Form 8876 April Department of the Treasury Internal Revenue Service Excise Tax on Structured Settlement Factoring Transactions S

Understanding Form 8876

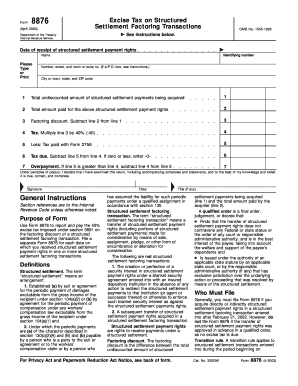

Form 8876, issued by the Department of the Treasury Internal Revenue Service, is specifically designed to report the excise tax on structured settlement factoring transactions. This form is crucial for businesses involved in purchasing structured settlements, as it ensures compliance with federal tax regulations. The excise tax applies to transactions where a recipient of a structured settlement sells their payment rights, and it is essential for the purchasing entity to accurately report these transactions to avoid penalties.

Steps to Complete Form 8876

Completing Form 8876 requires careful attention to detail to ensure accuracy. Here are the essential steps:

- Gather necessary information, including details about the structured settlement and the parties involved.

- Complete the form by filling in all required fields, ensuring that all information is accurate and up-to-date.

- Calculate the excise tax owed based on the transaction amount and include this figure on the form.

- Review the completed form for any errors or omissions before submission.

Obtaining Form 8876

Form 8876 can be obtained directly from the IRS website or through authorized tax professionals. It is available in a printable format, allowing users to complete it manually or digitally. Ensuring you have the most current version of the form is essential for compliance, as tax regulations may change.

Filing Deadlines for Form 8876

Timely filing of Form 8876 is critical to avoid penalties. The form must be submitted by the due date specified by the IRS, which typically aligns with the tax year in which the structured settlement transaction occurred. Keeping track of these deadlines helps ensure compliance and prevents unnecessary fines.

Legal Use of Form 8876

Form 8876 is legally mandated for entities engaged in structured settlement factoring transactions. Proper use of this form ensures that businesses adhere to federal tax laws and regulations. Failing to file or inaccurately reporting can lead to significant penalties, including fines and interest on unpaid taxes.

Key Elements of Form 8876

Several key elements must be included when completing Form 8876:

- Identification of the taxpayer and structured settlement transaction details.

- Calculation of the excise tax based on the transaction amount.

- Signature of the authorized representative to validate the information provided.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 8876 can result in severe penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is vital for businesses to understand their obligations and ensure timely and accurate filing to mitigate these risks.

Quick guide on how to complete form 8876 april department of the treasury internal revenue service excise tax on structured settlement factoring transactions

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely keep them online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Adjust and electronically sign [SKS] to ensure smooth communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions S

Create this form in 5 minutes!

How to create an eSignature for the form 8876 april department of the treasury internal revenue service excise tax on structured settlement factoring transactions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8876, and why is it important?

Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below is a crucial document for businesses involved in structured settlement transactions. This form is necessary to report excise tax obligations, ensuring compliance with IRS regulations. Understanding its significance can help businesses avoid potential penalties and streamline their tax processes.

-

How does airSlate SignNow assist with Form 8876 submissions?

airSlate SignNow provides a secure platform for businesses to prepare and eSign Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below effectively. The easy-to-use interface simplifies the document signing process, allowing users to focus on compliance. This reduces the likelihood of errors and enhances overall efficiency in tax filings.

-

What are the pricing options for airSlate SignNow solutions?

airSlate SignNow offers various pricing plans tailored to meet diverse business needs. These plans provide flexibility in accessing features, including assistance with Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below. By selecting a plan that fits your budget, you can leverage the full potential of our services.

-

What features of airSlate SignNow enhance the signing experience?

airSlate SignNow includes features like customizable templates and real-time tracking to improve the signing experience. These tools allow users to manage their Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below seamlessly. Enhanced functionality ensures that every transaction is completed accurately and on time.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow integrates smoothly with various software solutions, enhancing its versatility. This includes compatibility with accounting and tax software, making it easier to manage your Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below within your existing workflows. Integrations improve efficiency and reduce duplication of effort.

-

What are the advantages of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers multiple advantages, such as increased efficiency and improved accuracy. The platform’s focus on documents like Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below ensures compliance and ease of use. Businesses can reduce turnaround times and streamline their operations effectively.

-

Is training available for new users of airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources for new users. Understanding how to navigate and utilize tools for Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions See Instructions Below is essential, and our training materials and support team are here to help ensure a smooth transition.

Get more for Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions S

- Technical writing basics 4th edition pdf form

- Sro form

- My denver card application form

- Ol 29 i application for occupational license personal apps dmv ca form

- Forensic odontology webquest answer key form

- 4 footed friends form

- Compassionate leave form

- Medication administration record template excel form

Find out other Form 8876 April Department Of The Treasury Internal Revenue Service Excise Tax On Structured Settlement Factoring Transactions S

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement