliance. With airSlate SignNow, completing and signing the W 4 Fillable Form becomes a straightforward and efficient process.

-

How can I access the W 4 Fillable Form on airSlate SignNow?

You can access the W 4 Fillable Form directly on the airSlate SignNow platform. Simply log in, navigate to the forms section, and search for 'W 4 Fillable Form.' From there, you can fill it out, sign electronically, and share it with your employer.

-

Is the W 4 Fillable Form secure with airSlate SignNow?

Yes, the W 4 Fillable Form is secure when using airSlate SignNow. Our platform employs encryption and secure storage solutions to protect your personal information and documents. You can trust that your data remains confidential while using our service.

-

What features does airSlate SignNow offer for the W 4 Fillable Form?

airSlate SignNow provides various features for the W 4 Fillable Form, including easy document editing, electronic signatures, and a user-friendly interface. Additionally, you can save your progress, access templates, and track the status of your form submissions. These features streamline the entire form-filling process.

-

Can I integrate airSlate SignNow with other tools for the W 4 Fillable Form?

Yes, airSlate SignNow allows you to integrate with various tools to enhance the use of the W 4 Fillable Form. You can connect platforms such as Google Drive, Dropbox, and CRMs to manage your documents seamlessly. This integration ensures that the flow of information remains efficient and organized.

-

What are the benefits of using airSlate SignNow for fillable forms?

Using airSlate SignNow to complete the W 4 Fillable Form comes with numerous benefits, including time savings and improved accuracy. The electronic signature feature eliminates the need for printing and scanning, resulting in faster processing. Additionally, our platform offers multiple templates, making it easy to adapt forms to your needs.

-

Is there a pricing plan for using the W 4 Fillable Form on airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to different user needs, whether for individuals or businesses. You can choose a plan that suits your frequency of use and required features. With competitive pricing, accessing the W 4 Fillable Form and other functionalities becomes a cost-effective solution.

Get more for W 4 Fillable Form

Find out other W 4 Fillable Form

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy