Form 8876 Rev April Fill in Version Excise Tax on Structured Settlement Factoring Transactions

What is the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

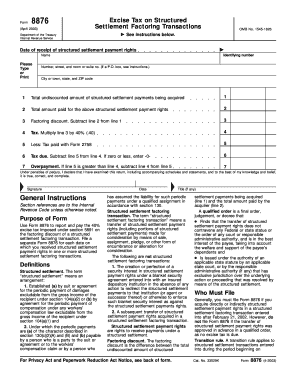

The Form 8876, also known as the Excise Tax on Structured Settlement Factoring Transactions, is a tax form used in the United States to report and calculate excise tax related to structured settlement transactions. This form is specifically designed for businesses engaged in structured settlement factoring, where they purchase future payment rights from individuals in exchange for a lump sum payment. The form helps the Internal Revenue Service (IRS) track these transactions and ensure compliance with federal tax regulations.

How to use the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

To effectively use the Form 8876, businesses must first determine if they are liable for the excise tax on structured settlement factoring transactions. Once confirmed, they should accurately fill out the form with the required information, including details about the transaction, the parties involved, and the calculated tax amount. It is essential to ensure that all entries are correct and complete to avoid penalties. After completing the form, it should be submitted to the IRS by the specified deadline.

Steps to complete the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

Completing the Form 8876 involves several key steps:

- Gather necessary documentation, including details of the structured settlement and the factoring transaction.

- Fill in the identification information for both the seller and the purchaser.

- Calculate the excise tax based on the amount of the structured settlement being factored.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the required deadline, either electronically or by mail.

Key elements of the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

Key elements of the Form 8876 include:

- Identification Information: Details about the seller and purchaser of the structured settlement.

- Transaction Details: Information regarding the structured settlement being factored, including payment amounts and schedules.

- Excise Tax Calculation: The formula used to determine the excise tax owed based on the transaction value.

- Signature: A declaration by the responsible party affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8876 are critical to ensure compliance with IRS regulations. Generally, the form must be filed by the 15th day of the second month following the end of the tax year in which the structured settlement factoring transaction occurred. It is essential for businesses to keep track of these dates to avoid late filing penalties.

Penalties for Non-Compliance

Failure to file the Form 8876 or inaccuracies in the information provided can result in significant penalties. The IRS may impose fines based on the amount of excise tax owed, as well as additional penalties for late filing. It is crucial for businesses to adhere to the filing requirements and ensure that all information is accurate to avoid these financial repercussions.

Quick guide on how to complete form 8876 rev april fill in version excise tax on structured settlement factoring transactions

Effortlessly Complete [SKS] on Any Device

The management of online documents has gained increased traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily locate the required document and securely archive it online. airSlate SignNow equips you with all the tools necessary to rapidly create, modify, and eSign your files without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Easily Edit and eSign [SKS]

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your files or obscure sensitive data with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your edits.

- Choose your preferred method for sending your document, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign [SKS] to guarantee effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

Create this form in 5 minutes!

How to create an eSignature for the form 8876 rev april fill in version excise tax on structured settlement factoring transactions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions?

The Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions is a tax form used to report excise taxes on certain structured settlement transactions. This form is essential for businesses engaged in factoring structured settlements to comply with IRS regulations. Using airSlate SignNow, you can easily prepare and eSign this form, streamlining your tax reporting process.

-

How does airSlate SignNow simplify the process of filling out Form 8876 Rev April?

airSlate SignNow offers an intuitive platform that allows users to quickly fill in the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions with guided prompts and templates. The software ensures that all necessary information is entered correctly, reducing the chance of errors. By utilizing airSlate SignNow, you will save time and enhance accuracy in submitting your excise tax forms.

-

What features does airSlate SignNow provide for managing Form 8876 Rev April submissions?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and real-time collaboration tools. These features enable users to manage their Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions efficiently and securely. Additionally, you can track document status and receive notifications, making the process seamless.

-

Is pricing for airSlate SignNow competitive for users needing the Form 8876 Rev April?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes needing the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions. With flexible monthly and annual subscription options, users can choose a plan that fits their budget and usage needs. The cost-effective solution helps businesses minimize overhead while ensuring compliance.

-

Can I integrate airSlate SignNow with other applications for Form 8876 Rev April management?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications such as Google Drive, Salesforce, and more, allowing for efficient management of the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions alongside your existing workflows. These integrations enhance productivity by connecting all your necessary tools in one platform, making document processing easier.

-

What are the benefits of using airSlate SignNow for Form 8876 Rev April?

Using airSlate SignNow for the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions offers numerous benefits, including enhanced compliance, reduced processing time, and improved document security. With electronic signatures, you can finalize your forms faster while keeping them secure. These advantages save time and foster trust with your clients and partners.

-

How can I ensure my data is secure when using airSlate SignNow for Form 8876 Rev April?

airSlate SignNow takes data security seriously and employs advanced encryption protocols to protect your documents during the eSigning process, including the Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions. Additionally, the platform provides user authentication options to restrict access to sensitive information, ensuring that your data remains confidential.

Get more for Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

Find out other Form 8876 Rev April Fill In Version Excise Tax On Structured Settlement Factoring Transactions

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed