Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return for Filers with Single Vehicle

Understanding the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

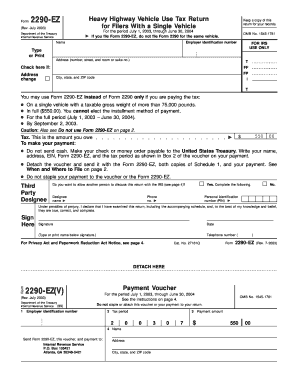

The Form 2290 EZ Rev July is a simplified version of the Heavy Vehicle Use Tax (HVUT) return specifically designed for individuals or businesses operating a single heavy vehicle. This form is essential for reporting and paying the annual tax imposed on heavy highway vehicles with a gross weight of 55,000 pounds or more. The IRS mandates that this form be filed annually, and it serves to ensure compliance with federal tax regulations related to heavy vehicle usage on public highways.

Steps to Complete the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

Completing the Form 2290 EZ involves several key steps:

- Gather Required Information: Collect details about your vehicle, including the Vehicle Identification Number (VIN), gross weight, and the date of first use.

- Fill Out the Form: Enter the required information in the appropriate fields. Ensure accuracy to avoid delays or penalties.

- Calculate the Tax: Use the IRS guidelines to determine the amount of tax owed based on your vehicle's weight and usage.

- Submit the Form: Choose your submission method—online through an e-filing service or by mailing a paper form to the IRS.

- Keep Records: Retain a copy of the completed form and any payment receipts for your records and potential audits.

How to Obtain the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

The Form 2290 EZ can be obtained directly from the IRS website or through authorized e-filing services. It is essential to ensure that you are using the most current version of the form, as the IRS updates forms periodically. If you prefer a paper version, you can print it out from the IRS website or request a physical copy from the IRS by mail.

Legal Use of the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

The legal use of the Form 2290 EZ is strictly for reporting and paying the Heavy Vehicle Use Tax for a single vehicle. It is crucial to file this form accurately and on time to avoid penalties. Failure to comply with the filing requirements can result in fines and interest charges. Additionally, the information provided on this form may be subject to audits by the IRS, making accuracy and honesty essential.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2290 EZ are typically set for the end of August each year. However, if you first use your vehicle after July, the deadline may vary based on the date of first use. It is important to check the IRS guidelines for specific dates each tax year to ensure timely filing and payment. Late submissions can incur penalties and interest charges, making it essential to stay informed about these deadlines.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 2290 EZ can lead to significant penalties. These may include a failure-to-file penalty, which is typically calculated based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on unpaid taxes. It is advisable to file the form on time and ensure that all information is accurate to avoid these financial consequences.

Quick guide on how to complete form 2290 ez rev july fill in version heavy vehicle use tax return for filers with single vehicle

Effortlessly complete [SKS] on any device

The management of online documents has become increasingly favored by both companies and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and digitally sign your documents swiftly and without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to modify and digitally sign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically available from airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal value as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and digitally sign [SKS] and ensure exceptional communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

Create this form in 5 minutes!

How to create an eSignature for the form 2290 ez rev july fill in version heavy vehicle use tax return for filers with single vehicle

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

The Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle is a simplified tax form used by owners of heavy vehicles to report and pay the Heavy Vehicle Use Tax (HVUT) for a single vehicle. This form streamlines the process, making it easier for filers to comply with IRS regulations and manage their tax obligations efficiently.

-

How can airSlate SignNow help with filing the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

airSlate SignNow provides a convenient platform for electronically signing and managing your Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle. With our user-friendly interface, you can fill out the form accurately, track your submission, and ensure compliance with tax requirements.

-

What are the pricing options for using airSlate SignNow to file the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

airSlate SignNow offers various pricing plans to accommodate different business needs. Users can choose from monthly or annual subscriptions, allowing you to access all features for filing the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle at a cost-effective rate, tailored for your budget.

-

Are there any integrations available with airSlate SignNow for filing the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

Yes, airSlate SignNow integrates seamlessly with several popular applications such as QuickBooks, Google Drive, and Dropbox, making it easier to manage your documents. These integrations allow for smooth data transfer and enhance your overall experience when filling out the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle.

-

What features does airSlate SignNow offer for filing the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

airSlate SignNow provides features such as document sharing, eSignature capabilities, and cloud storage to facilitate easy filing of the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle. These features ensure quick processing and enhance your productivity when managing important tax documents.

-

What are the benefits of using airSlate SignNow for the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

Using airSlate SignNow for the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle simplifies the filing process, saving you time and effort. Additionally, our secure platform protects your sensitive information, ensuring compliance and peace of mind as you manage your tax responsibilities.

-

Is it easy to obtain support if I have questions regarding the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle?

Absolutely! airSlate SignNow offers comprehensive customer support, including FAQs, live chat, and email assistance, to help with any queries related to the Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle. Our dedicated support team is here to assist you through the filing process and address your concerns.

Get more for Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

Find out other Form 2290 EZ Rev July Fill in Version Heavy Vehicle Use Tax Return For Filers With Single Vehicle

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement

- eSign Illinois Healthcare / Medical Resignation Letter Mobile

- eSign Illinois Healthcare / Medical Job Offer Easy

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now