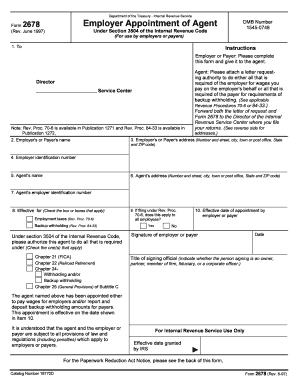

To 2678 Employer Appointment of Agent under Section 3504 of the Internal Revenue Code for Use by Employers or Payers Department Form

Understanding the NEPA CIL Acting as Agent W-2

The NEPA CIL acting as agent W-2 is a crucial form for employers and payers under the Internal Revenue Code. It enables employers to appoint an agent to handle specific tax responsibilities on their behalf. This form is particularly relevant for businesses that need to simplify their payroll processes and ensure compliance with federal tax regulations. By designating an agent, employers can streamline their tax reporting and payment obligations, which is essential for maintaining accurate records and avoiding penalties.

Steps to Complete the NEPA CIL Acting as Agent W-2

Completing the NEPA CIL acting as agent W-2 involves several key steps:

- Gather necessary information about the employer and the appointed agent.

- Fill out the form accurately, ensuring all details are correct.

- Sign the form to validate the appointment of the agent.

- Submit the completed form to the appropriate IRS office.

Each step is vital to ensure that the appointment is recognized and that the employer remains compliant with tax obligations.

Legal Use of the NEPA CIL Acting as Agent W-2

The NEPA CIL acting as agent W-2 serves a legal purpose by allowing employers to designate an agent for tax-related responsibilities. This legal framework helps clarify the roles and responsibilities of both the employer and the agent. It is essential for employers to understand the implications of appointing an agent, including the potential liabilities that may arise from this designation. Proper legal use of this form can protect employers from mismanagement of tax duties and ensure adherence to IRS regulations.

Key Elements of the NEPA CIL Acting as Agent W-2

Several key elements must be included in the NEPA CIL acting as agent W-2:

- The name and address of the employer.

- The name and address of the designated agent.

- The specific tax responsibilities being delegated.

- Signatures from both the employer and the agent.

Including all required information ensures the form is valid and helps prevent delays in processing.

Filing Deadlines for the NEPA CIL Acting as Agent W-2

Employers must be aware of the filing deadlines associated with the NEPA CIL acting as agent W-2. Generally, the form should be submitted before the first payroll of the year to ensure that the agent can handle tax responsibilities from the outset. Missing these deadlines can lead to complications in tax reporting and potential penalties. It is advisable to check the IRS guidelines for any updates on deadlines to remain compliant.

Examples of Using the NEPA CIL Acting as Agent W-2

Employers may find various scenarios where using the NEPA CIL acting as agent W-2 is beneficial. For instance, a small business owner may appoint an accountant as an agent to manage payroll taxes, allowing them to focus on core business activities. Similarly, a larger organization might designate a payroll service provider to ensure accurate and timely tax filings. These examples illustrate the flexibility and utility of the form in different business contexts.

Quick guide on how to complete to 2678 employer appointment of agent under section 3504 of the internal revenue code for use by employers or payers department

Effortlessly Prepare To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department on Any Device

Managing documents online has gained signNow traction among enterprises and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documentation, allowing you to locate the necessary form and securely archive it online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly and without hindrances. Manage To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Edit and eSign To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department with Ease

- Locate To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal effectiveness as a conventional wet ink signature.

- Review all the details and click the Done button to secure your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your choice. Modify and eSign To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the to 2678 employer appointment of agent under section 3504 of the internal revenue code for use by employers or payers department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the role of NEPA CIL acting as agent W2 in the document signing process?

NEPA CIL acting as agent W2 facilitates the efficient signing of documents by acting as a trusted intermediary. This service ensures that the signing process is compliant and secure, streamlining workflows for businesses. By leveraging NEPA CIL's expertise, organizations can reduce errors and improve turnaround time.

-

How does airSlate SignNow integrate with NEPA CIL acting as agent W2?

airSlate SignNow offers seamless integration with NEPA CIL acting as agent W2, enhancing your document management experience. This integration allows for easy routing of documents that require signatures, ensuring that every step is tracked and managed efficiently. Users can effortlessly connect their workflows to optimize the signing process.

-

What are the pricing plans for airSlate SignNow when using NEPA CIL acting as agent W2?

AirSlate SignNow offers flexible pricing plans designed to cater to various business needs, including those utilizing NEPA CIL acting as agent W2. These plans range from basic to premium features, allowing users to select the option that best fits their budget and requirements. Each plan includes essential features to support effective document signing.

-

What features does airSlate SignNow provide for users of NEPA CIL acting as agent W2?

Users of NEPA CIL acting as agent W2 can take advantage of features like custom workflows, real-time tracking, and automated reminders in airSlate SignNow. These powerful functionalities help ensure documents are signed promptly and correctly. Additionally, users can create templates to streamline repetitive signing processes.

-

How does NEPA CIL acting as agent W2 benefit my business?

Employing NEPA CIL acting as agent W2 in conjunction with airSlate SignNow signNowly benefits businesses by enhancing compliance and reducing the time spent on document management. This approach allows your team to focus on core activities while ensuring that all necessary signatures are secured efficiently. It also minimizes the risk of document-related errors.

-

Is airSlate SignNow secure when using NEPA CIL acting as agent W2?

Yes, airSlate SignNow prioritizes security, especially when utilizing NEPA CIL acting as agent W2. The platform employs advanced encryption methods to protect sensitive data throughout the signing process. Additionally, user authentication measures ensure only authorized individuals have access to documents, providing peace of mind for businesses.

-

Can I try airSlate SignNow before using NEPA CIL acting as agent W2?

Absolutely! AirSlate SignNow offers a free trial that allows you to explore its features, including those relevant to NEPA CIL acting as agent W2. This trial period helps you gauge the platform's effectiveness for your document signing needs without any financial commitment. You can identify the benefits firsthand before making a decision.

Get more for To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department

- 402 west washington street room w467 indianapolis in 46204 form

- Questionnaire for financial affidavit form

- Rosetta thurman happy black woman form

- Cbp form 7553

- Sca c900 instructions for expungement of records petition form

- Charity bike ride sponsorship form lodge westlancsmasons org

- Get the fund administration member benefit claim form

- Public relations agreement template form

Find out other To 2678 Employer Appointment Of Agent Under Section 3504 Of The Internal Revenue Code For Use By Employers Or Payers Department

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template