Form 56 Rev April Fill in Version Notice Concerning Fiduciary Relationship

What is the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

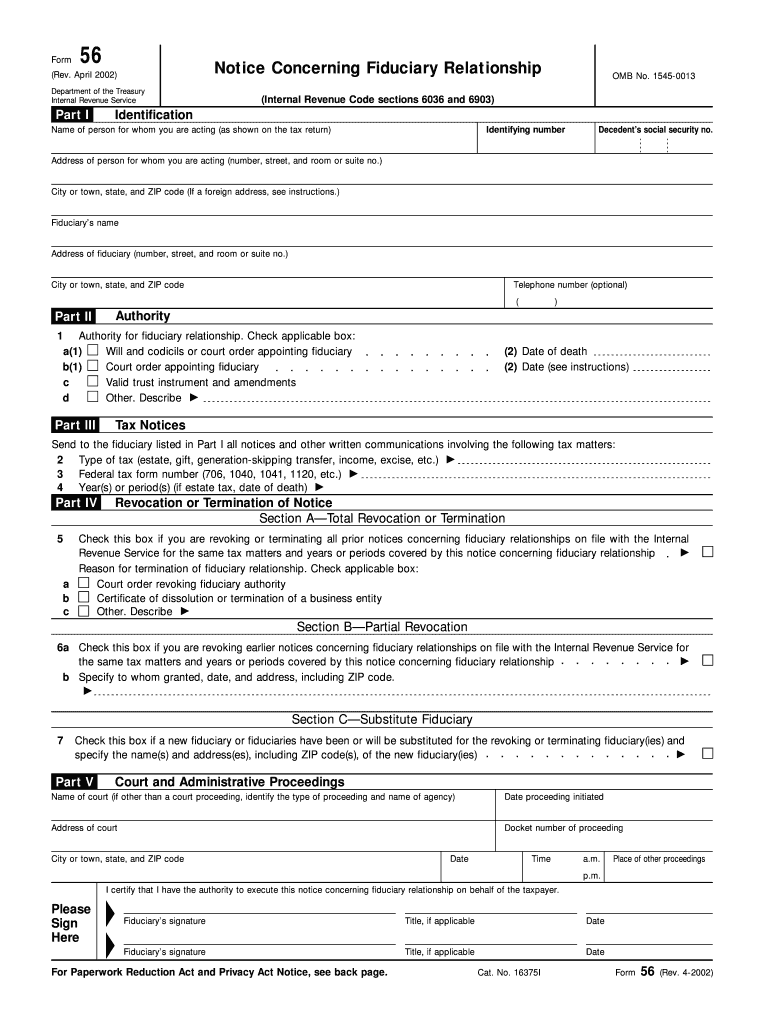

The Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship is an official document used to notify the Internal Revenue Service (IRS) of the creation or termination of a fiduciary relationship. This form is crucial for fiduciaries, such as executors, administrators, or trustees, as it provides the IRS with the necessary information to manage tax obligations associated with the estate or trust. By filing this form, fiduciaries can ensure compliance with tax regulations and facilitate proper communication with the IRS regarding their responsibilities.

How to use the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

Using the Form 56 Rev April Fill In Version involves filling out the required fields accurately to reflect the details of the fiduciary relationship. The form includes sections for the fiduciary's name, address, and the type of fiduciary relationship being established or terminated. It is important to provide precise information to avoid any complications with the IRS. Once completed, the form can be submitted electronically or via mail, depending on the preference of the fiduciary.

Steps to complete the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

Completing the Form 56 Rev April Fill In Version involves several key steps:

- Gather necessary information about the fiduciary and the entity involved.

- Fill in the fiduciary's name, address, and taxpayer identification number.

- Indicate the type of fiduciary relationship, such as executor or trustee.

- Provide details regarding the entity's name and address, if applicable.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

The legal use of the Form 56 Rev April Fill In Version is essential for establishing the fiduciary's authority to act on behalf of an estate or trust. This form must be filed to inform the IRS of any changes in fiduciary status, ensuring that the fiduciary can legally manage tax matters related to the estate or trust. Failure to file this form may result in complications with tax filings and responsibilities.

Key elements of the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

Key elements of the Form 56 Rev April Fill In Version include:

- Fiduciary's name and contact information.

- Type of fiduciary relationship being reported.

- Taxpayer identification number of the fiduciary.

- Details of the estate or trust involved.

- Signature of the fiduciary or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form 56 Rev April Fill In Version are generally linked to the specific circumstances of the fiduciary relationship. It is advisable to file the form promptly upon the establishment or termination of the fiduciary status to ensure compliance with IRS regulations. Keeping track of important dates related to tax filings can help avoid penalties and ensure the timely management of tax obligations.

Quick guide on how to complete form 56 rev april fill in version notice concerning fiduciary relationship

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to commence.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

Create this form in 5 minutes!

How to create an eSignature for the form 56 rev april fill in version notice concerning fiduciary relationship

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

The Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship is a document used to inform the IRS about the existence of a fiduciary relationship, such as a trust or estate. By using this form, fiduciaries can ensure compliance with tax responsibilities and inform relevant parties of their role. Understanding this form is crucial for maintaining accurate records and fulfilling legal obligations.

-

How can airSlate SignNow help me fill out the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

airSlate SignNow provides a user-friendly interface designed for easy document preparation and e-signing, including the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship. You can quickly fill out required fields, drag and drop signatures, and send the document securely online. This efficient process saves you time and ensures accuracy in your fiduciary communications.

-

What are the pricing options for using airSlate SignNow to manage the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

airSlate SignNow offers flexible pricing plans, starting from basic to premium options, catering to different business needs. Depending on the features you choose, prices can vary, but all include the capability to handle documents like the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship. Our affordable solutions ensure you get the best value while managing your important documents.

-

Can I integrate airSlate SignNow with other software for handling the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

Yes, airSlate SignNow seamlessly integrates with various applications and software, enhancing your workflow when managing the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship. Popular integrations include CRMs, cloud storage, and productivity tools. These integrations enable you to streamline operations and maintain all your documents in one location.

-

What security measures does airSlate SignNow implement for the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

airSlate SignNow prioritizes security with advanced encryption protocols and secure cloud storage to protect your sensitive documents, including the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship. Multi-factor authentication and user access controls ensure only authorized users can view and edit documents. Your data's safety and confidentiality are our top concern.

-

Is there a mobile app for airSlate SignNow to manage the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

Yes, airSlate SignNow offers a mobile application that allows you to manage documents like the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship on the go. With the app, you can fill out, sign, and send documents directly from your mobile device, ensuring flexibility and ease of use. This way, you can stay productive irrespective of your location.

-

What are the benefits of using airSlate SignNow for the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship?

Using airSlate SignNow for the Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship offers numerous benefits, including efficiency, reduced paperwork, and enhanced collaboration. You'll enjoy quick e-signing capabilities and real-time tracking of document status. This streamlined process minimizes delays and helps you manage your fiduciary responsibilities more effectively.

Get more for Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

Find out other Form 56 Rev April Fill In Version Notice Concerning Fiduciary Relationship

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document