Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

What is the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

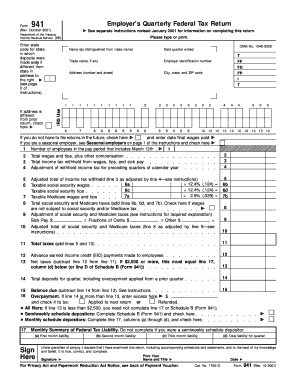

The Form 941 Rev October Fill in Version is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and is essential for ensuring compliance with federal tax obligations. Employers must accurately complete this form to provide the IRS with information about their payroll tax liabilities and the amounts they have withheld from employees' paychecks. The October revision incorporates any updates or changes in tax law, ensuring that employers have the most current information for reporting.

How to use the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

To effectively use the Form 941 Rev October Fill in Version, employers should first gather all necessary payroll records for the reporting period. This includes total wages paid, tips received, and any other compensation. Employers must then fill out the form by entering the appropriate figures in designated sections, such as the number of employees, total wages, and tax amounts withheld. After completing the form, it is critical to review all entries for accuracy before submission to avoid penalties or delays in processing.

Steps to complete the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

Completing the Form 941 Rev October Fill in Version involves several steps:

- Gather payroll records for the quarter, including total wages and tax withholdings.

- Fill in the employer identification information at the top of the form.

- Report the number of employees and total wages paid during the quarter.

- Calculate the total taxes withheld for Social Security and Medicare.

- Complete the sections regarding adjustments and any credits claimed.

- Sign and date the form to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 941 Rev October Fill in Version. The form is due on the last day of the month following the end of the quarter. For example, for the first quarter ending March 31, the form is due by April 30. Timely filing is essential to avoid penalties and interest on any unpaid taxes. Employers should also be aware of any changes to deadlines that may occur due to holidays or other factors.

Penalties for Non-Compliance

Failure to file the Form 941 Rev October Fill in Version on time or inaccuracies in reporting can result in significant penalties. The IRS may impose a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of twenty-five percent. Additionally, if the form is filed more than 60 days late, a minimum penalty may apply. Employers should ensure compliance to avoid these financial repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 941 Rev October Fill in Version. Employers should refer to the IRS instructions for detailed information on reporting requirements, calculations, and any updates to tax laws that may affect the form. Staying informed about IRS guidelines helps ensure accurate reporting and compliance with federal tax obligations.

Quick guide on how to complete form 941 rev october fill in version employers quarterly federal tax return

Easily Prepare [SKS] on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the right form and securely store it in the cloud. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

Effortlessly Modify and Electronically Sign [SKS]

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, and mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign [SKS] to ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

Create this form in 5 minutes!

How to create an eSignature for the form 941 rev october fill in version employers quarterly federal tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return?

The Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return is a document that employers must submit to the IRS each quarter. It reports income taxes, Social Security tax, and Medicare tax withheld from employee wages. This version ensures that employers have the most current guidelines and updates.

-

How can airSlate SignNow help me with the Form 941 Rev October Fill in Version?

airSlate SignNow simplifies the process of completing and submitting the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return. With its easy-to-use interface, you can fill in the form electronically and eSign it, reducing time and errors associated with paper forms.

-

Is there a cost associated with using airSlate SignNow for the Form 941?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that can help you manage the Form 941 Rev October Fill in Version efficiently. Check our pricing page for more details and choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with my existing software for handling Form 941?

Absolutely! airSlate SignNow offers integrations with a variety of software systems, allowing for seamless workflow management when dealing with the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return. You can connect it with popular platforms, ensuring that your data is synchronized and processes are streamlined.

-

What are the benefits of using airSlate SignNow for tax forms like Form 941?

Using airSlate SignNow for tax forms such as the Form 941 Rev October Fill in Version provides numerous benefits, including time savings and enhanced accuracy. The platform allows for electronic signing, which speeds up the submission process. Additionally, its user-friendly tools help minimize errors that could lead to costly penalties.

-

Is airSlate SignNow compliant with IRS regulations for Form 941?

Yes, airSlate SignNow ensures compliance with IRS regulations for the Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return. Our system is designed to keep up with the latest legal requirements and provide you with the compliance needed to avoid any issues during tax season.

-

How do I get started with airSlate SignNow for Form 941?

Getting started with airSlate SignNow for the Form 941 Rev October Fill in Version is simple. Sign up for an account on our website, choose a suitable pricing plan, and start creating and managing your tax forms securely. Our intuitive interface guides you through every step of the process.

Get more for Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

Find out other Form 941 Rev October Fill in Version Employer's Quarterly Federal Tax Return

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form