Real Estate Mortgage Investment Conduit REMIC Income Tax Return for Calendar Year or Short Tax Year Beginning , 20 See Separate Form

What is the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

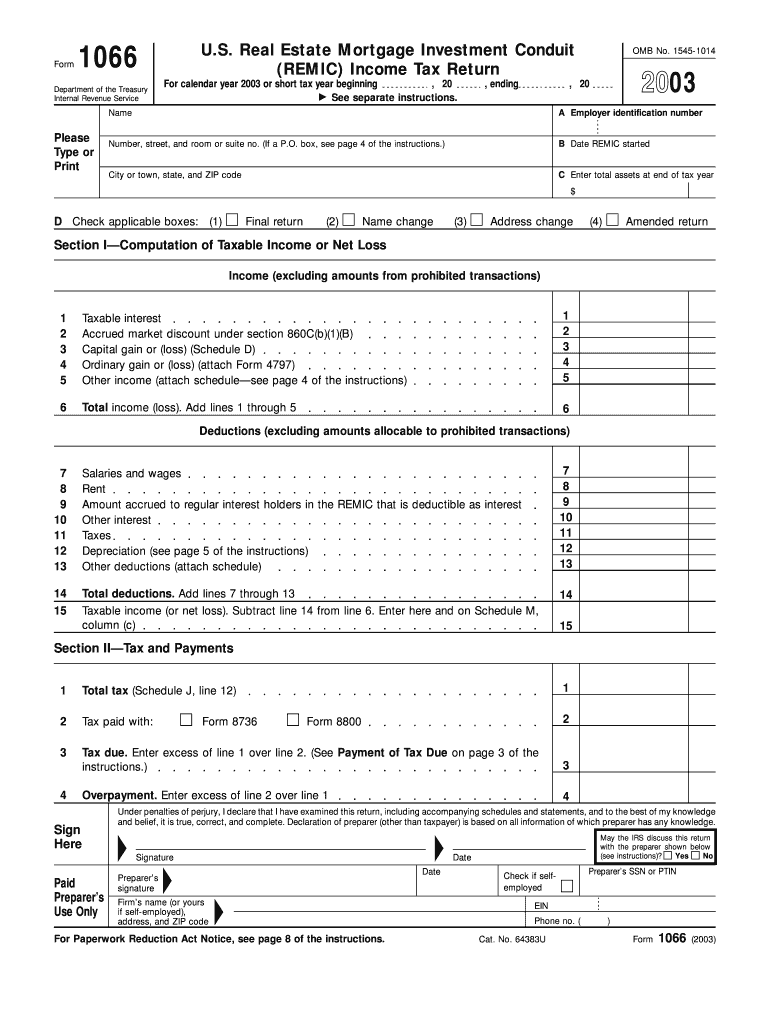

The Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return is a specialized tax form used by entities that operate as REMICs. These entities are structured to hold a pool of mortgages and issue mortgage-backed securities. The form is essential for reporting income, deductions, and credits associated with the REMIC's activities. It ensures compliance with federal tax regulations and provides the Internal Revenue Service (IRS) with necessary financial information.

How to Use the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

To use the REMIC Income Tax Return, entities must gather all relevant financial data related to their mortgage investments. This includes income from mortgage payments, expenses incurred, and any distributions made to security holders. The form requires accurate reporting to reflect the REMIC's financial position. Entities should consult the IRS instructions specific to the form to ensure all sections are completed correctly and in compliance with tax laws.

Steps to Complete the Real Estate Mortgage Investment Conduit REMIC Income Tax Return

Completing the REMIC Income Tax Return involves several steps:

- Gather financial documents, including income statements and expense reports.

- Fill out the form, ensuring all income and deductions are accurately reported.

- Review the form for completeness and accuracy, checking against IRS guidelines.

- Submit the form by the designated filing deadline, either electronically or via mail.

Entities should keep copies of the submitted form and all supporting documents for their records.

Filing Deadlines / Important Dates

Filing deadlines for the REMIC Income Tax Return typically align with the general tax filing dates set by the IRS. Entities must submit their returns by the fifteenth day of the fourth month following the end of their tax year. For those operating on a calendar year, this means the deadline falls on April fifteenth. If the entity has a short tax year, the deadline will vary accordingly. It's crucial to mark these dates on the calendar to avoid penalties.

Required Documents

To accurately complete the REMIC Income Tax Return, several documents are necessary:

- Income statements detailing all revenue from mortgage investments.

- Expense reports outlining operational costs and deductions.

- Documentation of distributions made to security holders.

- Any applicable IRS publications or guidelines related to REMIC taxation.

Having these documents ready will streamline the filing process and help ensure compliance.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the REMIC Income Tax Return can result in significant penalties. The IRS may impose fines for late submissions, inaccurate reporting, or failure to file altogether. These penalties can accumulate, leading to increased financial liability for the entity. It is essential to adhere to all filing regulations and deadlines to avoid these consequences.

Quick guide on how to complete real estate mortgage investment conduit remic income tax return for calendar year or short tax year beginning 20 see separate

Effortlessly prepare [SKS] on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without any delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of missing or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication throughout any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning , 20 See Separate

Create this form in 5 minutes!

How to create an eSignature for the real estate mortgage investment conduit remic income tax return for calendar year or short tax year beginning 20 see separate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Real Estate Mortgage Investment Conduit REMIC Income Tax Return?

A Real Estate Mortgage Investment Conduit REMIC Income Tax Return is a tax form required for entities structured as REMICs. This return reports the income, deductions, and credits of the REMIC for the calendar year or a short tax year. Understanding this tax return is crucial for compliance and tax planning.

-

How does airSlate SignNow assist with filing a REMIC income tax return?

airSlate SignNow provides a user-friendly platform to manage and eSign documents securely. While it does not directly file REMIC income tax returns, it streamlines the document signing process, ensuring that any necessary forms are completed quickly and efficiently. This can greatly simplify the compliance process for users.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a full suite of features including document templates, templates for the Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning, and customizable workflows. These features help businesses manage their paperwork more efficiently and reduce turnaround time for essential documents.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow presents a cost-effective solution for small businesses needing to manage their document signing processes. With various pricing plans, it can fit different budgets while providing essential features that support compliance, such as for the Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the REMIC Income Tax Return, enables businesses to streamline their compliance processes. The platform enhances document security, provides an audit trail, and allows for easy access to signed documents, ensuring that you meet deadlines without hassle.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely, airSlate SignNow can integrate with various accounting and finance software solutions. This integration allows users to easily manage their documents related to the Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning and ensures a seamless workflow between platforms.

-

What support does airSlate SignNow offer for users unfamiliar with tax documents?

airSlate SignNow provides comprehensive customer support to help users navigate their document needs, including tax-related forms. Resources such as user guides, FAQs, and customer service representatives are available to offer assistance with the Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning.

Get more for Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning , 20 See Separate

- Tennessee code annotated 36 6 413b5 provides that couples who complete premarital preparation courses shall be form

- Znt 30 form download

- Assigning oxidation numbers worksheet form

- Transamerica life insurance beneficiary change form

- Ace iq pdf form

- Bargain and sale deed form

- Swartz creek high school travel release form swartzcreek

- Halls of heddon catalogue form

Find out other Real Estate Mortgage Investment Conduit REMIC Income Tax Return For Calendar Year Or Short Tax Year Beginning , 20 See Separate

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT