Form 6088 Instructions

What is the Form 6088 Instructions

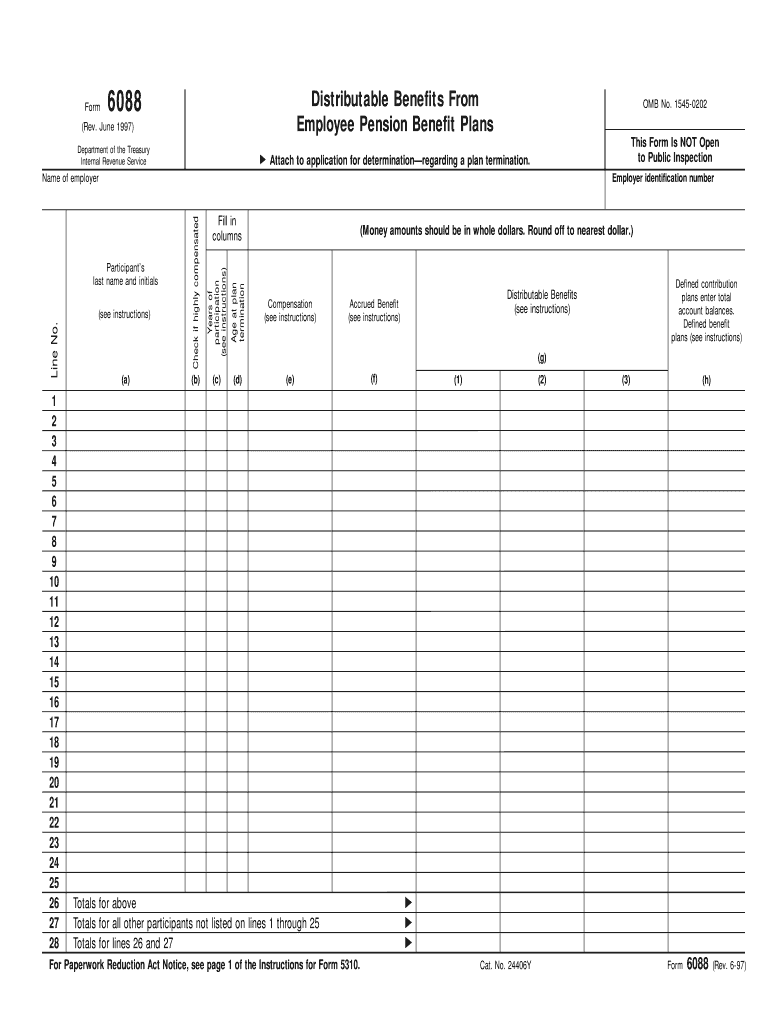

The Form 6088 instructions provide detailed guidance for individuals and businesses on how to complete IRS Form 6088. This form is primarily used to request a change in the accounting period for tax purposes. Understanding the instructions is crucial for ensuring compliance with IRS regulations and avoiding potential penalties. The instructions outline the purpose of the form, eligibility criteria, and the necessary steps to fill it out correctly.

Steps to complete the Form 6088 Instructions

Completing the Form 6088 involves several key steps:

- Gather all necessary financial documents that support your request for a change in accounting period.

- Review the eligibility criteria to ensure you qualify for the change.

- Fill out the form accurately, providing all required information, such as your business name, address, and the specific accounting period you wish to change.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form according to the specified submission methods outlined in the instructions.

How to obtain the Form 6088 Instructions

The Form 6088 instructions can be obtained directly from the IRS website or through various tax preparation services. It is important to ensure that you are using the most current version of the instructions, as they may be updated periodically. Additionally, many tax professionals can provide you with a copy of the instructions as part of their services.

Legal use of the Form 6088 Instructions

Using the Form 6088 instructions legally involves adhering to IRS guidelines and ensuring that all information provided is accurate and truthful. Misrepresentation or errors in the form can lead to penalties or delays in processing your request. It is advisable to consult a tax professional if you have questions about the legal implications of submitting the form.

Key elements of the Form 6088 Instructions

Key elements of the Form 6088 instructions include:

- Eligibility requirements for changing the accounting period.

- Detailed descriptions of each section of the form.

- Examples of acceptable reasons for requesting a change.

- Information on how to submit the form and any associated deadlines.

Filing Deadlines / Important Dates

Filing deadlines for Form 6088 are critical to ensure compliance with IRS regulations. Generally, the form should be submitted by the due date of your tax return for the year in which you wish to change your accounting period. It is essential to keep track of these dates to avoid penalties and ensure timely processing of your request.

Quick guide on how to complete form 6088 instructions

Effortlessly Prepare Form 6088 Instructions on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed materials, allowing you to obtain the required format and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form 6088 Instructions on any device using airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

How to Modify and eSign Form 6088 Instructions with Ease

- Locate Form 6088 Instructions and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 6088 Instructions and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6088 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 6088 instructions and why are they important?

The form 6088 instructions provide detailed guidance on how to complete the 6088 form required for various business applications. Understanding these instructions is crucial as they ensure your submissions are accurate, reducing the potential for delays in processing.

-

How can airSlate SignNow help with completing form 6088 instructions?

AirSlate SignNow simplifies the process of completing form 6088 instructions by allowing users to create and edit documents easily. With features designed for streamlining document workflows, users can ensure that their forms are filled out accurately and efficiently.

-

Are there any costs associated with using airSlate SignNow for form 6088 instructions?

airSlate SignNow offers a variety of pricing plans to accommodate different needs, including businesses that frequently work with form 6088 instructions. Users can choose a plan that fits their budget while benefiting from the tool's comprehensive features.

-

What features does airSlate SignNow offer for managing form 6088 instructions?

airSlate SignNow includes features like template creation, eSignatures, and automated workflows, which enhance the process of managing form 6088 instructions. These tools allow users to streamline their document management, making it easier to follow the required steps in the instructions.

-

Can airSlate SignNow integrate with other applications for form 6088 instructions?

Yes, airSlate SignNow can integrate with a variety of third-party applications, enhancing its functionality when working with form 6088 instructions. This integration allows users to connect their existing tools and workflows, making the entire process seamless.

-

What are the benefits of using airSlate SignNow for form 6088 instructions?

Using airSlate SignNow for form 6088 instructions offers numerous benefits, including time savings, reduced errors, and enhanced collaboration. The platform's user-friendly interface makes it accessible for users of all technical levels, ensuring that everyone can efficiently manage their documents.

-

Is there a trial period available for airSlate SignNow to understand form 6088 instructions better?

Absolutely! AirSlate SignNow typically offers a trial period, allowing users to explore its features related to form 6088 instructions without any commitment. This trial period is an excellent opportunity to assess how the platform can meet your document management needs.

Get more for Form 6088 Instructions

- C40b form

- Da form 2408 30

- Employee election form group benefit services

- Medical information amp release form go ministries gomin

- Departments police request a vacation house check form

- Clinical report as to mental form

- Put option agreement template form

- Home improvement remodel contract template form

Find out other Form 6088 Instructions

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF