Form 1120 FSC Fill in Version U S Income Tax Return of a Foreign Sales Corporation

What is the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

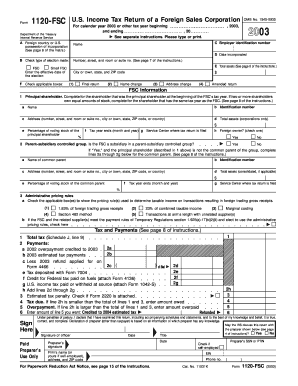

The Form 1120 FSC is a specific tax return designed for foreign sales corporations operating under U.S. tax laws. This form enables these corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). By filing this form, foreign sales corporations can claim certain tax benefits available to them under U.S. tax regulations. Understanding this form is crucial for compliance and optimizing tax obligations.

How to use the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

Utilizing the Form 1120 FSC involves several steps to ensure accurate reporting of financial information. First, gather all necessary financial documents, including income statements and expense reports. Next, accurately fill out the form with relevant details such as the corporation's name, address, and Employer Identification Number (EIN). Ensure that all income and deductions are reported correctly, as this will affect the tax liability. After completing the form, review it thoroughly for any errors before submission.

Steps to complete the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

Completing the Form 1120 FSC requires careful attention to detail. Follow these steps:

- Begin by entering the corporation's basic information, including name, address, and EIN.

- Report the corporation's gross income from sales and other sources.

- Deduct allowable expenses, such as cost of goods sold and operating expenses.

- Calculate the taxable income by subtracting total deductions from gross income.

- Complete any additional schedules required for specific deductions or credits.

- Sign and date the form, ensuring it is submitted by the appropriate deadline.

Legal use of the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

The legal use of the Form 1120 FSC is governed by U.S. tax laws, which outline the requirements for foreign sales corporations. This form must be filed annually to report income and claim applicable tax benefits. Failure to file or inaccuracies in reporting can lead to penalties or legal repercussions. It is essential for corporations to adhere strictly to IRS guidelines to maintain compliance and avoid any legal issues.

Key elements of the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

Key elements of the Form 1120 FSC include:

- Identification information: Name, address, and EIN of the corporation.

- Income reporting: Detailed sections for gross income and other income sources.

- Deductions: Categories for various allowable expenses that can reduce taxable income.

- Tax calculation: A section for determining the corporation’s tax liability based on taxable income.

- Signature: A required signature from an authorized corporate officer certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 FSC are crucial for compliance. Generally, the form must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. If additional time is needed, corporations may file for an extension, but the form must still be submitted by the extended deadline to avoid penalties.

Quick guide on how to complete form 1120 fsc fill in version u s income tax return of a foreign sales corporation

Complete [SKS] effortlessly on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers a sustainable alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to modify and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

Create this form in 5 minutes!

How to create an eSignature for the form 1120 fsc fill in version u s income tax return of a foreign sales corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation?

The Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation is a specific tax return form used by foreign sales corporations to report their income. This form is crucial for compliance with U.S. tax laws and helps ensure that foreign sales corporations meet their reporting obligations.

-

How can airSlate SignNow assist me with the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation?

airSlate SignNow streamlines the process of completing and electronically signing the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation. With our easy-to-use platform, you can fill out the form accurately, ensuring all necessary information is included for proper tax filing.

-

Is there a cost associated with using airSlate SignNow for the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation. Our pricing plans are designed to accommodate various business sizes and include different features, so you can choose one that fits your budget.

-

What features does airSlate SignNow provide for managing tax documents like the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation?

airSlate SignNow includes several features that are beneficial for managing tax documents such as the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation. These features include document templates, eSigning capabilities, secure storage, and real-time tracking to ensure that your tax documents are managed efficiently.

-

Are there integrations available with airSlate SignNow for completing the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation?

Yes, airSlate SignNow offers various integrations with popular business applications, enhancing the ease of completing the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation. Integrate with tools like Google Drive, Dropbox, and Microsoft Office to streamline your workflow.

-

Can multiple users collaborate on the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation using airSlate SignNow?

Absolutely! airSlate SignNow enables multiple users to collaborate seamlessly on the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation. This collaborative feature ensures that all stakeholders can provide input and review the document before finalizing it.

-

What are the benefits of using airSlate SignNow for the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation?

Using airSlate SignNow for the Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation provides numerous benefits, including time savings, increased accuracy, and a secure environment for document management. These advantages help streamline the tax filing process for foreign sales corporations.

Get more for Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

- Tennessee code annotated 36 6 413b5 provides that couples who complete premarital preparation courses shall be form

- Bargain and sale deed form

- Swartz creek high school travel release form swartzcreek

- Halls of heddon catalogue form

- Student accident form

- 101 rv rentals 289416481 form

- Livetheorangelife com hhrs form

- Timnath co sales tax form

Find out other Form 1120 FSC Fill in Version U S Income Tax Return Of A Foreign Sales Corporation

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free