Form 5213 Rev July Election to Postpone Determination as to Whether the Presumption Applies that an Activity is Engaged in for P

Understanding Form 5213 Rev July

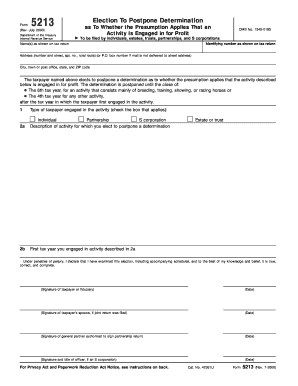

The Form 5213 Rev July, officially titled "Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit," is a tax-related document used by individuals and businesses in the United States. This form allows taxpayers to delay the IRS's determination regarding whether their activity qualifies as a business engaged in profit-making. By filing this form, taxpayers can extend the time frame for the IRS to assess their activities, which can be crucial for those who are uncertain about their profit motives.

How to Complete Form 5213 Rev July

Completing Form 5213 Rev July involves several key steps. First, ensure you have all necessary information at hand, including your tax identification number and details about the activity in question. Next, fill out the form by providing accurate information regarding your business activities and the reasons for your election to postpone the determination. It's important to review the completed form for accuracy before submission, as errors can lead to delays or complications with the IRS.

Obtaining Form 5213 Rev July

Form 5213 Rev July can be obtained directly from the IRS website or through authorized tax professionals. It is available in a downloadable format, allowing taxpayers to print and fill it out manually. Additionally, many tax software programs may include the form for electronic completion. Ensure you are using the most recent version of the form to comply with current IRS regulations.

Key Elements of Form 5213 Rev July

Several key elements must be included when filling out Form 5213 Rev July. These include your name, address, and taxpayer identification number, as well as a clear description of the activity in question. It is also essential to provide a statement indicating why you believe the presumption of profit does not apply to your activity. This information helps the IRS understand your position and the rationale behind your election to postpone the determination.

Legal Considerations for Form 5213 Rev July

Form 5213 Rev July has specific legal implications, particularly concerning tax obligations. By filing this form, you are formally notifying the IRS of your intent to delay the determination regarding your profit motive. This can impact your tax filings and any deductions related to the activity. It's advisable to consult with a tax professional to understand the legal ramifications of filing this form and ensure compliance with IRS regulations.

Filing Deadlines for Form 5213 Rev July

Timely filing of Form 5213 Rev July is crucial to avoid penalties. Generally, the form should be submitted by the due date of your tax return for the year in which you are electing to postpone the determination. This ensures that your request is considered within the appropriate tax period. Keep track of any changes in IRS deadlines to ensure compliance and avoid complications.

Quick guide on how to complete form 5213 rev july election to postpone determination as to whether the presumption applies that an activity is engaged in for

Complete [SKS] effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow supplies you with all the essentials to create, modify, and eSign your documents swiftly and without holdups. Manage [SKS] seamlessly on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and eSign [SKS] without any hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether it be via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your requirements in document management with just a few clicks from any device you prefer. Modify and eSign [SKS] and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For P

Create this form in 5 minutes!

How to create an eSignature for the form 5213 rev july election to postpone determination as to whether the presumption applies that an activity is engaged in for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit?

The Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit allows taxpayers to delay the IRS's determination of whether an activity qualifies as a business or hobby. This can provide additional time to demonstrate the profitability of the activity in question.

-

How can airSlate SignNow help me with Form 5213 Rev July?

airSlate SignNow simplifies the process of preparing and signing Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit. Our platform streamlines document management, allowing you to send, sign, and manage your forms online easily and securely.

-

What features does airSlate SignNow offer that benefit users completing Form 5213 Rev July?

airSlate SignNow offers features like eSignature functionality, automated workflows, and document tracking specifically beneficial for managing Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit. These features enhance the efficiency and convenience of your document processes.

-

Is there a cost associated with using airSlate SignNow for Form 5213 Rev July?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. You can choose a plan that best suits your requirements for managing Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit without breaking the bank.

-

Can I integrate airSlate SignNow with other applications when working with Form 5213 Rev July?

Absolutely! airSlate SignNow provides integrations with various business applications and software, making it easier to manage Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit alongside your existing tools. This streamlines your workflows and boosts productivity.

-

What benefits does using airSlate SignNow provide for preparing Form 5213 Rev July?

Using airSlate SignNow for your Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit allows for faster processing and compliance. You'll experience reduced paper work, improved accuracy, and the convenience of managing all your documents in one online platform.

-

How do I get started with airSlate SignNow for my Form 5213 Rev July needs?

Getting started with airSlate SignNow is simple. You can sign up for an account, explore our features, and begin preparing your Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For Profit right away. Our user-friendly interface is designed to guide you through the process effortlessly.

Get more for Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For P

Find out other Form 5213 Rev July Election To Postpone Determination As To Whether The Presumption Applies That An Activity Is Engaged In For P

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF