Form 8615 Tax for Children under Age 14 Who Have Investment Income of More Than $1,400

Understanding Form 8615 for Children with Investment Income

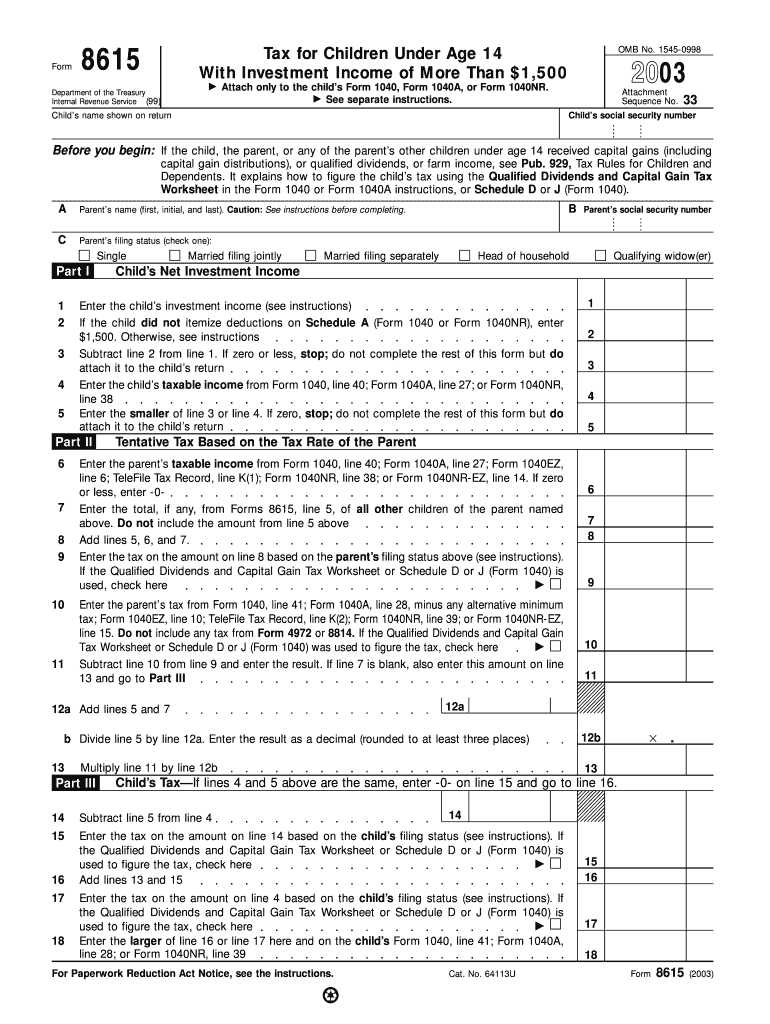

Form 8615 is a tax form specifically designed for children under the age of 14 who have investment income exceeding $1,400. This form is used to calculate the tax owed on the child's unearned income, which may be subject to the "kiddie tax" rules. The kiddie tax applies to prevent parents from shifting their investment income to their children to take advantage of lower tax rates. By using Form 8615, parents can ensure compliance with IRS regulations regarding their child's investment earnings.

How to Complete Form 8615

To complete Form 8615, you will need to gather specific information about the child's investment income and the parents' tax situation. The form requires details such as the child's total investment income, the parents' adjusted gross income, and any applicable deductions. It is important to fill out the form accurately to avoid any penalties. Each section of the form must be completed in accordance with IRS instructions, ensuring that all calculations are correct.

Obtaining Form 8615

Form 8615 can be obtained directly from the IRS website or through tax preparation software. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, many tax professionals can provide this form as part of their services. Ensuring you have the most current version of the form is essential, as tax regulations may change from year to year.

Key Components of Form 8615

Form 8615 consists of several key sections that must be completed. These include:

- Child's Information: This section requires the child's name, Social Security number, and other identifying details.

- Investment Income Details: Here, you will report the total amount of unearned income, including dividends, interest, and capital gains.

- Parental Information: This section asks for the parents' adjusted gross income and tax filing status.

- Tax Calculation: The form guides you through calculating the tax owed based on the child's income and the parents' tax rates.

Filing Deadlines for Form 8615

Form 8615 must be filed along with the child's tax return by the standard tax filing deadline, which is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to file on time to avoid potential penalties and interest on any taxes owed. If you need additional time, you may file for an extension, but the tax owed must still be paid by the original deadline.

IRS Guidelines for Form 8615

The IRS provides specific guidelines for completing Form 8615, including eligibility criteria and instructions for calculating the tax owed. It is crucial to review these guidelines carefully to ensure compliance with tax laws. The IRS website offers detailed instructions and resources to assist taxpayers in understanding their obligations regarding the kiddie tax and the use of Form 8615.

Quick guide on how to complete form 8615 tax for children under age 14 who have investment income of more than 1400

Effortlessly prepare [SKS] on any device

The management of online documents has become favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary for creating, editing, and electronically signing your documents promptly and without hindrance. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related procedure today.

How to adjust and electronically sign [SKS] with ease

- Acquire [SKS] and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400

Create this form in 5 minutes!

How to create an eSignature for the form 8615 tax for children under age 14 who have investment income of more than 1400

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400?

Form 8615 is used to calculate the tax on a child's unearned income, specifically for children under age 14 who have investment income exceeding $1,400. This form helps parents and guardians understand their tax obligations regarding children's investment income. Properly filing Form 8615 is crucial to avoid penalties and ensure accurate tax reporting.

-

How can airSlate SignNow help with filing Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400?

airSlate SignNow offers a seamless way to prepare and eSign important tax documents, including Form 8615. With our platform, users can easily fill out the necessary fields and send the form securely for eSignature. This ensures that your tax documents are handled efficiently and accurately, saving you time during tax season.

-

What are the pricing options for airSlate SignNow?

Our pricing plans cater to various needs, making it easy to select one that suits your budget. Whether you require basic features or advanced integrations, airSlate SignNow provides pricing tiers designed to offer value for users managing Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400. Check our website for the latest pricing details and promotions!

-

What features does airSlate SignNow provide for managing tax forms?

airSlate SignNow includes features like customizable templates, secure document storage, and advanced eSignature capabilities, all helpful when filling out Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400. Users can streamline their document workflow, ensuring compliance and reducing errors with taxes. Our intuitive interface makes the entire process user-friendly.

-

Can airSlate SignNow integrate with other tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software and accounting tools. This capability is valuable for users who need to manage documents related to Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400. By integrating with existing solutions, users can improve efficiency and reduce the need for manual data entry.

-

What benefits does airSlate SignNow provide for parents handling Form 8615?

Using airSlate SignNow offers several benefits for parents managing Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400. You can quickly eSign documents, track their status, and maintain a comprehensive record of all tax forms. Our easy communication features enhance collaboration with tax professionals as needed.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400. Our platform utilizes encryption and secure cloud storage to protect your data, ensuring peace of mind during the document management process.

Get more for Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400

Find out other Form 8615 Tax For Children Under Age 14 Who Have Investment Income Of More Than $1,400

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation