Form 3911 Rev January Taxpayer Statement Regarding Refund

What is the Form 3911 Rev January Taxpayer Statement Regarding Refund

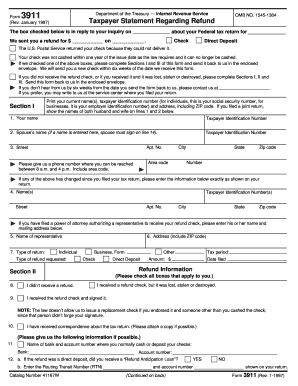

The Form 3911 Rev January, also known as the Taxpayer Statement Regarding Refund, is an official document used by taxpayers in the United States to inquire about the status of their tax refund. This form is particularly useful for individuals who have not received their expected refund within the standard processing time. By submitting this form, taxpayers can initiate an investigation into the status of their refund, ensuring that any issues are addressed promptly.

How to use the Form 3911 Rev January Taxpayer Statement Regarding Refund

To effectively use the Form 3911, taxpayers should first gather all necessary information, including their Social Security number, filing status, and the exact amount of the refund expected. After completing the form, it should be submitted to the appropriate IRS office. This form can be used when a refund is delayed, lost, or if there are discrepancies in the refund amount. It serves as a formal request for the IRS to review the taxpayer's account and provide updates regarding the refund status.

Steps to complete the Form 3911 Rev January Taxpayer Statement Regarding Refund

Completing the Form 3911 involves several key steps:

- Provide personal identification information, including your name, address, and Social Security number.

- Indicate your filing status and the tax year for which you are inquiring about the refund.

- Clearly state the amount of the refund you expected to receive.

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form should be mailed to the address specified in the instructions, or it can be submitted through the IRS's designated channels.

Key elements of the Form 3911 Rev January Taxpayer Statement Regarding Refund

The Form 3911 includes several important elements that taxpayers must fill out accurately:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Filing Status: Taxpayers must select their appropriate filing status, such as single, married filing jointly, or head of household.

- Refund Information: Indicate the expected refund amount and the tax year associated with the refund.

- Signature: A signature is required to validate the request and confirm the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 3911. Taxpayers are encouraged to wait at least 21 days after filing their return before submitting this form, as this allows adequate time for processing. Additionally, the IRS may request further information or documentation during their review process. It is essential to follow all instructions carefully to avoid delays in resolution.

Form Submission Methods

The Form 3911 can be submitted to the IRS through various methods. Taxpayers may choose to mail the completed form to the address indicated in the instructions. Alternatively, some taxpayers may have the option to submit the form electronically, depending on their specific circumstances. Ensuring that the form is sent to the correct address and in a timely manner is crucial for a prompt response from the IRS.

Quick guide on how to complete form 3911 rev january taxpayer statement regarding refund

Complete [SKS] easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure excellent communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3911 Rev January Taxpayer Statement Regarding Refund

Create this form in 5 minutes!

How to create an eSignature for the form 3911 rev january taxpayer statement regarding refund

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Form 3911 Rev January Taxpayer Statement Regarding Refund'?

The 'Form 3911 Rev January Taxpayer Statement Regarding Refund' is a document used by taxpayers to inquire about the status of their refund when it has not been received. This form allows individuals to report missing refunds and provides the IRS with the necessary information to assist in tracking the refund's status.

-

How can airSlate SignNow help with the 'Form 3911 Rev January Taxpayer Statement Regarding Refund'?

airSlate SignNow can streamline the process of filling out and submitting the 'Form 3911 Rev January Taxpayer Statement Regarding Refund' electronically. Our platform ensures that users can eSign and send their forms securely, simplifying interactions with the IRS and reducing paperwork hassles.

-

What are the key features of airSlate SignNow for submitting tax forms?

airSlate SignNow offers features like electronic signatures, document templates, and easy sharing capabilities, all of which are suited for submitting tax forms like the 'Form 3911 Rev January Taxpayer Statement Regarding Refund'. These tools enhance user efficiency and ensure compliance with legal requirements.

-

Is there a cost to use airSlate SignNow for the 'Form 3911 Rev January Taxpayer Statement Regarding Refund'?

Yes, airSlate SignNow offers various pricing plans that cater to individual and business needs. Our cost-effective solution ensures that users can easily eSign and submit documents, including the 'Form 3911 Rev January Taxpayer Statement Regarding Refund', without breaking the bank.

-

Can I integrate airSlate SignNow with other software to handle the 'Form 3911 Rev January Taxpayer Statement Regarding Refund'?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, making it easy to manage and submit the 'Form 3911 Rev January Taxpayer Statement Regarding Refund' along with other financial documents. This enhances workflow efficiency and ensures that everything is kept in one centralized location.

-

What benefits does using airSlate SignNow provide for tax document submission?

By using airSlate SignNow, users benefit from quicker processing times, improved security, and the convenience of managing multiple documents, including the 'Form 3911 Rev January Taxpayer Statement Regarding Refund', all in one place. This streamlined approach saves time and reduces the stress associated with traditional document handling.

-

How secure is the submission of the 'Form 3911 Rev January Taxpayer Statement Regarding Refund' via airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting the 'Form 3911 Rev January Taxpayer Statement Regarding Refund', users can be assured that their information is protected with industry-leading encryption and compliance with regulatory standards, keeping their sensitive data safe.

Get more for Form 3911 Rev January Taxpayer Statement Regarding Refund

Find out other Form 3911 Rev January Taxpayer Statement Regarding Refund

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile